When businesses liquidate, physical assets like equipment or inventory often take center stage. But intangible assets – patents, trademarks, customer data, and brand value – can hold untapped potential if properly assessed. These non-physical assets are harder to evaluate and sell, often recovering less than 10% of their book value. However, with the right methods and expertise, they can significantly boost creditor recoveries and attract buyers.

Key Takeaways:

- Intangible Assets: Include intellectual property, goodwill, proprietary tech, and digital assets.

- Valuation Methods: Cost, market, and income approaches are used, each adjusted for liquidation scenarios.

- Challenges: Limited markets, legal restrictions, and accounting complexities often hinder recovery.

- Solutions: Platforms like Urgent Exits and expert advisors can help connect sellers with buyers and navigate legal hurdles.

Proper valuation and strategic liquidation of intangible assets can make a difference in financial outcomes, even in distressed situations.

Valuation Methods for Intangible Assets

When it comes to valuing intangible assets during liquidation, there are three main approaches: the cost approach, the market approach, and the income approach (which includes liquidation value methods). Each offers a unique way of assessing value, but all require adjustments to account for the distressed nature of liquidation sales.

Understanding these methods is crucial for stakeholders to determine the best fit for a specific asset and situation. These approaches help bridge the gap between theoretical asset values and the practical realities of liquidation, enabling more accurate assessments.

Cost Approach

The cost approach looks at how much it would take to replace or recreate the intangible asset. This involves calculating all the expenses required to develop the asset and then adjusting downward for factors like obsolescence – whether physical, functional, or economic.

Take, for instance, a software company that spent $500,000 over three years developing a proprietary customer management system. While this initial cost might serve as a starting point, liquidation adjustments must account for outdated code, advancements in technology, and changing market needs. For example, a software license that once cost $200,000 to develop might now be worth far less due to obsolete programming, discontinued support, and reduced market demand. In a liquidation scenario, these factors can push the value even lower.

Market Approach

If replacement costs don’t tell the full story, the market approach offers another angle by comparing sales data and benchmarks from similar assets. This method assumes that comparable assets will sell for similar prices, after adjusting for quality, timing, and market conditions.

However, in liquidation, finding comparable sales can be tricky. Intangible assets are often unique, and distressed sales are rarely well-documented. For instance, selling a pharmaceutical company’s patent portfolio during bankruptcy may make it difficult to find directly comparable transactions.

To address this, appraisers might rely on broader industry benchmarks or specialized platforms like Urgent Exits, which connects buyers and sellers in distressed situations. Expert judgment is key to ensuring any comparisons reflect the discounts typical of forced sales.

Income and Liquidation Value Approaches

The income approach evaluates an asset based on its potential to generate future cash flows, which are then discounted to present value. Techniques under this approach include discounted cash flow (DCF) analysis and the relief-from-royalty method. However, in liquidation scenarios, these methods require significant adjustments.

For example, DCF models in liquidation use shorter forecast periods and higher discount rates to account for the increased risk. Similarly, the relief-from-royalty method, which calculates value based on avoided licensing fees, must reflect lower royalty rates and shorter usage periods due to reduced market demand and limited buyer interest.

The liquidation value approach takes a more straightforward path, estimating what an asset might fetch in a rapid, forced sale. This method applies steep discounts to fair market value, often relying on recent auction results or expert estimates. The resulting valuation typically represents only a fraction of the asset’s worth in a going-concern scenario.

Summary Comparison

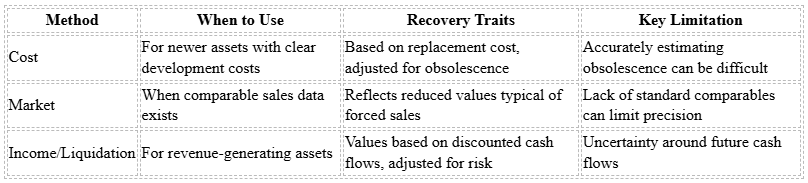

Each valuation method has its strengths and limitations, depending on the type of asset and the data available.

The choice of method depends on the asset’s nature and the availability of supporting data. For example, patents and trademarks tied to active licensing agreements might align better with income-based methods, while proprietary software or databases may be better suited to cost or market approaches. In practice, appraisers often combine multiple methods, reconciling the results to produce a final valuation.

Specialized platforms and expert advisors are critical in this process. Platforms like Urgent Exits can connect sellers with buyers familiar with the complexities of distressed assets, while experienced appraisers provide the insights and documentation needed to ensure the valuation holds up under legal scrutiny.

Challenges in Liquidation Valuations

Valuing intangible assets during liquidation can be a tough task for appraisers and liquidators. In the U.S., the distressed nature of these sales, combined with a maze of legal and financial complexities, makes the process even more challenging.

Limited Markets and Buyer Constraints

One of the biggest obstacles is the absence of active markets for intangible assets. Unlike stocks or bonds that trade on established exchanges, assets like patents, trademarks, or proprietary software don’t have standardized marketplaces where buyers and sellers can easily connect. Add to that the urgency of liquidation – often involving fire-sale conditions – and prices can drop dramatically. According to a 2022 survey of insolvency professionals, over 70% of intangible asset sales in liquidation fetched less than 20% of their last reported book value.

Strategic buyers might hold off on entering the market, waiting for better opportunities, while financial buyers often steer clear of intangible assets due to their inability to produce quick returns. Specialized assets, such as a pharmaceutical research database, appeal to a very narrow pool of potential buyers, which further drives down prices. These market challenges are compounded by legal complications that make valuations even harder. In the end, recovery rates for intangible assets can hover near zero, while tangible assets like equipment or inventory might still recover 30–70% of their book value.

Legal and Contractual Restrictions

Legal and contractual barriers add another layer of difficulty. Many intangible assets are tied up in licensing agreements or contracts that restrict their transfer without the licensor’s approval. Take, for instance, a software company whose most valuable asset – a licensed technology platform – might be unsellable because the original licensor hasn’t consented to a transfer. Even when consent is possible, the negotiation process can drag on, delaying the liquidation timeline.

Complications don’t stop there. Intellectual property disputes or unclear ownership can further muddy the waters. Provisions like non-compete clauses, geographic restrictions, or industry-specific limitations can reduce an asset’s attractiveness, forcing appraisers to apply steep discounts or even exclude certain assets entirely. On top of these contractual hurdles, regulatory and tax requirements add yet another layer of complexity.

Accounting and Tax Considerations

Accounting and tax rules create additional challenges. Under U.S. GAAP, impairment testing often slashes the book value of intangible assets before liquidation even begins, leaving appraisers with a lower valuation starting point. Tax treatment varies depending on the type of intangible asset, which can lead to different tax consequences during liquidation. The bankruptcy code further complicates things by prioritizing creditor claims. Costs like marketing, legal fees, appraisal expenses, and broker commissions are typically deducted before creditors see any distribution. Strict documentation requirements tied to accounting standards and bankruptcy laws also chip away at net recoveries.

Given these hurdles, navigating the valuation of distressed intangible assets requires specialized expertise. Platforms like Urgent Exits aim to simplify the process by connecting liquidators with advisors who can tackle the legal, accounting, and tax challenges that come with these valuations.

Step-by-Step Valuation Process

When valuing intangible assets during liquidation, a structured and thorough approach is key. This ensures the valuation is reliable and can hold up under scrutiny from courts, auditors, or potential buyers. The process can be broken down into three main phases, each building upon the last to create a comprehensive and defensible valuation.

Identify and Categorize Assets

Start by creating a detailed inventory of all intangible assets. This list should include items like patents, trademarks, copyrights, customer lists, proprietary software, trade secrets, licensing agreements, goodwill, and non-compete agreements. Don’t forget to include databases or customer relationships – they often hold significant value.

After compiling the list, confirm legal ownership of each asset. This involves reviewing documentation such as registration certificates, assignment agreements, or licensing contracts. For example, U.S. copyright registrations can be verified through the U.S. Copyright Office, while patent ownership is typically confirmed using USPTO records. Similarly, proprietary software or customer lists must have documentation proving the company’s legal right to transfer them.

Next, classify the assets based on their type and transferability. Some assets may be freely transferable, while others might come with legal or contractual restrictions. For instance, a software license might require the licensor’s consent for transfer, while trademarks could have geographic limitations. Only assets that can legally be transferred should be included in the liquidation valuation. Proper categorization is crucial, as it directly impacts the valuation method used.

Choose and Apply Valuation Methods

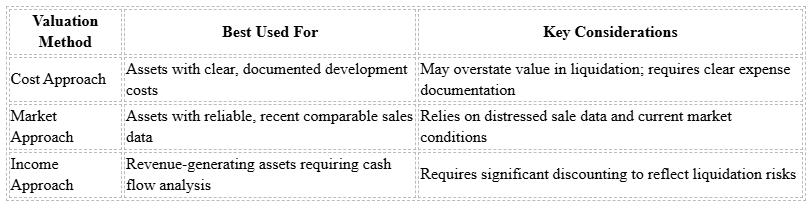

The valuation method you choose depends on the type of asset, available data, and how quickly the liquidation needs to occur. Here’s a breakdown of the three primary approaches:

- Cost Approach: Best for assets with well-documented development costs, like internally created software. However, in liquidation scenarios, this method may overestimate value, as buyers typically won’t pay full replacement costs for distressed assets.

- Market Approach: Ideal when there’s reliable data from recent comparable sales. Analyzing auction results and industry benchmarks can help estimate recovery rates. Keep in mind that intangible assets in liquidation often recover only 0–30% of their book value.

- Income Approach: Focuses on the asset’s ability to generate future cash flows. For liquidation, projections need to be heavily discounted to reflect distressed conditions.

Here’s a quick comparison of these methods:

Document and Prepare for Review

Thorough documentation is the backbone of a trusted liquidation valuation. Your documentation should include a complete asset inventory with proof of ownership, detailed valuation reports explaining the chosen methodology, and all supporting data used in the analysis. Insufficient records can lead to delays or disputes during the liquidation process.

Each report must clearly outline the assumptions, calculations, and evidence behind the valuation. For instance, if a patent’s value is based on projected licensing revenues, the report should explain the basis for those projections and justify the discount rate used under liquidation conditions. Transparency here is critical.

Organize all materials in an accessible format, ready for audits, court reviews, or buyer inquiries. Clearly state your assumptions and methods to withstand scrutiny. This preparation also means anticipating common questions about valuation techniques, recovery rates, and the market evidence supporting your conclusions.

Lastly, ensure your documentation aligns with Generally Accepted Accounting Principles (GAAP) and IRS requirements. Meeting these standards not only ensures compliance with U.S. legal and financial regulations but also builds trust with potential buyers and advisors. This level of preparation can help maximize the value of the liquidation process while minimizing potential challenges.

Using Urgent Exits for Intangible Asset Liquidation

Once you’ve completed a thorough valuation, the next step is finding the right market for your intangible assets. This can be tricky since traditional liquidation methods often fall short when it comes to monetizing intellectual property, customer lists, software, and other non-physical assets. That’s where specialized platforms come in – they connect sellers with buyers who understand and value distressed intangible assets.

Listing and Selling Intangible Assets

After preparing your valuation and documentation, it’s time to showcase your assets to the right audience. Urgent Exits offers a marketplace tailored for distressed or broker-rejected businesses, making it an ideal platform for selling intangible assets. This platform attracts buyers actively seeking undervalued opportunities, particularly those familiar with the nuances of distressed transactions.

Sellers can list assets like intellectual property, customer data, or software for quick review by potential buyers. Since the platform focuses on distressed situations, buyers are prepared for fast timelines and are skilled in assessing the income-generating potential of such assets. This targeted approach increases the chances of finding buyers who understand the value of your intangibles.

The platform also provides tools to track buyer engagement. Sellers can see how many buyers have viewed or saved their listings, offering real-time feedback on market interest. This data can help adjust pricing or improve how the assets are presented. Additionally, direct communication with interested buyers eliminates delays caused by intermediaries, which is crucial in time-sensitive situations.

Finding Advisors and Experts

Selling intangible assets often requires expertise beyond standard business transactions. Urgent Exits connects sellers with a network of professionals – appraisers, accountants, legal experts, consultants, and liquidators – who specialize in distressed asset sales.

These advisors bring specific skills to the table. For example, appraisers with credentials like ASA or AAA can handle intellectual property valuations in complex scenarios, while legal experts can navigate licensing or contractual challenges. Sellers can browse advisor profiles to find professionals with experience in areas like patent valuation, software licensing, or customer data transfers. For more intricate cases, sellers can even assemble a team of specialists, such as patent attorneys and tax accountants, to ensure smooth asset transfers.

Managing Transactions and Tracking Interest

When dealing with intangible assets, transparency and documentation are critical for legal and financial compliance. Urgent Exits offers tools to manage transactions efficiently. Sellers can monitor buyer activity in real time and respond promptly to inquiries about assets like patent portfolios, software licenses, or customer contracts.

The platform also simplifies managing multiple offers. For assets that attract varied buyer profiles, sellers can handle parallel discussions and compare offers with ease. Additionally, sellers can break down their intangible assets into smaller components to test market interest for each. This approach helps connect each asset type with the most suitable buyers, maximizing the overall recovery value.

Key Takeaways and Next Steps

Summary of Valuation Methods and Challenges

Valuing intangible assets in liquidation scenarios requires a cautious and distinct approach. Recovery rates can vary widely depending on the type of asset. For example, cash typically sees close to a 100% recovery rate, but specialized intangible assets often experience steep discounts or may even be excluded from the calculation altogether.

In U.S. Chapter 11 bankruptcy cases, the "best interests" test ensures that liquidation value serves as a baseline for creditor protection. However, several challenges – like limited buyer interest and contractual restrictions – can further diminish recoveries. Unlike physical assets, which tend to attract a broad pool of buyers, intellectual property, patents, and proprietary processes often have limited appeal and applicability. This reality underscores the need for strategic planning in handling distressed asset liquidation.

Benefits of Specialized Platforms

Specialized marketplaces can help overcome these valuation challenges. Traditional liquidation methods often fall short when dealing with intellectual property, customer lists, software, and other intangible assets.

Platforms such as Urgent Exits connect sellers with buyers who are familiar with distressed transactions. These platforms can often secure better pricing compared to standard liquidation auctions. Their real-time tracking tools also allow sellers to monitor market interest and adjust pricing or presentation strategies quickly – an essential feature in time-sensitive liquidation efforts.

Recommendations for Success

To maximize recovery from intangible assets, consider these practical steps:

- Thoroughly document all intangible assets: Include details like creation dates, registration numbers, expiration dates, and any contractual restrictions that could impact transferability.

- Work with specialized advisors early: Their expertise can help navigate complex valuation issues and improve recovery outcomes.

- Leverage targeted platforms like Urgent Exits: These platforms attract buyers who are experienced in distressed sales and fast-paced transactions.

- Set realistic expectations using market data: Compare recovery benchmarks from distressed sales to align theoretical asset values with actual market conditions.

While some intangible assets may yield minimal returns, intellectual property with broader applications can still generate meaningful recovery in the right circumstances.

FAQs

How can businesses accurately assess the value of intangible assets during liquidation to maximize returns for creditors?

Accurately determining the value of intangible assets during liquidation is essential for maximizing creditor recovery. Assets like trademarks, patents, customer lists, and goodwill often carry substantial worth, but their value hinges on the right evaluation methods and understanding of the market.

A few common approaches to valuing these assets include:

- Market-based valuation: This method compares the asset to similar ones recently sold in the market.

- Income-based valuation: Here, the focus is on estimating the future income the asset could generate.

- Cost-based valuation: This involves calculating what it would cost to recreate the asset from scratch.

Collaborating with skilled appraisers or financial consultants can help refine these valuations, ensuring they align with your specific circumstances.

Additionally, platforms like Urgent Exits can connect sellers with knowledgeable advisors and interested buyers. These resources can play a key role in accurately valuing intangible assets and positioning them for the best possible recovery during liquidation.

What challenges arise when valuing intangible assets during liquidation, and how can they be addressed?

Valuing intangible assets during liquidation can be tricky because these assets don’t have a physical form, making it hard to pin down their market value. The main hurdles? A lack of comparable market data, subjective valuation methods, and the risk of these assets losing value quickly in distressed scenarios.

To navigate these challenges, you can rely on established valuation methods like the income approach (projecting future cash flows), market approach (analyzing similar transactions), or cost approach (calculating the cost to recreate the asset). Bringing in seasoned appraisers or financial advisors who specialize in distressed assets can also make a big difference, offering insights that lead to a more precise valuation. Platforms like Urgent Exits are another option – they connect sellers with experts in managing and valuing distressed businesses, simplifying what can otherwise be a daunting process.

How can Urgent Exits help with selling intangible assets during liquidation?

Urgent Exits makes it easier for distressed businesses to sell intangible assets during liquidation. Through their specialized platform, sellers can list businesses that include assets like intellectual property, brand recognition, or customer databases, attracting buyers who are actively looking for these opportunities.

The platform not only connects sellers with interested buyers but also links them to experts like appraisers, consultants, and liquidators. These professionals provide valuable support in assessing and managing intangible assets, helping to make the liquidation process quicker and more efficient.