When valuing a business, two common approaches often come into play: liquidation value and going concern value. These methods are used to determine how much a company is worth, especially during financial distress. Here’s a quick breakdown:

- Liquidation Value: Reflects the cash generated from selling a company’s tangible assets (like equipment or inventory) if the business shuts down. This excludes intangible assets (e.g., brand reputation) and often results in lower valuations.

- Going Concern Value: Assumes the business will continue operating, taking into account both tangible and intangible assets, like goodwill and customer relationships. This typically leads to higher valuations.

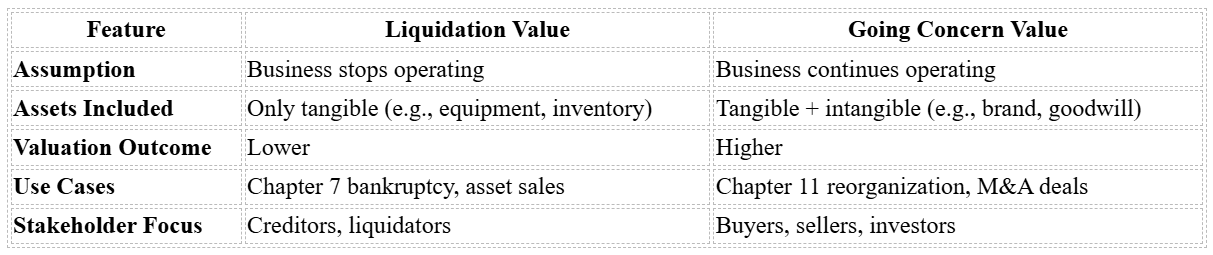

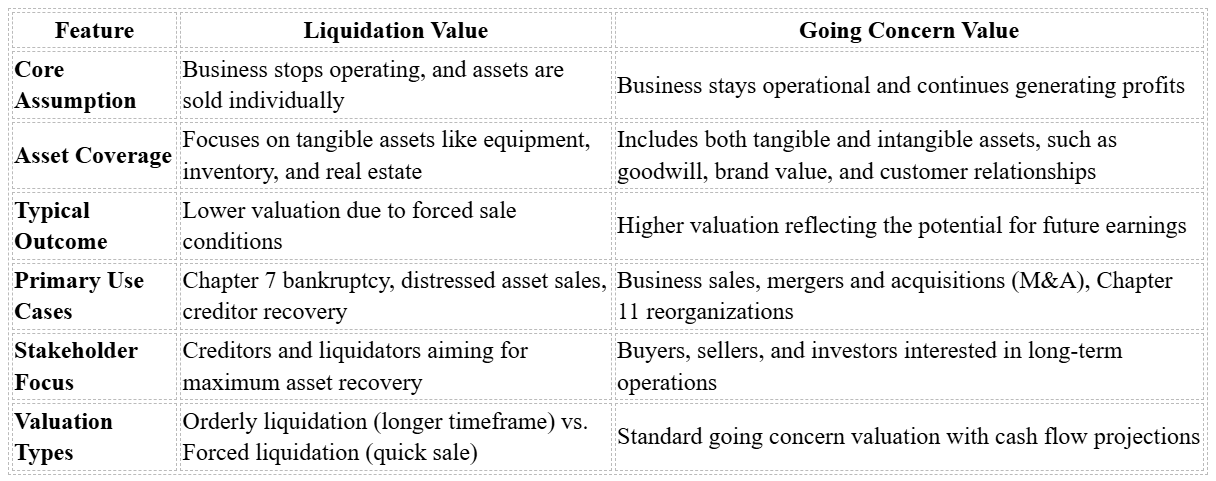

Quick Comparison

Choosing the right method depends on the business’s situation. Liquidation value is used when shutting down is inevitable, while going concern value applies when the business has potential for future earnings. Both methods guide stakeholders – creditors, buyers, sellers, and advisors – in making informed decisions about recovery, sales, or restructuring.

Liquidation Value: What It Is and When to Use It

What Is Liquidation Value?

Liquidation value represents the estimated cash that could be generated from the quick sale of a company’s physical assets – things like cash, receivables, inventory, equipment, and real estate. It excludes intangible assets such as intellectual property, brand value, and goodwill, focusing solely on tangible items. This approach deliberately ignores non-physical assets.

To calculate liquidation value, appraisers carefully evaluate all tangible assets. They consider factors such as the condition, age, and current market demand for each item. Additionally, they deduct selling costs, which may include auction fees, legal expenses, and storage charges, as well as any outstanding liabilities that need to be resolved. Forced sales often result in prices that fall significantly below the book value of the assets.

Orderly vs. Forced Liquidation Value

The context in which assets are sold plays a major role in determining their recovery value. An orderly liquidation allows for a controlled, extended sale process, which usually secures better prices. In contrast, a forced liquidation, such as an auction, often results in values that are 20–50% lower.

For instance, assets sold over a reasonable timeline typically fetch higher returns than those sold in a rushed, emergency auction setting.

When to Use Liquidation Value

Liquidation value is particularly useful when quick asset recovery is critical. It’s most often applied in situations like business closures, financial distress, or during Chapter 7 bankruptcies, insolvencies, or forced shareholder buyouts. It also helps estimate potential losses for creditors.

Financial advisors often use liquidation value as a baseline to gauge a company’s minimum worth when its ability to continue operating is in question.

For those needing a fast exit, platforms like Urgent Exits can connect sellers with buyers and advisors specializing in quick asset sales.

Going Concern Value: What It Is and When to Use It

What Is Going Concern Value?

Going concern value represents the worth of a business under the assumption that it will continue its operations into the foreseeable future. Unlike liquidation value, which focuses solely on the sale of physical assets, going concern value considers both tangible and intangible assets that contribute to future earnings. These intangibles include elements like goodwill, brand reputation, customer relationships, and intellectual property – assets that play a critical role in driving profitability.

The main difference lies in the assumption of continuity. Going concern value reflects the combined efficiency of assets working together, the expertise of experienced management, and the advantages of an established market presence. This often leads to a higher valuation compared to simply adding up asset values in a liquidation scenario. By emphasizing future potential, this approach lays the groundwork for precise valuation methods.

How to Calculate Going Concern Value

One common way to calculate going concern value is through the discounted cash flow (DCF) method. This approach estimates future free cash flows and discounts them to their present value. For example, a U.S. manufacturer with $500,000 in annual cash flows, a 2% terminal growth rate, and a 10% discount rate could use DCF to determine its valuation.

Another option is the market approach, which compares the business to similar companies involved in recent transactions. This method often uses valuation multiples like price-to-earnings ratios or enterprise value-to-revenue ratios from comparable deals.

Both methods can incorporate intangible assets – such as patents, trademarks, and customer lists – by factoring them into cash flow projections or treating them as standalone value components. Accurately calculating going concern value requires a thorough evaluation of the company’s competitive strengths, market position, and growth potential.

When to Use Going Concern Value

Going concern value is most relevant when a business is expected to continue operating successfully. Key scenarios include business sales, mergers and acquisitions, Chapter 11 bankruptcy reorganizations, and refinancing discussions. It’s especially useful for buyers targeting undervalued businesses with turnaround potential, where restructuring offers more value than liquidation.

For example, in U.S. Chapter 11 bankruptcy cases, courts often use going concern valuations to decide whether a business should be reorganized rather than liquidated. A retail chain filing for Chapter 11 might be valued as a going concern if it presents a viable plan to regain profitability, potentially increasing recoveries for creditors.

Financial advisors and appraisers frequently rely on this valuation approach for companies with positive future prospects or when stakeholders believe restructuring can succeed. Platforms like Urgent Exits connect sellers with buyers and specialized advisors, including appraisers and restructuring experts, to determine the best valuation strategy and help maximize the value of transactions.

Going Concern vs. Liquidation Premise of Value in Business Valuations for SBA 7a Lenders

Main Differences Between Liquidation Value and Going Concern Value

As we’ve seen, whether a business is valued based on liquidation or as a continuing operation leads to very different outcomes. Let’s break down the key distinctions between these two approaches.

Side-by-Side Comparison

Orderly liquidation (longer timeframe) vs. Forced liquidation (quick sale)

Standard going concern valuation with cash flow projections

Liquidation value tends to result in lower estimates since it reflects assets sold individually, often under pressure. On the other hand, going concern value includes a premium for the synergy created by assets functioning as part of a profitable business.

Even within liquidation scenarios, orderly liquidation – where assets are sold over a reasonable timeframe – can yield better prices than forced liquidation, which happens under tight deadlines. These differences influence the decisions stakeholders make in distressed situations.

What This Means for Buyers, Sellers, and Advisors

Understanding these valuation methods is critical for stakeholders navigating distressed transactions. Here’s how each group might approach these values:

- Sellers often compare both methods. While going concern value typically offers higher recovery, sellers may be forced to accept a liquidation-based valuation if the business can’t continue operating. The gap between these two values can be stark, especially in dire situations.

- Buyers hunting for undervalued opportunities look for businesses where liquidation value is significantly lower than potential going concern value. They assess whether they can acquire assets at liquidation pricing and restore the business to profitability through restructuring or operational improvements. This gap represents their potential profit margin.

- Advisors play a key role in determining which valuation method best supports a realistic recovery plan. Appraisers evaluate whether going concern factors still hold weight, while restructuring consultants analyze whether operational changes can bridge the gap between current distressed conditions and sustainable performance. Bankruptcy attorneys use these valuations to guide decisions between Chapter 7 liquidation and Chapter 11 reorganization.

- Creditors focus on liquidation value to set minimum recovery expectations. Secured creditors, in particular, rely on the value of specific collateral. Meanwhile, unsecured creditors may benefit more from a going concern scenario but often face the harsh reality of liquidation when operations cease.

The choice of valuation method directly shapes negotiations and deal structures. Platforms like Urgent Exits help connect sellers needing quick exits with buyers seeking turnaround opportunities, as well as advisors who specialize in distressed transactions. These tools ensure valuations reflect the true state and potential of a business, enabling deals that align with everyone’s goals.

How to Choose the Right Valuation Method

Picking the right valuation method is no small matter. It can influence recovery amounts, deal structures, and big-picture strategies. It all boils down to understanding whether a business holds more value as an ongoing operation or through the sale of its assets. Here’s a closer look at how to approach this decision.

What to Consider When Choosing a Valuation Method

For businesses in serious financial trouble – like those facing Chapter 7 bankruptcy – liquidation value is often the starting point. Tangible assets tend to lose value quickly during a sale, so this method focuses on what can realistically be recovered. On the other hand, businesses with short-term struggles but a path to sustainability may be better evaluated using a going concern valuation, especially in Chapter 11 cases where future earnings potential is still in play.

The type of assets a company holds and broader industry trends also play a big role. Companies rich in intangible assets – like brand value, customer relationships, or intellectual property – are typically better suited for a going concern valuation. These assets rarely hold much value in a liquidation scenario. For businesses with mostly tangible assets, the difference between liquidation and going concern values is often minimal.

Time constraints can also dictate the valuation method. When cash is urgently needed, a forced liquidation – where assets are sold quickly at discounted prices – might be the only option. However, if there’s more time, an orderly liquidation allows for a more deliberate sales process, maximizing returns.

Stakeholder priorities add another layer of complexity. For example:

- Secured creditors often focus on collateral values and may push for quick liquidation to prevent further losses.

- Unsecured creditors might prefer ongoing operations, but only if the business can stay afloat.

- Owners usually lean toward going concern valuations because they offer higher recovery potential.

- Buyers might see liquidation prices as an opportunity to acquire assets cheaply, with plans to rebuild operational value later.

How Urgent Exits Supports Valuation and Transactions

Urgent Exits provides a streamlined way to navigate these valuation challenges, connecting stakeholders with the right expertise to handle distressed business transactions. The platform recognizes that businesses in financial trouble need precise valuation methods and effective deal execution.

For sellers looking for a quick exit, Urgent Exits offers access to both liquidation specialists and turnaround buyers. This dual approach helps sellers weigh realistic liquidation proceeds against potential offers based on going concern valuations. Tracking buyer interest also provides insight into market conditions.

For buyers, the platform is a goldmine for spotting undervalued opportunities. It helps them identify businesses where the gap between liquidation and going concern values creates clear profit potential. Many of these buyers specialize in purchasing distressed assets at liquidation prices and then improving operations to unlock ongoing value.

Advisors – including appraisers, restructuring consultants, bankruptcy attorneys, and liquidators – benefit as well. Urgent Exits connects them with motivated clients in need of guidance. These professionals play a key role in choosing the right valuation method, conducting appraisals, and advising on whether liquidation or reorganization makes the most sense.

Since Urgent Exits focuses on broker-rejected and distressed businesses, many listings involve companies that don’t fit neatly into traditional valuation methods. This creates unique opportunities for savvy buyers and advisors to combine different valuation approaches for maximum advantage.

Conclusion: Key Points About Liquidation Value vs. Going Concern Value

Grasping the distinction between liquidation value and going concern value is crucial for navigating financial decisions in distressed business scenarios. These two valuation methods take vastly different approaches to determining the worth of a struggling company.

Key Differences and When to Use Each

Liquidation value focuses on the assumption that the business will cease operations and sell its assets individually. This method only considers tangible assets, leaving out intangibles like brand equity, customer loyalty, or intellectual property.

Going concern value, on the other hand, assumes the business will continue to operate and generate earnings in the future. This approach accounts for both tangible and intangible assets, such as goodwill and customer relationships, often leading to higher valuations. The core idea here is that an operational business can be worth more than the sum of its parts.

Choosing between these methods depends largely on the company’s current financial state and future prospects. Liquidation value is most relevant in cases like Chapter 7 bankruptcies or forced asset sales. In contrast, going concern value is appropriate when the business has a roadmap for recovery, such as in Chapter 11 reorganizations or acquisitions.

Timing is another critical factor. Orderly liquidation value assumes that assets can be sold over a reasonable period to maximize their worth, while forced liquidation value reflects the lower returns from quick, auction-style sales. These nuances guide stakeholders toward more strategic and informed decisions.

Actionable Steps for Stakeholders in Distressed Transactions

Understanding these valuation methods is only the beginning – stakeholders must now decide how to act.

- Sellers should seek both liquidation and going concern appraisals. This dual perspective helps set realistic expectations and informs whether to pursue a fast asset sale or invest in finding a buyer who values the business as a going concern.

- Buyers can capitalize on the difference between these values. Many successful distressed acquisitions involve purchasing assets at liquidation prices and then improving operations to unlock the higher going concern value.

- Advisors, such as appraisers, restructuring experts, bankruptcy attorneys, and liquidators, should step in early to guide stakeholders. Their expertise ensures accurate valuations, helps navigate the choice between liquidation and restructuring, and prevents rushed or poorly informed decisions.

Urgent Exits serves as a bridge in these transactions, connecting sellers with liquidation experts and turnaround buyers, while offering buyers access to distressed businesses with untapped potential.

FAQs

What is the difference between liquidation value and going concern value, and how do they affect stakeholders during financial distress?

Liquidation value and going concern value are two distinct approaches to evaluating a business, especially when it faces financial difficulties. Liquidation value represents the estimated amount a company could generate by selling off its assets quickly, often at a reduced price, to settle debts. This valuation is typically used when a business is shutting down or cannot continue operations. In contrast, going concern value assumes the business will remain operational, focusing on its ability to generate revenue and profit over the long term.

These two perspectives can have a major impact on stakeholders. Creditors, for instance, might recover only a fraction of their claims based on liquidation value. However, if the business is assessed as a going concern, there’s the potential for greater recovery through restructuring or selling the company as a whole. For owners and investors, liquidation often results in financial losses, while keeping the business operational could safeguard or even enhance their equity. Understanding these valuations is crucial for making sound decisions during tough times.

What should you consider when choosing between liquidation value and going concern value for a business valuation?

When choosing between liquidation value and going concern value for valuing a business, the company’s financial condition and future outlook play a crucial role.

Liquidation value is most relevant when a business is struggling financially, dealing with operational issues, or preparing for a quick sale of its assets. In contrast, going concern value is used for businesses expected to continue operating, with prospects for recovery or growth.

The key is understanding the business’s situation – whether it’s in financial distress and requires an immediate exit or is stable with potential for long-term success. This context will help determine the best valuation approach.

How can buyers find profit opportunities by analyzing the difference between liquidation value and going concern value?

Buyers can spot profit opportunities by targeting businesses where the liquidation value – what the assets would fetch in a quick sale – is much lower than the going concern value, which reflects the business’s worth as an ongoing operation. This difference often signals a chance for financial gain, particularly in cases involving distressed businesses.

Distressed businesses present a unique chance for buyers to find undervalued assets. By digging into financial statements, assessing market trends, and evaluating the operational potential, buyers can identify businesses where reorganization or operational improvements might unlock untapped value. Additionally, platforms that focus on distressed business transactions can simplify the search by connecting buyers with motivated sellers and overlooked opportunities.