Business liquidation is the process of closing a company, selling its assets, and using the proceeds to pay off debts. It’s important to understand the timelines involved, as they vary depending on the type of liquidation:

- Creditors’ Voluntary Liquidation (CVL): Takes 6–24 months.

- Members’ Voluntary Liquidation (MVL): Usually completed in 6–12 months.

- Compulsory Liquidation: The longest process, taking 24–36+ months.

Each phase of liquidation involves key steps: assessing insolvency, appointing a liquidator, selling assets, and formally dissolving the business. Factors like asset complexity, creditor disputes, and tax issues can impact the timeline.

Professional advisors (like accountants, lawyers, and appraisers) and platforms like Urgent Exits can help streamline the process by connecting businesses with buyers and ensuring compliance with legal requirements. Proper planning and expert guidance are essential to avoid delays and complications.

Liquidation Timeline: How Long Does the Process Really Take?

Main Phases of the Liquidation Process

In the U.S., business liquidation typically unfolds in four key phases, each involving specific steps to ensure compliance with legal and financial obligations. Knowing these stages can help stakeholders navigate the process more smoothly and avoid unnecessary delays.

Planning and Insolvency Assessment

Liquidation begins when business owners acknowledge serious financial challenges. At this stage, they assess whether the company is insolvent by reviewing essential financial records, such as balance sheets, cash flow statements, and lists of assets and liabilities. The goal is to determine if the business can meet its financial obligations or if its liabilities outweigh its assets. Professional advisors often play a critical role in clarifying legal responsibilities and exploring potential alternatives before committing to liquidation.

During this phase, companies prepare a Statement of Affairs, which provides a detailed financial overview. In cases of Members’ Voluntary Liquidations, directors must also confirm that the company will remain solvent for at least the next 12 months. Depending on the complexity of the business, this evaluation can take several weeks to complete.

Liquidator Appointment

After deciding to liquidate, the next step is appointing a liquidator – typically an insolvency practitioner. This is done through resolutions passed by shareholders, and in some cases, creditor approval may also be required. The appointment process involves submitting specific documentation, including the company’s financial statements and the prepared Statement of Affairs.

Once appointed, the liquidator takes full control of the company’s operations. Their responsibilities include managing communications with creditors, overseeing the sale of assets, and guiding the liquidation process. With the liquidator in place, the focus shifts to valuing and selling the company’s assets.

Asset Sale and Distribution

This phase centers on evaluating and selling the company’s assets, often the most challenging part of the process. The liquidator identifies, collects, and determines the value of all assets, ranging from physical property to intellectual property. Assets are typically sold through auctions or private sales to achieve the best possible return. In some cases, directors may purchase company assets, but such transactions must be independently appraised at fair market value and approved by creditors.

Once assets are sold, the proceeds are distributed according to a legally mandated order. Secured creditors, like banks holding collateral, are paid first. Next are preferential creditors, such as employees owed wages. Unsecured creditors are paid after that, and any remaining funds go to shareholders. This phase can take several months, especially if disputes over asset values or creditor claims arise. Clear communication and thorough documentation are crucial to avoid complications.

Final Business Closure

The final phase involves completing all legal steps to formally dissolve the company. This includes filing detailed reports with state and federal agencies, such as the Secretary of State and the IRS, outlining the liquidation process, asset sales, and creditor payments. The company must also deregister for tax purposes and be removed from official registries. These requirements vary by state and often involve submitting specific forms and final tax filings.

For a straightforward voluntary liquidation, the entire process generally takes between 3 and 12 months.

Throughout these stages, platforms like Urgent Exits connect business owners with experienced professionals to streamline asset sales and the closure process. While the company’s legal existence ends with its dissolution, the liquidator may remain involved to address any lingering issues, ensuring that all documentation is in order to prevent future complications.

Liquidation Timelines by Type

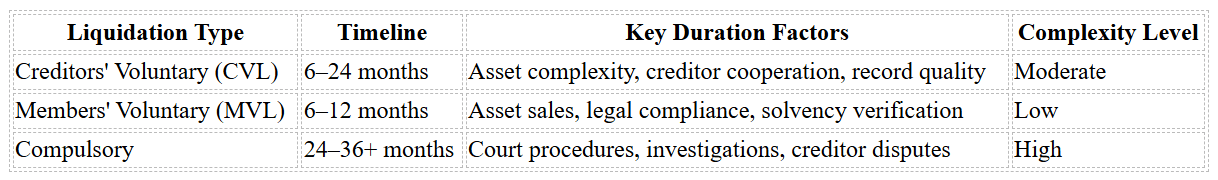

Liquidation timelines vary depending on the type of process, as each comes with its own set of insolvency conditions and legal requirements. The duration can range widely, influenced by factors like the complexity of assets, creditor cooperation, and legal proceedings. By understanding these distinctions, you can better prepare and manage expectations for everyone involved.

Creditors’ Voluntary Liquidation (CVL)

A Creditors’ Voluntary Liquidation (CVL) usually takes 6 to 24 months. This option is chosen when a company is insolvent and decides to liquidate voluntarily rather than wait for creditors to intervene.

The process can be quicker – around 6 months – if the company has simple assets and creditors cooperate. However, if the asset portfolio is more complicated or disputes arise with creditors, it may stretch beyond 12 months. Well-maintained financial records and accurate creditor information can significantly speed up the process, while poor documentation often causes delays.

Members’ Voluntary Liquidation (MVL)

Members’ Voluntary Liquidation (MVL) generally takes 6 to 12 months. This process is reserved for solvent companies that can pay off all their debts within 12 months. It’s often used when shareholders wish to wind down operations in an orderly manner.

Since the business remains solvent, there are no creditor disputes, which makes the process smoother and faster compared to insolvency-related liquidations. Full repayment to creditors eliminates the need for extended negotiations or conflict resolution, keeping the timeline relatively short.

Compulsory Liquidation

Compulsory liquidation, on the other hand, is the longest process, typically taking 24 to 36+ months. This court-ordered liquidation is initiated when creditors file a petition against a company that has failed to pay its debts and hasn’t opted for voluntary liquidation.

The extended timeline is due to several factors, including court oversight, procedural delays, and investigations. Every major decision – such as appointing a liquidator or approving asset sales – requires judicial approval, adding layers of complexity. Additionally, investigations into the conduct of company directors are more common in compulsory liquidations, often prolonging the process. Administrative steps, like the transfer of cases from official receivers to private insolvency practitioners, can also add time.

Partnering with experienced professionals can make a big difference in how efficiently these processes are handled. Services like Urgent Exits connect struggling businesses with liquidators, specialized buyers, and advisors who know how to navigate even the most complex situations. Engaging experts early on can help streamline the process, regardless of the liquidation type, and ensure smoother progress toward resolution.

Planning and Managing Liquidation Milestones

Handling liquidation effectively requires careful planning and keeping a close eye on key steps to avoid delays and unnecessary expenses. Building on the outlined phases, this section focuses on managing milestones to ensure the process stays on track.

Key Liquidation Milestones

Liquidation involves several crucial milestones, each with specific deadlines. It all begins with the insolvency assessment, where financial records are examined to confirm the company can no longer meet its obligations. This step is typically completed right away and serves as the foundation for everything that follows.

Next comes the liquidator appointment, usually occurring 1–2 weeks after a shareholder or creditor vote. One of the most time-sensitive steps is creditor notification. Known creditors are typically informed within 30 days, while notices for unknown creditors are published publicly. U.S. law enforces strict deadlines for these notifications, and missing them can lead to legal issues and extended timelines.

The asset collection, valuation, and sales phase can take anywhere from 1 to 6 months, depending on the complexity of the assets and market conditions. This phase concludes with debt settlement, where proceeds are distributed to creditors based on legal priority rules, including any outstanding tax obligations to the IRS.

The final step is filing reports and dissolution with state and federal authorities. Once the final report is submitted, companies are typically dissolved automatically within three months, officially closing the business.

Factors That Affect Timeline Length

Several factors can influence how long each milestone takes. For instance, asset complexity often plays a significant role. Companies with diverse portfolios – such as intellectual property, international holdings, or specialized equipment – may need extra time to properly value and market these assets.

Creditor disputes can also throw a wrench into the process. If creditors contest claims or challenge asset valuations, mediation or legal action may be required, potentially adding months to the timeline. This is especially common when disputes involve large sums or intricate contracts.

Tax-related issues are another common source of delays. Unresolved tax liabilities, missing returns, or disputes with the IRS must be settled before the final dissolution can proceed. This challenge can become even more complicated for businesses operating across multiple states with varying tax regulations.

The quality of the company’s documentation is also a critical factor. Missing financial records, incomplete contracts, or poorly organized creditor information can slow down the audit and assessment phases. On the flip side, well-maintained records can help speed up the early stages of liquidation.

Lastly, regulatory compliance can add complexity. State and industry-specific requirements may involve additional oversight or reporting, which could extend the timeline. However, some businesses might qualify for faster procedures depending on their situation.

Managing Deadlines and Schedules

Staying on top of deadlines starts with creating a detailed liquidation timeline that includes all milestones and their dependencies. Tools like Trello or Asana can be helpful for tracking progress and setting automated reminders.

Maintaining consistent communication with the liquidator and other advisors is essential. Weekly or bi-weekly meetings can help identify potential issues early and adjust timelines as needed. These check-ins also ensure the process continues to move forward without unnecessary delays.

A unified calendar is another valuable tool for managing statutory deadlines. Setting reminders ahead of key dates – such as creditor notification periods, tax filings, and regulatory submissions – can help avoid costly mistakes.

Centralizing all liquidation documents in a cloud-based system can also prevent delays. This allows liquidators, accountants, and legal advisors to access up-to-date information quickly, avoiding issues caused by missing paperwork when it’s needed most.

Engaging professional advisors early in the process is another smart move. Experts can help pinpoint potential bottlenecks and keep the schedule on track.

For the asset sale phase, platforms like Urgent Exits can save significant time. These platforms connect businesses with motivated buyers and specialized advisors, allowing assets to be listed and sold quickly. Instead of spending months searching for buyers through traditional channels, companies can often complete this step in just weeks, keeping the overall process on schedule.

The success of liquidation depends on proactive planning, regular communication, and timely engagement with professionals. Treating liquidation as a well-managed project can help businesses complete the process faster and with fewer complications, ensuring steady progress from start to finish.

Advisors and Platforms for Liquidation Support

Navigating a business liquidation isn’t something most business owners are equipped to handle on their own. The process involves a maze of legal requirements, asset valuation, and creditor negotiations – all of which can lead to costly mistakes without proper guidance. To avoid these pitfalls and ensure compliance with federal and state regulations, professional support is essential.

Working with Professional Advisors

Liquidation involves a team of specialized professionals, each bringing expertise to specific parts of the process:

- Accountants: These experts lay the groundwork by preparing detailed financial statements and addressing tax obligations. They coordinate with the IRS and state tax authorities to resolve outstanding liabilities, ensuring tax issues don’t delay the dissolution process.

- Lawyers: Legal advisors play a key role in guiding businesses through regulatory filings, creditor notifications, and potential disputes. They also protect directors from claims of misconduct and manage creditor negotiations, which can otherwise drag out the timeline.

- Appraisers: Accurate asset valuation is critical, especially for unique items like intellectual property or specialized equipment. Appraisers provide independent assessments to ensure assets are neither undervalued nor sold below market price, which helps creditors receive fair distributions.

- Auctioneers: When it comes to converting physical assets into cash, auctioneers are invaluable. They organize sales – whether online or in person – and tap into broad buyer networks to expedite the process, keeping liquidation on schedule.

- Liquidators: Acting as the central coordinators, liquidators oversee the entire process, from asset collection to final dissolution. They manage creditor communications, ensure compliance with regulations, and prioritize the distribution of proceeds. Their involvement often speeds up the process and minimizes disputes.

Attempting to handle liquidation without professional support can lead to serious setbacks, including asset undervaluation, missed creditor claims, extended timelines, increased costs, and even legal risks.

In the UK, between 1,500 and 2,000 company voluntary liquidations occur monthly, emphasizing how common these processes are and the need for professional expertise. Similarly, in the United States, business bankruptcies and liquidations fluctuate with economic trends, but expert involvement consistently proves critical for better outcomes.

Professional advisors often work hand-in-hand with digital platforms that simplify asset sales and streamline the overall process.

How Urgent Exits Supports Liquidation

Platforms like Urgent Exits are designed to complement the expertise of professional advisors and make liquidation more efficient. Traditional brokers often shy away from distressed companies, leaving business owners with limited options. Urgent Exits fills this gap by offering a marketplace tailored specifically for distressed businesses and liquidation scenarios.

Here’s how the platform streamlines the process:

- Quick Listings: Business owners can list their companies in minutes, which is crucial when working under tight deadlines.

- Targeted Asset Sales: The platform connects sellers with buyers who specialize in distressed assets and understand their potential. This targeted approach often reduces the time needed to complete sales from months to just weeks.

- Real-Time Feedback: Tracking tools allow sellers to monitor buyer interest through views and saves, providing valuable insights into market response.

- Comprehensive Advisor Network: From appraisers and auctioneers to lawyers and liquidators, Urgent Exits offers access to a wide range of professionals experienced in distressed business situations. This eliminates the need to search for individual specialists.

Because the platform is dedicated to distressed businesses, all participants – whether buyers, sellers, or advisors – are familiar with the unique challenges and time pressures involved. This shared understanding often leads to faster decisions and smoother negotiations compared to general business marketplaces.

Urgent Exits also leverages technology like virtual meetings and digital documentation to improve accessibility and communication, allowing stakeholders to collaborate seamlessly, regardless of location.

Conclusion

Knowing your liquidation timeline is key to ensuring a smooth and orderly wind-down of your business. The process unfolds in clear stages, and when handled properly, it can make stepping away from your business far less stressful.

The time it takes to liquidate depends on the type of process involved. Voluntary liquidations, for example, tend to wrap up faster than court-ordered ones. In the U.S., around 1,500 to 2,000 voluntary liquidations happen each month. Having a solid grasp of these timelines helps business owners set realistic expectations and make better decisions.

Proper planning can mean the difference between a well-organized liquidation and a chaotic, expensive ordeal. Without the right guidance, businesses risk undervaluing assets, overlooking creditor claims, dragging out the process, or even facing legal issues. A well-thought-out approach protects everyone involved and avoids unnecessary complications.

Technology has also made the liquidation process more efficient. Platforms like Urgent Exits offer a dedicated space where distressed businesses can quickly list for sale, connect with specialized buyers, and tap into a network of experienced professionals.

Starting early and working with experts can lead to better outcomes. Specialized platforms are just one part of the support system that helps protect stakeholders and sets the stage for new opportunities down the road.

FAQs

What key factors influence how long the business liquidation process takes?

The time it takes to complete a business liquidation can vary greatly, influenced by several key factors. The business’s size and complexity are significant – larger companies with extensive assets, numerous liabilities, and multiple stakeholders generally require more time to wind down. Similarly, legal and financial responsibilities, like paying off debts, resolving disputes, and adhering to state and federal regulations, can add to the timeline.

The type of liquidation also affects the duration. For example, voluntary liquidation tends to move faster than court-ordered processes, which often involve additional oversight and procedural requirements. That said, careful planning and enlisting experienced professionals, such as liquidators or financial advisors, can help make the process smoother and reduce unnecessary delays.

What is the difference between a liquidator’s role in Creditors’ Voluntary Liquidation and Compulsory Liquidation?

In a Creditors’ Voluntary Liquidation (CVL), the liquidator is chosen by the company’s shareholders and creditors to manage the structured closure of the business. Their job involves selling off the company’s assets, paying creditors, and distributing any leftover funds to shareholders – all while adhering to legal guidelines.

On the other hand, Compulsory Liquidation begins when a court appoints a liquidator after a creditor files a petition to wind up the company. While their duties – such as selling assets, paying debts, and ensuring legal compliance – are similar to those in a CVL, they operate under stricter court oversight, placing greater emphasis on safeguarding creditors’ interests.

What advantages does Urgent Exits offer during the business liquidation process?

Urgent Exits takes the hassle out of liquidation by offering a streamlined platform where sellers can quickly list distressed businesses. It’s designed to connect sellers with motivated buyers who are on the lookout for undervalued businesses that still have room to grow.

For buyers, the platform opens doors to a variety of businesses with promising turnaround opportunities. It also serves as a bridge for advisors – like accountants and liquidators – to connect with clients who need their expertise. By simplifying these connections, Urgent Exits helps make the often-complicated liquidation process smoother and more efficient for all parties involved.