Cash flow problems can quickly cripple a business. If expenses outpace income or cash becomes inaccessible, immediate action is critical. 82% of business failures in the U.S. are tied to poor cash management, emphasizing the need for prompt responses.

When cash dries up, businesses typically have three options to regain control:

- Asset Sales: Sell equipment, real estate, or inventory for fast cash (30–90 days).

- Distressed M&A: Sell the business at a reduced valuation to transfer ownership while managing debts (60–180 days).

- Liquidation: Close the business and sell all assets, either voluntarily or through bankruptcy.

Each route depends on your assets, debts, and timeline. Acting quickly and strategically can prevent further losses and improve outcomes.

Quick Exit Solutions Overview

When a business faces a cash crisis, quick decisions are essential to preserve what remains. There are three main exit strategies that can help struggling companies manage financial turmoil while considering the interests of stakeholders. Each method caters to specific circumstances and offers distinct benefits based on the company’s assets, market position, and time constraints. Here’s a closer look at these options.

3 Main Exit Options for Distressed Businesses

Asset Sales

This approach involves selling off assets like equipment, real estate, inventory, or intellectual property to generate immediate cash. It’s particularly effective for companies with valuable assets but temporary liquidity problems. Since the process can often be completed within 30 to 90 days, it’s a good fit for businesses that need a quick cash infusion but want to avoid shutting down entirely.

Distressed Mergers and Acquisitions (M&A)

In this scenario, the business is transferred to a buyer at below-market valuations, often with the buyer assuming the company’s debts. These transactions can take various forms, such as asset purchases, stock sales, or mergers. While distressed M&A deals can take longer – typically 60 to 180 days – they offer a way to transition the business while potentially preserving more value. The complexity of the deal and the required due diligence often determine the timeline.

Liquidation

This option involves selling all assets and formally closing the business. It’s the last resort when a company can no longer operate profitably or when other strategies aren’t viable. Liquidation can be voluntary, led by the business owner, or court-supervised through bankruptcy proceedings. While it tends to yield the lowest financial recovery, it provides a clear resolution to financial struggles.

How to Choose the Right Exit Strategy

Selecting the right exit strategy depends on several factors, including the company’s assets, timeline, debt structure, and obligations to stakeholders.

- Asset Value and Liquidity: Businesses with valuable, easily transferable assets may benefit from asset sales, while those with more integrated operations might lean toward M&A.

- Time Constraints: Companies under immediate creditor pressure might prioritize asset sales for quick cash, while those with more time could explore M&A for potentially better outcomes.

- Debt Structure: Businesses with secured debts tied to specific assets may find it challenging to sell those assets individually, making a whole-business transaction through M&A more practical. On the other hand, companies with mostly unsecured debt often have more flexibility.

- Owner’s Personal Involvement: Owners who have personally guaranteed debts may prefer strategies that reduce their exposure, while those deeply involved in daily operations must consider whether buyers can successfully run the business without their expertise.

- Market Conditions and Industry Trends: Certain industries may offer more M&A opportunities due to consolidation, while others with active secondary markets for equipment may favor asset sales.

- Stakeholder Obligations: The impact on employees, customers, and suppliers is another critical factor. Some strategies are better at maintaining these relationships and minimizing disruption.

Each of these strategies – asset sales, distressed M&A, and liquidation – provides a pathway forward, depending on the unique challenges and opportunities a business faces.

Asset Sales for Quick Cash Flow Relief

When facing financial challenges, selling assets can provide a fast solution to improve cash flow. This approach allows you to convert assets into cash within 30–90 days, offering a critical lifeline during tough times. The key is to act quickly, price competitively, and follow a clear plan to maximize liquidity when it matters most.

Preparing Assets for Quick Sale

Start with a detailed inventory. Make a comprehensive list of all assets, including real estate, equipment, vehicles, inventory, intellectual property, and accounts receivable. For each item, note its condition, age, and current market demand. This inventory will help you prioritize which assets to sell first for the best results.

Gather all necessary paperwork. For equipment, ensure you have purchase receipts, maintenance records, and warranties. For real estate, collect deeds, surveys, and zoning documents. For vehicles, secure titles and registration. Having these documents organized and ready can eliminate delays that might otherwise cost you valuable time.

Check for liens or restrictions. Review any liens or collateral agreements tied to your assets and, if needed, get lender approvals in advance. This step avoids legal issues that could derail a sale.

Get professional appraisals. Accurate valuations are crucial for setting competitive prices. For equipment, look at recent sales of similar items on auction sites or industry platforms to establish realistic price ranges. A professional appraisal can also reassure buyers of the asset’s value.

Work with a commercial attorney. Ensure title transfer documents are prepared correctly. Buyers are often cautious about unclear ownership, and any uncertainty could cause them to back out of a deal.

How to Get Higher Returns from Asset Sales

Once your assets are ready to sell, use these strategies to maximize returns while staying within tight timelines.

Set prices strategically. If you need to sell within 60–90 days, price assets at 70–80% of their appraised value. For sales within 30 days, consider pricing at 60–70%. While lower prices may seem like a loss, a quick sale often saves money by avoiding ongoing carrying costs.

Target the right buyers. Sell manufacturing equipment to industry peers or specialized dealers. Real estate can attract investors, developers, or businesses looking for operational space. Inventory often moves fastest through industry contacts, liquidators, or companies that can use the items immediately. Using niche marketplaces or networks typically yields better results than generic classified ads.

Bundle assets for added appeal. Grouping related items can increase their value. For example, a complete production line is often worth more than selling individual machines. Similarly, office furniture and equipment packages appeal to businesses setting up new locations, and vehicle fleets with maintenance records can command higher prices than individual trucks. Bundling simplifies transactions for buyers and can justify higher offers.

Offer flexible payment terms. Attract more buyers by allowing 20–30% down payments, with the remaining balance secured by the asset itself. This option appeals to buyers who see the value but need time to arrange full financing. Be sure to include clear default terms to protect yourself if payments stop.

Leverage multiple marketing channels. Maximize exposure by listing assets on industry-specific marketplaces, contacting equipment dealers, and reaching out to competitors who may need additional capacity. For real estate, work with commercial brokers. The broader your reach, the better your chances of finding buyers willing to pay fair prices quickly.

Be upfront about asset condition and value. Buyers understand the nature of distressed sales. Being honest about your timeline and the asset’s condition often attracts serious inquiries. Focus on showcasing the asset’s value rather than explaining why you’re selling.

Set clear deadlines and minimum prices. To avoid drawn-out negotiations, establish firm minimum prices and deadlines for offers. If multiple buyers are interested, create urgency by setting a "best and final offer" deadline. This approach keeps negotiations efficient while maintaining competitive pressure.

Distressed M&A Transactions

When cash flow issues threaten a company’s survival, distressed M&A provides a faster route to a resolution, often closing in just 60–90 days compared to the typical 6–12 months. This urgency attracts buyers looking for undervalued opportunities, but it also presents unique challenges, particularly with pricing, due diligence, and structuring the deal.

Distressed M&A is distinct from asset sales because it involves selling the entire business entity rather than individual components. This approach can preserve more value and ensure operational continuity. Buyers in these scenarios often include private equity firms, strategic acquirers, and turnaround specialists who focus on distressed situations.

Below, we’ll explore common deal structures and strategies for navigating these high-pressure transactions.

Common Distressed M&A Deal Structures

Different deal structures cater to various needs and circumstances. Here are the most common ones:

- Asset Purchase Agreements: These allow the buyer to select specific assets while assuming only certain liabilities, leaving unwanted debts with the seller. This structure minimizes risk for buyers and often speeds up the process. On the seller’s side, excluded liabilities remain their responsibility, but the deal’s simplicity can make it appealing.

- Stock Sales: In these deals, the buyer acquires ownership of the entire company, including all assets and liabilities. While less common due to liability concerns, stock sales can work well if the business has clean financials and the buyer wants to retain contracts, licenses, or relationships that might not transfer in an asset deal. These transactions often command higher prices but require more extensive due diligence.

- Section 363 Bankruptcy Sales: Conducted during Chapter 11 bankruptcy proceedings, these court-supervised sales allow assets to be sold free of most liens and liabilities. They typically close quickly and offer buyers strong legal protections. However, bankruptcy filings come with additional costs and public disclosures that some sellers prefer to avoid.

- Mergers: This structure involves combining the seller’s company with the buyer’s operations. It often preserves jobs and ensures operational continuity, with the buyer typically assuming the seller’s debts in exchange for a lower purchase price. Mergers work best when the seller’s business complements the buyer’s operations or offers strategic value.

Choosing the right structure depends on factors like urgency, liability concerns, and buyer preferences. Asset deals tend to move the fastest, while stock sales and mergers may yield higher value if there’s time for extended negotiations.

With these structures in mind, the next step is negotiating terms that protect your interests.

How to Negotiate Distressed Deals

In distressed M&A, every decision counts. Here’s how to approach negotiations effectively:

- Acknowledge the urgency but highlight value. Buyers already know you’re under financial stress, so be upfront about the situation while emphasizing the underlying strengths of the business. Frame the urgency as an opportunity for buyers to acquire valuable assets quickly, rather than a sign of desperation. Set firm deadlines for offers to maintain credibility.

- Provide detailed financial documentation. Prepare 24 months of financial records, including tax returns and cash flow projections. Be transparent about the causes of the cash flow crisis and the steps you’ve taken to address it. Honesty can build trust and prevent surprises during due diligence.

- Prioritize speed and certainty over maximum price. A slightly lower all-cash offer might be better than a higher bid with complex contingencies. Evaluate offers based on the buyer’s ability to close quickly and their track record with similar deals.

- Bridge valuation gaps with earnouts and consulting roles. Earnouts tied to clear performance milestones can help align interests. For instance, you could agree to stay on as a consultant for a short period, ensuring the business transitions smoothly while benefiting from its future success.

- Leverage platforms like Urgent Exits. These platforms connect you with qualified buyers and advisors who understand the unique demands of distressed deals. They streamline the process by allowing you to list your business, track buyer interest, and communicate directly with prospects.

- Clarify liability allocation. In asset deals, specify which liabilities the buyer will assume and which will remain with your business. Common liabilities buyers take on include trade payables, customer deposits, and employee obligations, while sellers usually retain bank debt, tax liabilities, and legal claims.

- Structure payment terms carefully. Request earnest money deposits (typically 5–10% of the purchase price) to ensure buyer commitment. Consider escrow arrangements to handle post-closing adjustments or warranty claims. If seller financing is involved, secure the loan with the assets being sold and require personal guarantees from the buyer’s principals.

- Plan communications for employees and customers. Buyers often worry about losing key employees or customers during the transition. Develop a plan to reassure stakeholders, such as offering retention bonuses to critical staff or holding joint customer meetings to ensure smooth handovers.

In distressed M&A, balancing speed with thorough preparation is essential. While time is of the essence, investing effort upfront in documentation and deal structuring can lead to faster closings and better outcomes for everyone involved.

Liquidation: How to Wind Down Your Business

When selling assets or pursuing distressed mergers and acquisitions isn’t an option, liquidation becomes the next step. This process turns your business assets into cash to pay off creditors and close operations. The reality? Liquidation often recovers only a fraction of what those assets are worth on paper. It’s a path best suited for businesses that have assets to sell but lack the operational strength for a sale or merger.

The critical choice lies in deciding between voluntary liquidation, where you remain in control, and court-supervised liquidation through Chapter 7 bankruptcy. Each option comes with its own set of benefits, depending on your circumstances. Here’s how to approach liquidation in an orderly and effective way.

Steps for Orderly Liquidation

A well-planned liquidation focuses on maximizing asset value while avoiding unnecessary legal hurdles. It requires careful coordination with creditors, employees, and the necessary authorities. Here’s a step-by-step guide:

- Take Stock of Your Assets

Start by creating a detailed inventory of everything the business owns – equipment, inventory, accounts receivable, intellectual property, real estate, and more. Get professional appraisals for major assets to determine realistic pricing. - Secure Your Assets

Protect your assets immediately by updating locks, ensuring insurance coverage, and taking other security measures. Notify your insurer about the liquidation, as some policies may have clauses limiting coverage if operations cease without notice. - Communicate with Creditors

Reach out to creditors early to explain your situation and share your plan. Transparency can help reduce conflicts and foster cooperation. Providing regular updates on sales progress and recovery estimates can also smooth the process. - Sell High-Value, Quick-Turnaround Items First

Prioritize assets that can be sold quickly, like inventory or equipment, to preserve their value. Accounts receivable can lose value over time, so address these early – considering options like factoring if needed. - Handle Employee Matters Properly

Notify employees promptly, adhering to federal and state regulations like the WARN Act. Pay final wages, accrued vacation, and any severance obligations quickly, as employee claims often take priority during liquidation. - Resolve Tax Obligations

File final tax returns and settle any outstanding tax issues. Work with a tax professional experienced in business closures to navigate this process efficiently. - Document Everything

Keep thorough records of all asset sales, payments to creditors, and related expenses. This not only ensures transparency but also protects you legally throughout and after the process.

Voluntary vs. Court-Supervised Liquidation

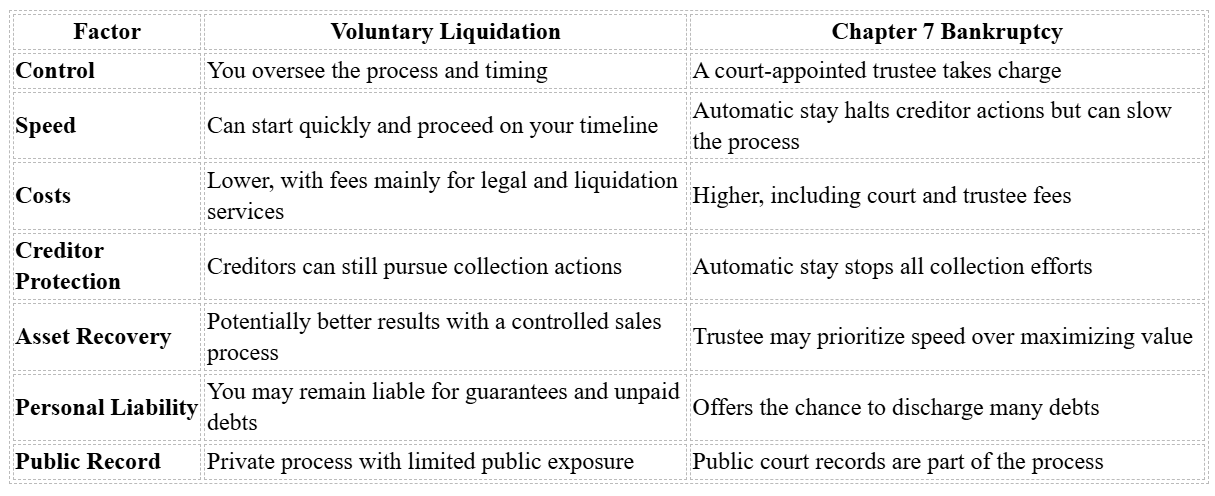

Once the groundwork is laid, you’ll need to decide between voluntary liquidation or court-supervised Chapter 7 bankruptcy. Here’s how the two compare:

Voluntary liquidation works well if creditors are cooperative, debts are manageable, and you have valuable assets that could benefit from targeted marketing. This approach gives you flexibility to time sales for better results. However, without the protection of an automatic stay, creditors may continue collection efforts, which can complicate matters.

Chapter 7 bankruptcy, on the other hand, provides the legal shield of an automatic stay, halting creditor actions immediately. A court-appointed trustee oversees the process, which can be simpler but less flexible. While it may help discharge certain debts, the public nature of the proceedings and additional costs make this option more suitable for businesses with complex debt situations or aggressive creditors.

Choosing the right liquidation path depends on your business’s specific challenges. If your debts are straightforward and creditors are willing to cooperate, voluntary liquidation may be the better option. But if you’re dealing with complicated debt structures or creditor disputes, Chapter 7 bankruptcy offers stronger legal protections.

To simplify the process, Urgent Exits connects businesses with liquidation specialists and buyers, particularly for companies with specialized inventory or equipment. This can help you recover assets more efficiently while ensuring a smoother exit.

Conclusion: Choosing Your Exit Strategy

When cash flow issues threaten your business, time becomes your most critical resource. Recognizing the crisis early allows you to take control and plan a structured exit, rather than watching your business spiral into collapse. Acting quickly is the foundation for choosing the right exit strategy.

Options like asset sales can provide fast access to cash by liquidating valuable items, while distressed mergers or acquisitions can help retain operational value. In cases where no other solution fits, liquidation can recover value from assets. Each path has its place, but the decision isn’t always straightforward.

A January 2025 survey found that over 60% of small businesses in the U.S. identified cash flow as their biggest financial challenge. Many turned to quick fixes like asset sales or short-term financing to stay afloat. This statistic highlights how common these struggles are – you’re not alone in facing tough choices.

Take the example of Green Earth Goods, a small U.S. retailer that weathered a cash flow crisis during a recession. Instead of waiting for perfect conditions, they took immediate action by cutting overhead costs and selling off excess inventory. This decisive approach stabilized their finances and proved that quick, bold moves often yield better results than hesitation.

In today’s financial climate, rising borrowing costs have made strategies like fast asset sales and alternative financing even more appealing for businesses in need of immediate relief. Professional guidance can be the difference between a smooth exit and unnecessary losses. Platforms like Urgent Exits connect you with experienced buyers, legal experts, and advisors who specialize in distressed business situations. Whether you’re selling assets, finding a buyer for your business, or navigating liquidation, having the right support can dramatically improve your outcome.

Ultimately, your exit strategy should align with your specific assets, debts, timeline, and goals. The key is to act without delay – every day that passes can limit your options and reduce potential recovery. Cash flow crises don’t wait, and businesses that confront them head-on with purpose and speed are the ones most likely to emerge on solid ground.

FAQs

What should a business evaluate when deciding between asset sales, distressed M&A, or liquidation to address cash flow issues?

When weighing options like asset sales, distressed M&A, or liquidation, businesses need to carefully consider their financial position, how quickly they need cash, and the potential effects on stakeholders.

- Asset sales might be the right move if the company owns valuable assets that can be sold individually to raise cash while keeping the business running.

- Distressed M&A is often suitable when the business still has operational value but needs a fast sale, usually at a lower price. This process requires analyzing liabilities and dealing with legal challenges.

- Liquidation is generally the last option, chosen when continuing operations or selling the business isn’t feasible. It involves selling assets to pay off creditors but often leads to minimal recovery for stakeholders.

The right path depends on the company’s financial health, how urgent the cash needs are, and the current market environment. Each option comes with its own set of challenges and implications, so a thorough evaluation is crucial to make the most informed decision.

What steps can a company take to quickly sell its assets and ease cash flow problems?

To address cash flow challenges and sell assets quickly, it’s crucial to showcase those assets in a way that attracts buyers and ensures a seamless transaction. Start by maintaining clear and accurate financial records – this not only builds trust but also gives potential buyers the transparency they need to make confident decisions. Make sure all assets are fully operational and properly documented, as this can speed up the process and help secure the best possible price.

Another key step is to simplify and optimize operations to make the business or its assets more appealing. For example, offering a turnkey setup, where operations can continue smoothly without the current owner’s involvement, can significantly reduce buyer concerns. This approach not only makes the sale process faster but also helps retain the asset’s value.

What’s the difference between voluntary and court-supervised liquidation, and how do they affect business owners?

Voluntary liquidation is a process where a company’s directors or shareholders decide to close the business. This can happen for various reasons, such as insolvency, the retirement of key stakeholders, or a strategic choice to shut down operations. One of the benefits of this route is that it allows for a more structured and cost-efficient closure, giving business owners more control over how the process unfolds.

On the other hand, court-supervised liquidation – also known as compulsory liquidation – occurs when a court orders the closure of a business. This usually happens at the request of creditors seeking repayment. This method tends to be more formal, often comes with higher costs, and can be unpredictable, as creditors may take an aggressive stance in pursuing their claims.

For business owners, voluntary liquidation is generally a more straightforward and manageable way to exit the business, while court-supervised liquidation can present additional hurdles and less favorable outcomes.