Looking for businesses priced below their worth? Here’s the key: focus on temporary challenges, not structural problems. Many businesses are undervalued due to owner fatigue, poor management, or market shifts, but still have strong fundamentals like loyal customers or valuable assets. By identifying these opportunities, you can buy low and turn them into profitable ventures.

Key Takeaways:

- What to Look For: Recurring revenue, strong customer relationships, and assets undervalued due to short-term issues.

- Where to Search: Online platforms like Urgent Exits, professional networks, and public records (e.g., bankruptcy filings or tax liens).

- Signs to Watch: Declining revenue, high debt tied to assets, or operational inefficiencies like outdated systems or high turnover.

- How to Evaluate: Conduct deep financial and operational reviews, focusing on cash flow, liabilities, and customer or supplier relationships.

- Risk Management: Use strategies like asset purchases, earnouts, or escrow to minimize risks during acquisitions.

Success comes from spotting hidden potential, acting quickly, and assembling the right team to improve struggling businesses. Let’s explore the details.

Key Signs of an Undervalued Business

Finding an undervalued business means looking past surface-level challenges to uncover hidden potential that others might overlook. The trick is identifying businesses facing temporary setbacks rather than those with deep, structural problems. Below are some key indicators that could signal a worthwhile investment opportunity. These financial and operational clues can help you dig deeper into a business’s true value.

Financial Metrics to Watch

Certain financial indicators can reveal businesses that are undervalued:

- Price-to-asset ratios: A business priced below the value of its tangible assets – like equipment, real estate, inventory, or intellectual property – might be a hidden gem. This suggests the market is undervaluing its core assets.

- Cash flow patterns: Negative cash flow can sometimes be a temporary issue rather than a sign of decline. For example, one-time events like legal settlements, equipment repairs, or inventory write-offs might skew the numbers. If the business still holds valuable assets, it could be poised for recovery.

- Revenue trends: Declining revenue due to factors like reduced marketing, supply chain hiccups, or owner neglect often signals a fixable problem. With the right management and investment, these businesses can bounce back.

- Debt-to-equity ratios: High debt levels aren’t always a deal-breaker, especially if the debt is tied to valuable assets or manageable cash flow. Understanding how the debt impacts the business’s recovery potential is key.

- Working capital issues: Cash flow bottlenecks caused by high inventory levels or slow-moving receivables might be temporary. With better management, these issues can often be resolved, unlocking hidden value.

Non-Financial Signs of Opportunity

Sometimes, the most telling signs aren’t in the financial statements. Operational and management-related issues can also reveal opportunities:

- Owner fatigue: Signs like deferred maintenance or outdated operations often lead to discounts. These businesses may just need fresh energy and attention to thrive.

- Operational inefficiencies: Outdated technology, manual processes, or poorly optimized supply chains can present opportunities for quick improvements. Fixing these inefficiencies often leads to immediate gains.

- Staffing challenges: High turnover, unfilled positions, or an aging workforce might point to management problems rather than deeper business flaws. Companies with a loyal customer base but staffing issues can often recover quickly under new leadership.

- Prime location: Businesses sitting on valuable real estate or enjoying strong foot traffic might underperform simply because of poor execution. A better strategy could unlock their potential.

- Customer concentration: While reliance on a few large customers might seem risky, it can also indicate stability – especially if those customers are creditworthy and have long-term relationships with the business.

- Regulatory compliance issues: Problems like environmental cleanup, safety upgrades, or licensing requirements often scare off buyers. However, businesses priced below their post-compliance value can represent excellent opportunities for those willing to tackle these challenges.

Industry Context Matters

Beyond the business itself, external factors can also shape its value. Understanding the broader industry landscape is crucial:

- Cyclical downturns: Industries like construction, manufacturing, or hospitality often face cycles. Businesses that survive downturns tend to emerge stronger when conditions improve, making them attractive investments.

- Technology disruption: While some businesses struggle to adapt to new technology, others in the same sector may thrive by leveraging it. Identifying which companies can use technology to their advantage is critical.

- Regulatory changes: Shifts in regulations can create winners and losers. For instance, stricter environmental standards might hurt some manufacturers but benefit those already compliant.

- Consumer behavior shifts: Changes in consumer habits, like the rise of online shopping, may hurt traditional retailers but create opportunities for businesses with strong e-commerce platforms or unique in-store experiences.

- Supply chain disruptions: Temporary supply chain issues can undervalue otherwise healthy businesses. Companies with diversified suppliers or local sourcing advantages might be especially well-positioned.

- Labor market changes: Businesses with strong employee retention programs or automation investments often outperform competitors struggling with workforce challenges.

Where to Find Undervalued Business Opportunities

Finding undervalued businesses isn’t just about knowing how to spot them – it’s about knowing where to look. The best opportunities often aren’t splashed across public listings. Instead, they require a thoughtful approach and a mix of strategies. Let’s dive into three key sources to uncover these hidden gems.

Using Online Marketplaces

Online marketplaces are a convenient starting point. They offer access to a wide range of distressed assets from multiple sellers, giving you more chances to find the right fit. One standout platform is Urgent Exits, which specializes in distressed business listings. It provides tools like advanced filtering by industry and location, unlimited browsing, and direct contact with sellers. Plus, you can save listings and track engagement metrics, helping you time your offers strategically.

To maximize your success on these platforms:

- Set up saved searches to get early alerts on new listings.

- Keep an eye on older listings – sellers may be more willing to negotiate after their businesses have been on the market for a while.

Working with Professional Networks

Your professional network can be a goldmine for uncovering off-market opportunities. Often, the best deals never make it to public listings – they’re shared within trusted circles. Building strong relationships across various industries and roles can open doors to these exclusive opportunities.

Key players like business brokers, bankruptcy attorneys, and turnaround consultants often have early insights into distressed businesses. Stay connected with them and offer mutual value to remain on their radar. You can also leverage second-degree connections to reach business owners in need of help.

Here are a few tips to strengthen your network:

- Build relationships with "super connectors" who can introduce you to a broader pool of contacts.

- Join or create investment groups focused on distressed assets to share expertise and resources.

- Stay active in your network by engaging with others’ projects and consistently offering valuable insights.

Using Public Records and Data

Public records are another powerful tool for identifying distressed businesses. They provide independent, factual data that can complement your digital searches and networking efforts. Bankruptcy filings, for example, are a common starting point. Through PACER (Public Access to Court Electronic Records), you can access detailed records on Chapter 11 reorganizations and Chapter 7 liquidations. These documents often include financial statements, creditor details, and asset lists, offering a clear picture of a company’s situation.

But bankruptcy filings are just the beginning. Other public records to explore include:

- State and local records: These can reveal lawsuits, tax liens, or regulatory issues that signal financial trouble.

- UCC filings: These show secured debt obligations, which can indicate a company’s financial health.

- Industry-specific databases: Government or regulatory bodies often maintain records on safety violations, licensing issues, or other sector-specific concerns.

To stay ahead of emerging opportunities, consider setting up Google Alerts with terms like "business for sale", "liquidation", or "asset sale", tailored to your target industries or locations. Local business journals and newspapers are also great for spotting early signs of distress before they become widely known.

For deeper insights, you might invest in commercial databases that track credit ratings or payment histories. While these services may require a subscription, they can uncover opportunities that others might overlook, giving you a valuable edge in the search for undervalued businesses.

Evaluating Turnaround Potential and Managing Risks

Identifying a distressed business opportunity is just the beginning. The real challenge lies in evaluating its potential for recovery and managing the risks involved. This phase demands thorough analysis, carefully crafted strategies, and the right team to handle the complexities that come with such situations.

Conducting Due Diligence

When dealing with distressed businesses, due diligence takes on an entirely new level of importance. Unlike standard acquisition reviews, this process must be swift and uncover issues that are often hidden beneath the surface.

Start with a detailed financial analysis that goes beyond the basics. Dive into cash flow patterns and receivables to understand how the business ended up in its current state. Pay close attention to seasonal trends, customer concentration risks, and any unusual transactions that might suggest issues like related-party dealings or asset stripping.

In these cases, asset valuation is a critical step. Book values often fail to reflect the real worth of assets, so it’s essential to bring in qualified appraisers. They can provide both liquidation and going-concern estimates, giving you a clearer picture of what you’re working with.

Be on the lookout for hidden liabilities. These can include pending lawsuits, employee claims, or unpaid wages and benefits, which can quickly add up. For example, violations of the WARN Act can lead to substantial penalties. Environmental liabilities also demand special attention, as they can persist even after an asset purchase and may require costly remediation efforts.

Additionally, assess the company’s key operational relationships. Financial troubles often strain or sever relationships with customers, suppliers, and other stakeholders. Understanding which relationships can be repaired and which are beyond saving is essential for gauging the true potential of a turnaround.

Risk Management Strategies

Once you’ve identified the key risks through due diligence, the next step is to structure the deal in a way that minimizes those risks. This is where smart deal structuring plays a critical role.

One effective approach is to favor asset purchases or Section 363 sales. Asset purchases allow you to select the assets and liabilities you want to acquire, while Section 363 sales under U.S. bankruptcy law provide "free and clear" title to assets, offering legal protection against hidden liabilities with court approval.

Another powerful tool is debtor-in-possession (DIP) financing. By providing financing to the distressed company before the acquisition, you gain significant influence over the bankruptcy process and often secure priority repayment. This strategy is especially effective if you’re the stalking horse bidder in a Section 363 auction.

To address valuation disagreements, consider using earnout structures. These allow part of the purchase price to be contingent on the business’s future performance, reducing your upfront risk while aligning incentives with the seller.

Escrow arrangements also provide added protection. Holding back 10-20% of the purchase price in escrow for 12-18 months can safeguard against undisclosed liabilities or misrepresentations that surface after closing.

When it comes to insurance, things can get tricky. Representations and warranties insurance can cover seller misrepresentations, but policies for distressed businesses often come with higher premiums and exclusions. If the business operates in industries with contamination risks, environmental insurance may be necessary to shield you from potential cleanup costs.

Once you’ve addressed these risks, the next step is assembling the right team to execute the turnaround plan.

Building a Turnaround Team

Having the right team in place before closing the deal is crucial for a successful turnaround. Distressed acquisitions require specialized skills that go beyond what general business advisors can offer.

Your legal team should include attorneys experienced in bankruptcy law, distressed mergers and acquisitions, and employment issues. They’ll need to handle complex creditor relationships, regulatory compliance, and potential preference actions. Industry-specific legal expertise is a bonus, as sector regulations can add unique challenges.

On the financial side, you’ll need more than a traditional CFO. Look for professionals skilled in cash management during crises, creditor negotiations, and restructuring. Hiring a Chief Restructuring Officer (CRO) can help stabilize operations and manage relationships with stakeholders after the acquisition.

Operational leadership is another key area. The current management team may be ineffective or already depleted. Identify potential interim executives, including operations managers who can quickly address inefficiencies and stabilize day-to-day activities.

Industry-specific advisors are invaluable in these situations. They can pinpoint operational improvements, assess market positioning, and prioritize turnaround initiatives. Their connections can also help reestablish relationships with customers, suppliers, and talent that are critical for recovery.

Don’t overlook the importance of communication experts. Distressed businesses often face damaged reputations and strained relationships with employees, customers, and suppliers. Professionals skilled in crisis communication can rebuild trust and stabilize the business post-acquisition.

While assembling this team may increase your upfront costs, it’s an investment in the success of the turnaround. The potential losses from a failed acquisition or poorly executed recovery far outweigh the cost of expert advice. Careful evaluation and a strong team are the foundation for transforming undervalued opportunities into successful ventures.

Negotiation Strategies for Distressed Deals

Negotiating with distressed sellers requires a quick yet cautious approach. The goal is to leverage the seller’s urgency while maintaining a professional and respectful relationship.

Tailoring Negotiation Tactics

To negotiate effectively, it’s crucial to understand the seller’s urgency – whether it’s due to looming loan defaults or mounting debt. Craft an offer that addresses their immediate concerns while securing terms that work in your favor.

One effective strategy is seller financing, which combines an upfront payment with a deferred balance or an earn-out tied to the business’s future performance. For example, in 2020, a distressed manufacturing acquisition in Ohio successfully used this approach to bridge valuation gaps.

You can also offer non-cash concessions to make the deal more appealing without increasing your financial burden. For instance, agreeing to retain key employees or providing transition support can address the seller’s concerns and build goodwill.

These strategies are especially relevant in the current economic climate. With nearly $500 billion in high-yield bond maturities looming through 2028 and a projected 3–4% default rate for U.S. companies by 2025, creative deal structures are more important than ever.

These tailored tactics lay the groundwork for selecting the right acquisition structure, as explored in the following comparison.

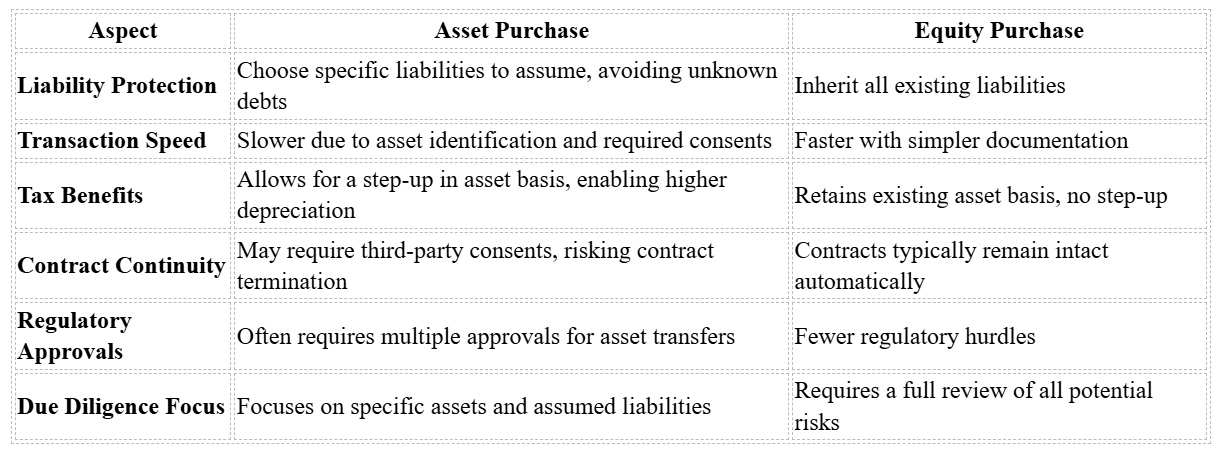

Asset vs. Equity Purchases Comparison

The decision to pursue an asset purchase or an equity purchase significantly affects your risk exposure and the complexity of the deal. Here’s how the two approaches stack up:

In distressed acquisitions, asset purchases are often preferred for their ability to shield buyers from unknown liabilities. However, this advantage comes with added complexity and time, which can be a challenge when speed is critical.

Balancing Speed and Thoroughness

When negotiating distressed deals, it’s essential to adapt your due diligence process to fit the accelerated timeline. This means focusing on the most critical areas to minimize risks without unnecessary delays.

Prioritize due diligence around cash flow analysis, key legal and regulatory reviews, and operational essentials, such as relationships with major customers and suppliers. This approach helps identify high-impact risks, such as lawsuits or compliance issues, without wasting time on less urgent details.

To further protect yourself, negotiate strong post-closing safeguards. For example, include indemnification clauses to cover undisclosed liabilities, and set aside part of the purchase price in escrow to address any surprises after the deal closes.

Lastly, keep the seller informed about your expedited process. Clearly explaining your focus on critical issues builds trust and ensures that both parties can move quickly without unnecessary missteps.

Conclusion: Finding Undervalued Opportunities for Growth

Tapping into undervalued business opportunities takes a mix of market savvy, analytical thinking, and timely decision-making. As financial pressures mount across industries, more distressed businesses are coming onto the market, creating unique chances for growth. Success in this area hinges on spotting early warning signs, conducting focused due diligence, and structuring deals that balance protecting your interests with addressing the seller’s immediate concerns. Timing is everything – being able to tell the difference between short-term setbacks and deeper, structural issues is key to identifying businesses that can thrive with the right changes.

The best strategies combine multiple methods of discovery while zeroing in on businesses with strong potential for a turnaround. Online platforms can provide quick access to listings, but your professional network often holds the real gems – off-market opportunities that haven’t hit the public eye yet.

Key Points to Remember

Here are some essential strategies to keep in mind for leveraging undervalued opportunities:

- Financial analysis is your cornerstone: Go beyond surface-level issues and dig into cash flow trends, debt obligations, and working capital requirements.

- Targeted due diligence sets you apart: Focus on critical areas like cash flow, key customer relationships, and any pressing legal concerns.

- Tailor your negotiation strategy: Align your offers with the seller’s immediate needs, whether that means offering quick cash or using creative financing structures like asset-based deals.

- Leverage your professional network: It’s often the fastest way to uncover high-quality opportunities before they’re broadly available.

- Don’t be fooled by surface-level issues: Businesses with clear paths to profitability often hide behind temporary challenges that can be resolved with the right approach.

FAQs

How can I tell if an undervalued business is facing temporary setbacks or deeper structural issues?

Temporary setbacks in undervalued businesses are the kind of short-term hurdles that might temporarily shake investor confidence. These could include a drop in market sentiment, minor operational issues, or predictable seasonal slowdowns. The key here is that these challenges don’t typically alter the company’s long-term potential. You can often spot these situations by diving into recent financial reports, keeping an eye on market trends, and reading news that hints at the issues being temporary and likely to improve.

Structural issues, however, are a different story. These are long-term, more serious problems that can jeopardize the business’s future. Think of things like consistent revenue declines, losing a competitive edge, or major disruptions in the industry. Spotting these requires a deeper dive – analyzing financial data over multiple quarters, understanding how the company stacks up against competitors, and keeping tabs on significant shifts in the industry landscape.

To tell the difference between the two, focus on the numbers. Look at financial trends, evaluate how well the company can adapt to challenges, and figure out if the problems are just bumps in the road or signs of deeper, fundamental issues.

What’s the best way to use public records and data to find undervalued business opportunities?

To find overlooked business opportunities in the U.S., start by diving into public records like corporate filings, bankruptcy records, and business registration data. These documents can offer insights into businesses facing financial struggles or those with untapped potential waiting to be realized. Pay close attention to financial metrics such as price-to-earnings (P/E), price-to-book (P/B), and debt-to-equity ratios – these can help you spot businesses that might be undervalued.

Another effective approach is building connections with industry professionals and keeping an eye on business sale listings or bankruptcy filings. Pair these efforts with a detailed analysis of market trends and industry-specific data, and you’ll be better equipped to identify businesses that have strong potential for recovery or growth.

What are the best ways to reduce risks when buying a distressed business with significant debt?

When acquiring a distressed business burdened with high debt, it’s crucial to take steps that minimize risks and set the stage for a successful turnaround. Start by conducting thorough due diligence. Dive deep into the company’s financials, debt structure, and any potential liabilities. This process helps you identify hidden risks that could complicate the acquisition.

Next, create a flexible action plan. This plan should address uncertainties and lay out clear steps to revitalize the business. Bringing in seasoned professionals, like financial advisors or turnaround experts, can offer invaluable guidance and support during this phase.

Lastly, prioritize risk mitigation strategies. These might include negotiating better terms, focusing on critical assets, and enforcing strict credit risk management practices. By taking these measures, you can limit your exposure and give the business a better chance at achieving long-term stability.