When selling a financially troubled business, the structure of the deal – asset sale or stock sale – can dramatically affect outcomes for both buyers and sellers. Each approach offers distinct advantages and risks, especially under the time pressure typical of distressed sales.

Key Points:

- Asset Sale: Buyers pick specific assets and liabilities, avoiding unwanted obligations. Sellers retain excluded liabilities. Offers tax benefits (e.g., depreciation) but can involve slower processes due to approvals and documentation.

- Stock Sale: Buyers acquire the entire company, including all liabilities. This simplifies the process and ensures business continuity, but buyers face higher risk of inheriting hidden problems. Sellers benefit from faster transactions and lower tax rates (capital gains).

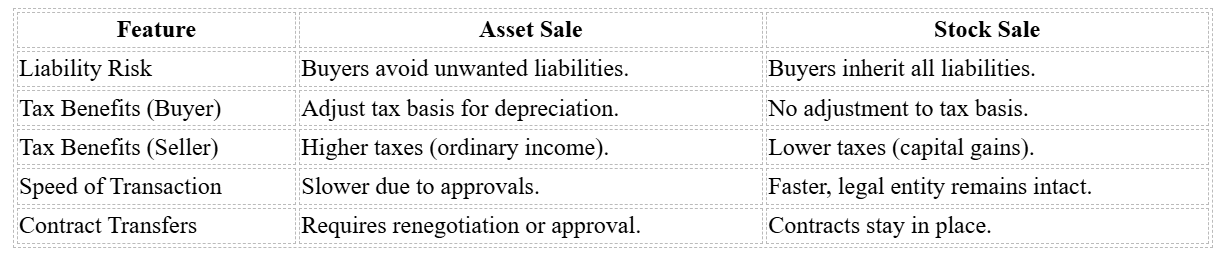

Quick Comparison:

Choosing the right structure depends on the business’s liabilities, urgency, and tax implications. Buyers often prefer asset sales for reduced risk, while sellers favor stock sales for simplicity and tax savings. Expert advisors can help navigate these complex decisions efficiently.

Asset Sale in Distressed Deals

What Is an Asset Sale?

An asset sale focuses on the purchase of specific assets from a business rather than acquiring the entire company. In this setup, the buyer identifies and selects the assets they want – such as equipment, inventory, intellectual property, customer contracts, or real estate – and decides which liabilities, if any, they are willing to take on.

This structure gives buyers a high level of control. Unlike a stock sale, where the buyer inherits all assets and liabilities, an asset sale allows buyers to avoid unwanted obligations, such as unresolved lawsuits or environmental risks. The selling entity remains intact after the transaction, holding onto any assets and liabilities excluded from the deal.

This flexibility is especially useful in distressed situations. For instance, a struggling restaurant chain might sell off its prime real estate and kitchen equipment while leaving behind burdens like unfavorable leases, vendor disputes, or pending lawsuits. However, transferring each asset requires separate documentation, adding a layer of complexity to the process.

Benefits of Asset Sales for Buyers and Sellers

For buyers, asset sales come with notable tax perks. One major advantage is the ability to adjust the value of acquired assets to their fair market value, which can lead to higher depreciation deductions. For example, purchasing depreciated equipment at its current market value can result in significant tax savings.

Operationally, buyers gain greater control. They can choose which employees to retain, which contracts to assume, and which vendor relationships to continue, giving them the opportunity to streamline and rebuild operations. For sellers, especially in distressed scenarios, breaking up the business and selling assets individually can sometimes yield a higher recovery value. A tech company, for example, might achieve a better return by selling its patents separately rather than as part of a whole business sale.

Another key benefit is the increased certainty of closing the deal. Since buyers can avoid taking on unknown risks, the due diligence process is often faster and more straightforward. In time-sensitive distressed sales, this streamlined process can be critical, helping both buyers and sellers address solvency concerns and close the deal quickly.

Drawbacks and Challenges in Asset Sales

Despite the advantages, asset sales come with their own set of hurdles. One major challenge is obtaining external approvals. Many valuable contracts include change-of-control clauses that require consent from customers, suppliers, or landlords before they can be transferred. Some customer contracts even allow termination when assigned to a new owner. Additionally, employees must be rehired under new agreements, which can lead to severance obligations, the loss of skilled workers, or operational disruptions during the transition.

Another issue arises with encumbered assets. In distressed businesses, assets are often used as collateral for debts. Buyers may need to settle these liens or negotiate their release with creditors, adding complexity to the transaction. Valuation disputes over these assets can also slow the process and impact the overall deal value.

Separating assets from the broader business can sometimes diminish their value. For example, certain assets may lose their appeal when disconnected from the integrated operations of the company. Furthermore, bulk sale laws in some states require specific notifications when a business sells most of its assets. These laws can delay transactions, which is particularly problematic in urgent distressed sales.

Lastly, disputes over how to allocate the purchase price can create tax complications. The IRS requires buyers and sellers to agree on how the price is distributed among the assets. Buyers often prefer to assign more value to depreciable assets for tax benefits, while sellers may lean toward allocations that qualify for capital gains treatment. These disagreements can delay the deal and increase the likelihood of audits for both parties.

Stock Sale in Distressed Deals

What Is a Stock Sale?

A stock sale involves transferring ownership of a company through the sale of its shares. In this type of transaction, all the company’s assets, liabilities, contracts, and obligations are passed along to the buyer in a single, comprehensive deal. The company itself remains the same legal entity, but it operates under new ownership.

This type of sale hands over complete control to the buyer. The new owner steps into the shoes of the previous owner, taking on not just the rights but also the responsibilities of the business. Unlike asset sales, where buyers can selectively acquire specific assets, stock sales are an all-or-nothing deal. The company continues operating as is, with its existing contracts, licenses, and relationships intact.

In distressed situations, this approach can be both a blessing and a curse. For instance, if a buyer acquires a struggling manufacturing firm through a stock sale, they gain the company’s equipment and customer relationships. However, they also inherit its debts, pending lawsuits, and environmental liabilities. Because the legal entity doesn’t change, the business can keep running without interruption, but the new owners must take on all the existing obligations. This comprehensive transfer comes with distinct advantages, which we’ll explore next.

Benefits of Stock Sales for Buyers and Sellers

Stock sales come with several advantages, particularly when speed and continuity are critical. Since the legal structure of the company remains unchanged, contracts usually don’t need to be renegotiated, nor is third-party consent often required. This can be especially important for distressed companies that need to finalize deals quickly to avoid bankruptcy.

For sellers, stock sales offer a straightforward way to exit the business. Instead of disentangling assets and liabilities, the seller transfers everything in one transaction and walks away. This is particularly appealing for owners who want to avoid lingering responsibilities or potential future claims tied to the business.

From a buyer’s perspective, stock sales ensure business continuity. Employee contracts, customer relationships, and regulatory approvals typically remain intact, which is crucial for distressed companies. Licenses and permits also transfer with the entity, avoiding the hassle of reapplying or meeting new qualifications.

Sellers often benefit from tax advantages in stock sales. Many transactions qualify for capital gains treatment, which can mean lower tax rates compared to ordinary income. Although buyers don’t receive the stepped-up basis benefit available in asset sales, they may save on overall costs due to reduced legal complexity and faster deal closures. However, these benefits come with risks, which we’ll cover in the next section.

Risks of Stock Sales in Distressed Transactions

The biggest risk in a stock sale is the potential for inheriting unknown liabilities. Buyers assume responsibility for all the company’s obligations, including those that may not surface during due diligence. This is especially risky with distressed companies, which often have incomplete records, unresolved legal issues, or hidden financial troubles.

Environmental liabilities are a major concern. For example, a buyer might later discover that the company is responsible for costly cleanup efforts due to contamination. These expenses can far exceed the purchase price and lead to ongoing regulatory challenges. Other risks include product liability claims, employment disputes, or unpaid taxes that weren’t fully disclosed.

In distressed deals, the need for speed often limits the time available for thorough due diligence. Buyers may not have enough time to fully investigate the company’s financial health, legal standing, or operational challenges. This time crunch increases the likelihood of missing critical issues that could impact the company’s value or future viability.

Debt-related complications can also arise. If the company has significant outstanding loans, creditors might challenge the transaction or demand immediate repayment. Some loan agreements include change-of-control clauses that accelerate repayment when ownership changes hands. Buyers must carefully review all debt agreements and may need to negotiate with lenders before finalizing the purchase.

Tax issues are another potential pitfall. If the company has unpaid taxes with the IRS or state authorities, these obligations transfer to the buyer. Tax authorities can pursue the new owners for any outstanding amounts. Additionally, if the deal isn’t structured properly, it could trigger additional tax liabilities or jeopardize favorable tax elections made by the company in the past.

Finally, regulatory hurdles can complicate stock sales, especially in industries with strict oversight. Some sectors require regulatory approval for ownership changes, which can delay or even block transactions. In time-sensitive situations, these requirements can derail deals or force buyers to accept less favorable terms to speed up approval.

Asset Sale vs Stock Sale: Side-by-Side Comparison

Key Differences Between Asset Sales and Stock Sales

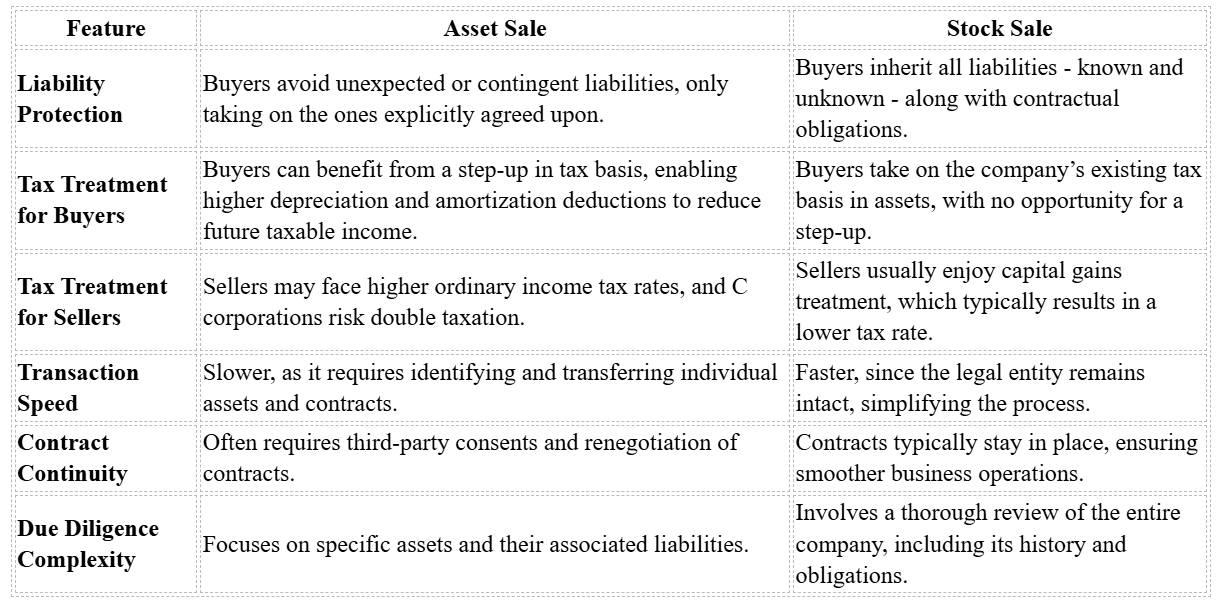

When deciding between an asset sale and a stock sale in distressed transactions, the choice often boils down to how risks are distributed and which party benefits from tax advantages. Each structure impacts buyers and sellers differently, creating a unique set of pros and cons for both sides.

These differences highlight how each approach allocates risk and tax benefits. Asset sales offer buyers liability protection and tax advantages through depreciation deductions, while stock sales provide sellers with capital gains treatment and a quicker, cleaner exit.

How to Choose Between Asset Sale and Stock Sale

When selecting between an asset sale and a stock sale, several factors come into play. The urgency of the deal, the nature of liabilities, and tax consequences for both parties are key considerations.

- Choose an asset sale if the company has substantial liabilities. Buyers can cherry-pick valuable assets and leave behind unwanted obligations.

- Opt for a stock sale when speed is critical and liabilities are minimal. This approach maintains business continuity, which can be essential for preserving contracts, licenses, and customer relationships.

- Consider a Section 338(h)(10) election to enjoy the best of both worlds. This option allows a stock sale to be treated as an asset sale for tax purposes, while retaining the simpler legal structure of a stock sale.

Distressed transactions often involve tight timelines and limited due diligence. These constraints can make stock sales appealing for their speed, but they also increase the risk of uncovering hidden issues later.

The best outcomes come from early collaboration with legal and tax experts. Engaging advisors before negotiating a letter of intent helps both buyers and sellers evaluate their options and structure deals that align with their goals – while avoiding unpleasant surprises down the road.

Negotiation Strategies for Distressed Business Transactions

Focus on Speed and Deal Certainty

Distressed business transactions come with intense time constraints that fundamentally reshape the negotiation process. Sellers, often under immense pressure to secure liquidity, prioritize closing deals quickly over achieving the highest price. This urgency creates a buyer’s market, shifting negotiating power in favor of buyers, who must also act swiftly to evaluate opportunities and make decisions with long-term consequences. For sellers, the challenge lies in balancing the need for speed with the preservation of their business’s remaining value, while buyers must conduct accelerated due diligence to minimize risks.

Adding to the complexity are the roles of creditors, bondholders, and bankruptcy courts, each with their own priorities and timelines. Identifying the key decision-makers early in the process and understanding their concerns is essential to navigating these dynamics effectively.

In these scenarios, managing creditor expectations becomes a vital skill. Creditors are focused on recovering as much value as possible and often recognize that a quick sale can yield better overall outcomes than a drawn-out liquidation. Skilled negotiators use this shared urgency to create a cooperative environment while maintaining trust with all stakeholders. This environment sets the stage for structuring terms that balance the interests of both buyers and sellers.

How to Structure Better Terms in Distressed Deals

Cash offers often take center stage in distressed transactions. Sellers, driven by the need for immediate liquidity, may accept lower valuations in exchange for the certainty of a quick close. Buyers with secured cash financing are well-positioned to negotiate terms that work in their favor.

Asset purchases are particularly appealing in these situations, as they allow buyers to acquire valuable assets while sidestepping potential liabilities. Platforms like Urgent Exits connect buyers with motivated sellers who understand that speed and deal certainty often outweigh achieving the highest price. This dynamic creates opportunities for buyers who are prepared to act decisively.

For deals where a straightforward asset or stock purchase doesn’t meet both parties’ needs, hybrid structures can offer creative solutions. These might involve acquiring specific assets while taking on certain liabilities or structuring stock sales with carve-outs for particular risks. The goal is to craft a deal that addresses the seller’s urgency while safeguarding the buyer’s interests.

Working with Advisors in Distressed Transactions

After structuring the deal, expert advisors become indispensable in navigating the legal and logistical challenges of distressed transactions. Their insights help identify potential pitfalls that could otherwise be missed in the rush to close.

Valuing distressed assets presents unique challenges, as traditional valuation methods often fall short when businesses are under financial duress. Due diligence in these cases focuses on pinpointing critical deal-breakers rather than conducting the thorough reviews typical of standard M&A deals. Advisors with expertise in distressed transactions can quickly identify red flags and set realistic expectations, helping both parties find workable solutions through innovative deal structures.

Legal compliance is another critical area, especially when bankruptcy proceedings or creditor agreements are in play. Advisors ensure that transactions adhere to existing agreements and court orders, reducing the risk of procedural missteps. No matter the deal structure, having skilled advisors involved strengthens the negotiation process and reduces the likelihood of post-closing issues. In the fast-paced world of distressed transactions, investing in experienced advisory services often leads to smoother deals and better outcomes for all parties involved.

Key Takeaways: Asset Sale vs Stock Sale in Distressed Deals

Choosing the Right Structure for Your Distressed Transaction

When dealing with distressed companies, deciding between an asset sale and a stock sale comes down to balancing risk, speed, and financial implications. Buyers often lean toward asset sales because they can cherry-pick specific assets while sidestepping unknown or contingent liabilities that might be lurking in the distressed company’s books. This approach helps minimize exposure to unforeseen risks.

Tax considerations also play a pivotal role. Asset sales allow buyers to "step up" the tax basis of the acquired assets, enhancing depreciation benefits. On the other hand, stock sales are more appealing to sellers because they typically qualify for capital gains treatment and avoid the double taxation often associated with asset deals.

The administrative burden can also tip the scales. Stock sales tend to close faster since the legal entity remains intact. In contrast, asset sales often require transferring multiple assets individually, which can slow the process. Understanding these nuances is essential for structuring a distressed deal strategically.

Steps Toward a Successful Distressed M&A Deal

Aligning the deal structure with risk tolerance and tax objectives is critical for maximizing speed and certainty – two key factors in distressed transactions. Given the tight timelines and high stakes, preparation and expert guidance are indispensable. Advisors experienced in distressed M&A can uncover potential pitfalls, craft creative solutions, and navigate the complexities that define these deals.

For buyers and sellers ready to dive into distressed transactions, platforms like Urgent Exits connect motivated parties who understand the unique challenges of these deals. In the end, the most successful outcomes stem from prioritizing speed and certainty over chasing the "perfect" price. Making structural choices early with the right advisory team can significantly increase the likelihood of a smooth and efficient transaction.

Asset vs Stock Sale & the 338(h)(10) – Half Asset – half Stock Purchase. Buying – Selling Business

FAQs

What should I consider when deciding between an asset sale and a stock sale in a distressed business deal?

When weighing an asset sale versus a stock sale in a distressed business transaction, several important factors come into play – liability transfer, tax considerations, and control over the acquired assets.

An asset sale allows buyers to pick and choose which assets and liabilities they want to take on. This selective approach is particularly appealing in distressed situations, as it helps buyers avoid unwanted obligations. On the other hand, a stock sale involves transferring ownership of the entire company, including all its liabilities – both known and hidden. While this can streamline the process for sellers, it introduces greater risk for buyers.

Tax implications also play a crucial role. Asset sales and stock sales are taxed differently, and the financial impact can vary significantly for both parties. The decision between these two methods often hinges on the deal’s unique circumstances, such as the business’s financial condition, the buyer’s willingness to take on risk, and the seller’s plans for exiting the business.

What are the tax differences between asset sales and stock sales, and how do they impact deal structures in distressed transactions?

Tax considerations heavily influence how distressed business transactions are structured. In an asset sale, sellers often encounter double taxation. First, the business entity is taxed on the sale of its assets. Then, when the proceeds are distributed, sellers face another round of taxes. On the flip side, buyers tend to favor asset sales because they can depreciate the acquired assets and reduce their liability exposure.

In contrast, a stock sale usually works out better for sellers from a tax perspective. These transactions are typically taxed as capital gains at the individual level, which often results in lower tax rates. For buyers, however, stock sales come with a mixed bag of tax implications. While they may inherit the company’s tax attributes – potentially offering certain advantages – they also take on the risk of any hidden liabilities tied to the business. Ultimately, whether an asset or stock sale is chosen depends on the financial goals and risk tolerance of both parties.

What risks do buyers face in stock sales during distressed transactions, and how can they minimize them?

When buying stock in a distressed business, there’s always the chance of taking on hidden liabilities – things like unpaid debts, unresolved legal battles, or lingering tax issues. These surprises can quickly turn into costly headaches if not identified and managed upfront.

To steer clear of such pitfalls, it’s crucial to carry out comprehensive due diligence. This means diving deep into the company’s financial and legal records to spot any potential problems. It’s also wise to negotiate protective measures – such as indemnities, warranties, or escrow agreements – to safeguard your investment. On top of that, having clear, well-drafted contracts can help ensure the deal aligns with your objectives while reducing the risk of unexpected complications.