Liquidation appraisals estimate how much money can be recovered from assets when a business shuts down. Unlike standard valuations, these focus on urgent sales, often at lower prices, to repay creditors. Here’s what you need to know:

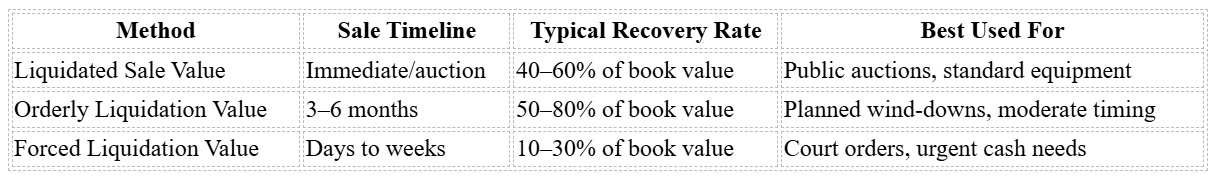

- Three Main Techniques:

- Liquidated Sale Value: Quick auctions with minimal prep, recovering 40–60% of book value.

- Orderly Liquidation Value: Planned sales over months, recovering 50–80%.

- Forced Liquidation Value: Fast, court-ordered sales, recovering 10–30%.

- Key Factors Affecting Value:

- Asset condition and market demand.

- Time constraints and sale strategy.

- Costs like broker fees and taxes.

- Best Practices:

- Hire certified appraisers for accurate assessments.

- Use market data and valuation tools.

- Collaborate with advisors like auctioneers and legal experts.

Platforms like Urgent Exits simplify this process, connecting sellers with buyers and providing real-time market data for faster, more precise valuations.

Main Appraisal Methods for Liquidation

Liquidation appraisals typically rely on three primary methods, each tailored to different sale scenarios and time constraints.

Liquidated Sale Value

This method estimates the price assets might bring in an immediate auction setting. It assumes a quick sale with very little marketing or preparation, which often leads to lower recovery rates since fewer buyers are reached. It’s commonly used for assets like standard office equipment or inventory with broad market appeal. Factors such as the asset’s condition, current market trends, and ease of transfer are key considerations. This approach is often seen in Chapter 7 bankruptcy cases, where court deadlines demand swift asset sales. For example, a manufacturing company shutting down might sell its office furniture quickly, recovering around 40–60% of the book value for items in good condition.

Orderly Liquidation Value

Orderly Liquidation Value allows for a longer sales timeline, typically spanning several months. This extra time enables targeted marketing, negotiations, and the ability to reach industry-specific buyers. It’s particularly effective during planned business closures or restructuring efforts, where management can carefully strategize asset sales. Appraisers can break larger lots into smaller, more appealing pieces, often leading to higher returns. Assets sold this way typically recover 50–80% of their book value, thanks to the more deliberate and organized process.

Forced Liquidation Value

Forced Liquidation Value comes into play when assets must be sold under extreme time pressures, such as foreclosure auctions or court-ordered liquidations. Because of the urgency, this method usually yields the lowest recovery rates. Even assets with strong value may sell at steep discounts, and highly specialized or customized items might only recover 10–30% of their book value. Despite the lower returns, this method provides a critical benchmark for creditors and stakeholders to understand the lowest potential recovery outcomes.

In practice, liquidations often mix these methods. For example, a company might use forced liquidation for outdated inventory, orderly liquidation for high-value machinery, and liquidated sale value for general office equipment. The choice depends on factors like time constraints, asset type, and any legal requirements. The next section will explore the key elements that influence these liquidation values.

Factors That Affect Liquidation Values

Several important elements influence how much assets will bring during a liquidation sale. By examining asset conditions and the timing of sales, we can better understand the practical factors that shape valuations. This insight not only helps appraisers deliver more precise assessments but also allows business owners to set realistic expectations when selling distressed assets. These considerations highlight the crucial roles of asset quality and timing in determining final recovery rates.

Asset Condition and Market Trends

The condition of an asset – its maintenance, age, and resistance to becoming outdated – plays a major role in its resale value. Well-maintained, newer assets typically fetch higher prices, while damaged or outdated items often sell for less.

Market demand also significantly impacts recovery values. When demand for a specific type of asset is high, sellers can achieve better returns. On the flip side, if the market is saturated with similar items or economic conditions are weak, even high-quality assets may have to be sold at steep discounts. For instance, in one manufacturing business liquidation, well-maintained CNC machines sold for 80% of their book value due to strong demand in the U.S., whereas outdated office equipment brought in less than 20% because of oversupply and low buyer interest.

Depreciation and obsolescence further reduce asset values. These factors stem from physical wear, functional limitations, and external market conditions. Additionally, asset liquidity – how easily an asset can be converted to cash – affects its value. Highly liquid assets, like cash equivalents or marketable securities, tend to retain most of their worth. On the other hand, specialized or custom-built equipment often sells at a significant discount, as such items are tailored for niche uses and have limited resale appeal.

While asset quality and market trends are critical, the timing and strategy of the sale also play a pivotal role in determining outcomes.

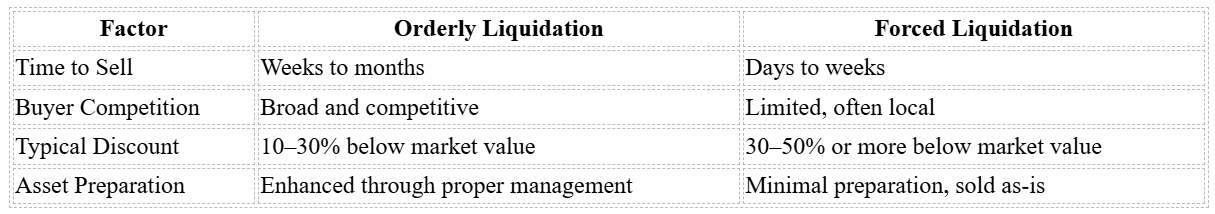

Time Constraints and Sale Strategy

When sellers face tight deadlines, they often have to lower prices, as rushed sales leave little room for preparation or attracting competitive buyers.

The sale strategy chosen can also make a big difference. Forced liquidations, which must be completed within 90 days or less, often result in assets selling at discounts of 30–50% (or more) below market value. This is largely due to limited buyer competition and minimal preparation time. In contrast, orderly liquidations – where sellers have weeks or months to plan – allow for better asset preparation, targeted marketing to specific buyers, and competitive bidding. These factors typically reduce discounts to 10–30% below market value.

Costs like broker commissions, legal fees, disposal taxes, and administrative expenses further cut into net recovery. For example, if assets sell for $500,000 but incur $50,000 in related costs, the net liquidation value drops to $450,000.

Here’s a quick comparison of orderly versus forced liquidation strategies:

Professional appraisers take these factors into account by analyzing recent sales data, consulting industry databases, and working with local brokers to benchmark asset values against similar transactions.

Ultimately, the interplay between asset condition, market trends, time constraints, and sale strategy explains why liquidation values can vary so much – even for similar types of assets.

Best Practices and Tools for Liquidation Appraisals

Liquidation appraisals demand precision, expertise, and the right tools to address the challenges that come with rapid asset valuation. Missteps in this process can lead to costly inaccuracies, so it’s critical to rely on proven methods and resources.

Use Professional Appraisal Services

When it comes to liquidation scenarios, certified appraisers play a crucial role. Their objectivity and adherence to standardized methodologies ensure valuations meet both legal and financial expectations. By working with appraisers certified by recognized organizations like the Appraisal Institute or the American Society of Appraisers, you gain access to professionals trained in asset-specific valuation techniques. These experts are well-versed in handling a range of liquidation types, from orderly sales with flexible timelines to forced liquidations requiring swift action.

Certified appraisers excel at tackling common challenges, such as valuing specialized assets or dealing with limited market comparables. They conduct detailed inspections and use industry-specific recovery rates to arrive at accurate valuations, ensuring a comprehensive and reliable appraisal process.

Apply Market Data and Valuation Software

Market data is a cornerstone of accurate liquidation appraisals. Information such as recent auction results, distressed asset sales, industry depreciation rates, and broker surveys provides critical benchmarks for determining recovery rates and market values. For instance, platforms like Urgent Exits offer real-time data on distressed business sales, helping appraisers stay informed about current demand and pricing trends. This continuous stream of information is invaluable for gauging market conditions and identifying motivated buyers.

In addition to market data, valuation software enhances the appraisal process by analyzing large datasets and modeling asset portfolios. Tools like NAV (Net Asset Value) calculators and specialized platforms integrate real-time market trends, allowing appraisers to deliver consistent and precise valuations. For assets with active secondary markets, the market approach is particularly effective, while asset-based or discounted cash flow methods are better suited for unique or less liquid assets. Together, these tools and data sources provide appraisers with the insights needed to handle even the most complex scenarios.

Work with Experienced Advisors

Navigating liquidation scenarios often requires input from a multidisciplinary team. Advisors such as insolvency practitioners, auctioneers, M&A lawyers, exit planners, and turnaround specialists bring diverse expertise to the table, significantly improving the appraisal process.

For example, insolvency practitioners help manage compliance and creditor negotiations, ensuring the appraisal aligns with legal requirements. Auctioneers contribute valuable market insights, maximizing asset exposure and encouraging competitive bidding. Meanwhile, legal experts ensure regulatory standards are met, and industry specialists provide detailed knowledge about specific asset types and market conditions.

Platforms like Urgent Exits simplify the process by connecting advisors with buyers and sellers of distressed businesses. This marketplace model allows professionals to offer tailored services, facilitating smoother liquidation and exit strategies.

To make the most of this collaborative approach, it’s essential to clearly define the scope of work for each team member. Every advisor should understand their role and how their expertise contributes to achieving accurate and defensible valuations. This teamwork not only streamlines the appraisal process but also improves asset recovery outcomes, benefiting all stakeholders involved.

How Urgent Exits Supports Liquidation Appraisals

Urgent Exits tackles the dual challenge of speed and precision in liquidation appraisals by offering a specialized marketplace tailored for distressed businesses and the professionals assisting them.

Access to Motivated Buyers and Advisors

Urgent Exits connects sellers with buyers actively searching for undervalued opportunities and advisors experienced in the nuances of distressed transactions. Sellers can list their businesses in just a few minutes, gaining direct access to certified appraisers, restructuring consultants, auctioneers, and legal experts. The platform’s search filters allow users to quickly find professionals based on industry, asset type, or geographic location.

Take, for example, a small manufacturing business under creditor pressure. After listing its assets on Urgent Exits, the business attracted multiple buyers and an appraiser within days. The appraiser confirmed the market value, and the seller negotiated a sale above initial expectations. The entire transaction wrapped up in just three weeks, showcasing the platform’s ability to connect the right stakeholders under tight deadlines.

Urgent Exits also features a network of advisors well-versed in distressed business scenarios. These professionals ensure appraisals account for all critical factors, including asset condition, market demand, and legal restrictions. Their expertise enhances the credibility of valuations, which is essential for lenders, courts, and other decision-makers relying on these figures. This network forms the backbone of reliable, data-supported appraisals.

Marketplace Data for Accurate Valuations

In addition to its matching system, Urgent Exits offers real-time market data to support accurate appraisals. The platform compiles insights on recent sales, pricing trends, and outcomes for distressed assets. This information provides appraisers with reliable benchmarks, enabling them to validate their assumptions and adjust for current market dynamics.

One of the biggest hurdles in liquidation appraisals is the lack of relevant comparable sales data. Traditional methods often rely on outdated or irrelevant information. Urgent Exits addresses this issue by continuously updating its data, ensuring appraisers have access to the most current market insights.

Metrics like listing views, saves, and inquiries also offer valuable clues about buyer interest. This helps appraisers anticipate which assets might spark competitive bidding and which may require more aggressive pricing to attract buyers. By providing access to comparable sales data, historical transaction records, and expert commentary, the platform fosters transparency in the valuation process. This transparency reduces disputes between sellers, buyers, and creditors, as all parties can rely on objective data to back their positions. Ultimately, these insights not only refine valuations but also make the sale process more efficient.

Simplifying the Liquidation Process

Urgent Exits goes beyond connecting stakeholders and offering data – it simplifies the entire liquidation process. The platform’s user-friendly interface eliminates many of the administrative headaches that typically slow down liquidations. Sellers can upload documents, communicate securely with interested parties, and monitor buyer activity – all in one place.

Features like automated notifications and integrated document management help speed up the timeline from listing to sale. This rapid response is critical for maximizing asset recovery and minimizing losses. In many cases, sellers using Urgent Exits can complete sales faster than they would through traditional methods.

Sellers can also attach appraisal reports, asset inventories, and market data directly to their listings. Advisors can add commentary and analysis within the platform, creating a transparent record of the valuation process. This documentation is invaluable for due diligence, lender reviews, and legal compliance, which are often time-consuming aspects of liquidation.

Urgent Exits’ direct communication channels between sellers, buyers, and advisors remove unnecessary intermediaries, allowing negotiations to move faster. With new businesses being listed daily, the marketplace ensures distressed assets gain the exposure they need during critical timeframes, keeping the process efficient and effective.

Conclusion

Liquidation appraisals demand a thoughtful approach that balances precision with the urgency often tied to asset sales. The three main techniques – Liquidated Sale Value, Orderly Liquidation Value, and Forced Liquidation Value – are tailored to fit different scenarios, and selecting the appropriate method can significantly influence recovery results for creditors and stakeholders.

The success of these appraisals hinges on understanding how factors like asset condition, market trends, time constraints, and sales strategies affect recovery rates. Professional appraisers play a key role here, using up-to-date market data and specialized valuation tools to provide unbiased and informed assessments.

In addition to these traditional methods, advancements in technology are transforming liquidation processes. Digital platforms like Urgent Exits are making it easier to connect sellers with motivated buyers, streamlining administrative tasks and offering access to real-time market insights. These tools help overcome many of the challenges typically associated with liquidation scenarios.

By combining accurate valuations with expert insights, stakeholders can maximize recoveries and ensure equitable outcomes. Whether addressing manufacturing equipment under creditor pressure or niche-market assets, the integration of proven appraisal methods with modern technology creates a strong framework for navigating liquidation effectively.

In today’s fast-paced market, using the right valuation strategy and connecting with motivated buyers are critical to achieving fair market value and avoiding the pitfalls of fire-sale recoveries for distressed assets.

FAQs

What’s the difference between Liquidated Sale Value, Orderly Liquidation Value, and Forced Liquidation Value in terms of timing and recovery rates?

The differences between Liquidated Sale Value, Orderly Liquidation Value, and Forced Liquidation Value come down to how quickly assets are sold and the recovery rates that can be expected from each scenario:

- Liquidated Sale Value refers to assets sold through a planned process, often via auction, with the goal of achieving the best possible return within a reasonable timeframe. Because the process is organized, recovery rates tend to be higher than in rushed sales.

- Orderly Liquidation Value assumes assets are sold over a structured and deliberate period. This allows more time to market the assets effectively, which often leads to better recovery rates than a forced liquidation. However, the value may still fall short of fair market value.

- Forced Liquidation Value applies to situations where assets must be sold quickly, often due to financial distress, such as bankruptcy or foreclosure. These sales are conducted under tight deadlines, leading to lower recovery rates because there’s less time to attract buyers or negotiate favorable terms.

Grasping these distinctions is essential for accurate appraisals, particularly when evaluating assets for auctions or distressed business sales.

How do asset condition and market trends affect the liquidation value of a business’s assets?

The condition of assets is a major factor in determining their liquidation value. Assets that are well-maintained or relatively new tend to fetch higher prices, as buyers are often willing to pay more for items in good working condition. On the other hand, older or poorly maintained assets usually sell for less, reflecting their diminished appeal and functionality.

Market trends also play a key role in shaping asset values. Supply and demand for specific items can cause prices to fluctuate. For instance, if a certain type of machinery is in high demand, its liquidation value is likely to increase. Conversely, an oversupply of similar assets in the market can push prices downward.

For businesses that need to sell quickly, platforms like Urgent Exits offer a practical solution. These platforms connect sellers with buyers efficiently, helping to ensure that assets are sold promptly and at competitive rates.

Why is it crucial to work with certified appraisers and experienced advisors during a liquidation appraisal?

When it comes to liquidation appraisals, having certified appraisers and seasoned advisors on your side is crucial. Their expertise ensures accurate valuations, helping you determine the fair market value of assets – a key factor in achieving the best possible returns during auctions or sales.

These professionals excel at handling even the most challenging valuations, such as distressed or hard-to-sell assets. By partnering with them, you benefit from precise assessments, insider industry knowledge, and strategies tailored to your unique circumstances. This guidance empowers you to make well-informed decisions throughout the liquidation process.