When businesses go bankrupt, understanding tangible (physical) vs. intangible (non-physical) assets is key to valuing what creditors can recover. Tangible assets like machinery, real estate, and inventory are easier to price due to established markets. Intangible assets – such as patents, trademarks, and customer lists – are harder to value since their worth depends on future income potential and market demand.

Here’s a quick breakdown:

- Tangible assets: Physical items with clear market data (e.g., equipment, vehicles). Easier to sell, less volatile in price.

- Intangible assets: Non-physical items tied to intellectual property or brand value (e.g., software, goodwill). Require complex valuation methods like income-based approaches.

Key challenges include:

- Time pressures in bankruptcy often lead to steep discounts.

- Intangible assets may lose value when separated from the business.

- Courts rely on expert valuations to ensure creditor fairness.

For example, in the Polaroid bankruptcy, the brand and patents fetched $88.6M, far more than its physical assets. Yet, intangible assets often recover less than 32% of their book value in bankruptcy sales.

Platforms like Urgent Exits aim to improve pricing by connecting sellers and buyers in distressed markets, helping reduce losses. Proper valuation methods – cost, income, or market-based – are critical for fair outcomes.

Main Differences Between Physical and Non-Physical Assets

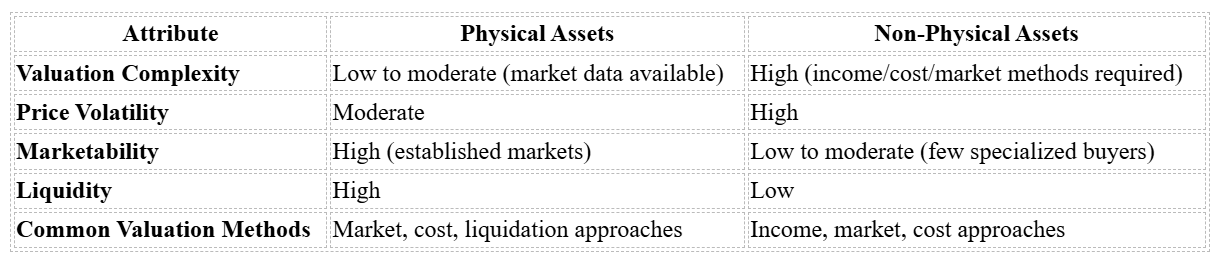

The differences between tangible and intangible assets significantly impact how quickly they can be sold and what creditors can recover during bankruptcy. Building on earlier definitions, let’s dive into how these two asset types differ, particularly in terms of valuation challenges.

Types of Physical and Non-Physical Assets

Physical assets are the cornerstone of many traditional businesses. They include things like real estate, manufacturing equipment, delivery vehicles, office furniture, and inventory. These are tangible items you can touch, inspect, and move.

Non-physical assets, on the other hand, reflect a company’s intellectual capital and competitive edge. Examples include patents (which protect inventions), trademarks (which guard brand identity), and copyrights (which cover creative works). Customer databases, filled with valuable contact details and purchasing histories, also fall into this category, as does proprietary software that gives operational advantages. Goodwill, tied to a company’s reputation and brand value, is another key example.

While physical assets like real estate and inventory are valued using clear market references, intangible assets such as patents or goodwill depend on projected income and competitive positioning. These differences are crucial for understanding the valuation challenges outlined below.

Valuation Difficulty and Market Comparison

Valuing these two asset types is a very different process. Physical assets are easier to appraise because they have established market comparisons. For example, determining the value of a delivery truck might involve looking at recent sales of similar vehicles, factoring in mileage and condition, and arriving at a fairly accurate estimate.

Intangible assets are trickier to value since their worth depends on future income potential and market conditions. For instance, the value of a patent may shift due to technological advancements or changes in management strategy. Similarly, brand value can plummet during bankruptcy if customer confidence erodes.

Here’s a quick comparison of key valuation differences between these asset types:

In forced liquidation scenarios, physical assets like equipment or inventory often sell for 20–70% below book value, and buyers can estimate these discounts fairly reliably. However, intangible assets face even steeper discounts – or may fail to attract any bids at all without effective marketing.

While physical assets benefit from established secondary markets that provide clear benchmarks, intangible assets rely on income or cost-based valuation methods. This makes their pricing more volatile and heavily dependent on buyer interest and perceived future value. For example, a software patent might not appeal to most buyers but could be extremely valuable to a competitor aiming to avoid infringement issues.

Interestingly, studies show that up to 80% of a modern business’s value can come from intangible assets. However, these assets often recover only a small fraction of their book value in bankruptcy sales. This gap between book value and recovery value creates significant challenges for creditors and complicates reorganization efforts.

Platforms like Urgent Exits specialize in connecting sellers and buyers, offering expertise tailored to both physical and intangible assets – especially when niche valuation strategies are needed.

Valuation Methods for Bankruptcy Asset Review

When bankruptcy courts need to determine the value of assets, they typically use three primary valuation methods. The choice of method depends on the type of asset being evaluated and the data available. These approaches, rooted in fundamental valuation principles, play a critical role in shaping bankruptcy outcomes.

Main Valuation Methods

The asset approach, often called the cost approach, estimates an asset’s value based on what it would cost to replace it. This method works well for tangible assets like machinery or office equipment, where replacement costs are straightforward. For example, consider a company that owns a three-year-old delivery truck. An appraiser might determine its value by starting with the price of a new truck and then accounting for depreciation based on factors like age, mileage, and condition.

The income approach values an asset by calculating the present value of its expected future cash flows. A common tool here is discounted cash flow (DCF) analysis, which projects future earnings and applies a discount rate to reflect their current value. This approach is particularly useful for intangible assets such as patents or customer databases that generate ongoing revenue. It’s also widely used in Chapter 11 reorganizations to evaluate the feasibility of a business plan.

The market approach determines value by comparing the asset to similar ones that have recently been sold. This method relies on actual transaction data. For example, in the case of real estate, appraisers might analyze recent sales of comparable properties. For intangible assets, such as patents or trademarks, the method might involve reviewing recent licensing deals or sales that provide benchmarks.

Liquidation value refers to the amount an asset could fetch in a quick-sale scenario, often lower than fair market value due to the urgency involved. Courts differentiate between orderly liquidation value, which assumes there’s enough time to find a buyer, and forced liquidation value, which involves an immediate sale.

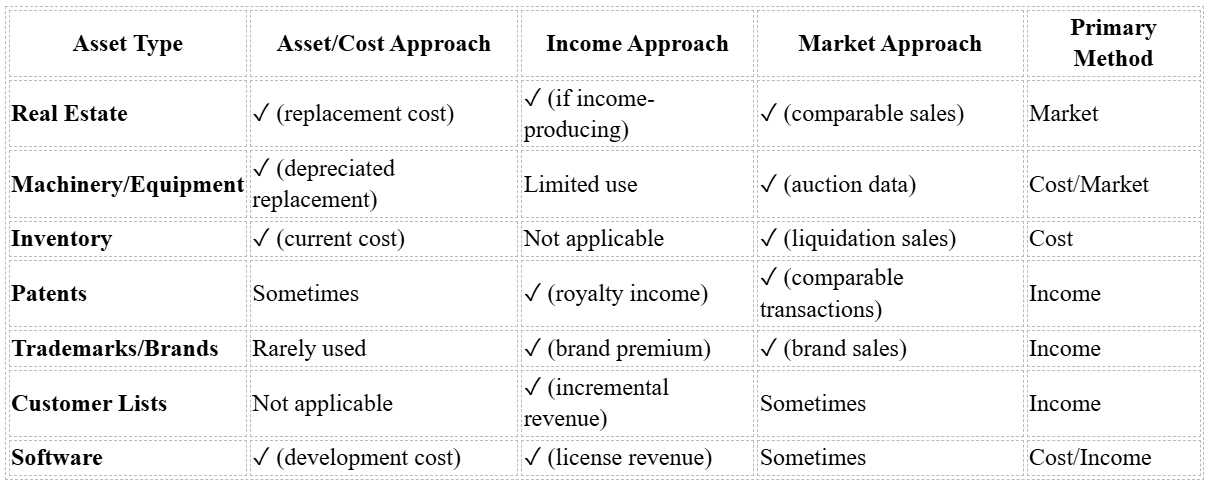

Comparing Methods for Different Asset Types

Here’s a breakdown of which methods tend to work best for various types of assets:

For tangible assets, the cost and market approaches are typically the go-to options. Appraisers often rely on manufacturer pricing, auction results, or recent sales data to determine value.

Intangible assets, on the other hand, are more complex to evaluate. For example, patents are usually valued using the income approach, as their worth often stems from anticipated licensing revenues or cost savings. Trademarks are frequently assessed using the relief-from-royalty method, which estimates the cost a company would incur to license similar branding rights. Customer lists are valued based on projected additional revenue from existing relationships, though these estimates can be tricky if key personnel aren’t retained.

The context of the valuation – whether for a going concern or liquidation – also influences the method used. In Chapter 11 reorganizations, courts often require DCF analysis to prove that a business can generate enough cash flow to satisfy creditors. In Chapter 7 liquidations, the cost and market approaches are more common since assets are typically sold individually.

Platforms like Urgent Exits help bridge theory and practice by providing real transaction data from distressed business sales. This kind of market intelligence is especially useful when comparable sales data is scarce, such as with niche intangible assets or specialized business operations.

Accurate valuation is essential for determining creditor recovery and guiding business restructuring efforts. Courts usually rely on expert testimony to justify the chosen valuation method, and appraisers often use multiple approaches to validate their findings.

sbb-itb-84c8851

Problems and Case Studies in Asset Valuation

Bankruptcy asset valuation comes with its own set of hurdles, directly influencing how creditors recover their money and the overall fate of the business. These issues become even trickier when intangible assets are involved, as conventional valuation methods often fall short.

Common Problems in Bankruptcy Asset Valuation

Time pressures often force assets to be sold quickly and at steep discounts. In bankruptcy scenarios, the need for immediate liquidation can result in prices far lower than what would be achieved in a more orderly sale process.

Limited comparable sales data poses challenges for valuing unique or specialized assets. When recent comparable sales are unavailable, appraisers turn to income-based or cost-based methods. For intangible assets, techniques like the relief-from-royalty method or comparisons with transactions in similar industries are common. However, these methods demand numerous assumptions and rely heavily on expert judgment.

Legal restrictions and loss of integration value can further diminish asset prices. For instance, software licenses might not be transferable, franchise agreements may require third-party approval, and patents could be tied up in ongoing litigation. Intangible assets – such as customer lists, proprietary software, and brand names – tend to hold much greater value when part of a functioning business rather than sold off individually.

Conflicts over valuation methods can delay proceedings and drive up costs. Courts often require expert testimony to validate the chosen valuation approach, and appraisers frequently use multiple methods to support their conclusions.

These issues highlight the complexities of asset valuation, particularly when comparing tangible assets with their intangible counterparts.

Case Studies: Physical and Non-Physical Asset Effects

Real-world bankruptcy cases shine a light on how valuation challenges play out, often leading to starkly different outcomes for physical and intangible assets.

Take the eToys bankruptcy (2001–2002), for example. During the dot-com boom, the domain name etoys.com was worth millions. But in bankruptcy, it sold for just $248,000 – a dramatic drop that shows how intangible assets can lose significant value when separated from the operating business.

On the other hand, the Polaroid bankruptcy (2008–2009) demonstrated that some intangible assets can retain high value even in liquidation. Polaroid’s brand name and intellectual property fetched $88.6 million at auction, while its physical assets, like factories and equipment, were sold for far less. This case highlights how strong brand recognition and valuable patents can still attract competitive bids.

Similarly, the RadioShack bankruptcy (2015) revealed shifting market dynamics for intangible assets. The company’s customer database and trademarks sold for $26.2 million, while physical inventory and store fixtures were liquidated separately. This case emphasizes the growing demand for certain intangibles – especially customer data – which now have relatively liquid markets.

These examples illustrate a clear trend: while tangible assets often deliver predictable liquidation values, intangible assets are far more volatile. Studies show that the liquidation value per dollar of book value is typically lower for identifiable intangibles (around 0.32) compared to property, plant, and equipment (around 0.35). This reflects the higher uncertainty and market illiquidity tied to intangible assets.

New platforms like Urgent Exits are starting to tackle some of these challenges. By creating marketplaces for distressed businesses and assets, these platforms connect sellers with motivated buyers, appraisers, legal experts, and restructuring advisors. This can improve price transparency and encourage competitive bidding, helping to reduce the steep discounts often seen in distressed sales.

These cases and trends underline why asset valuation in bankruptcy is such a complex process. The outcomes hinge on the type of asset, the market environment, and the unique circumstances of each case.

Effects on Distressed Business Deals

Asset valuation plays a pivotal role in shaping distressed business deals, influencing deal structures, buyer interest, and overall transaction outcomes.

How Asset Valuation Affects Business Deals

Tangible assets establish a clear foundation for pricing. Assets like real estate, equipment, and inventory provide a reliable baseline for valuation thanks to established markets and dependable appraisal methods. These assets often serve as collateral for secured creditors, giving buyers predictable liquidation values to work with when making offers.

Intangible assets, on the other hand, can either enhance a deal’s appeal or complicate negotiations. For example, distressed tech companies with valuable patents may attract higher offers, while uncertainty about the future benefits of certain intangibles can stall discussions. In industries like technology, media, and services, intangible assets can make up over 80% of a company’s value, forcing buyers and sellers to approach deals differently.

Consider a software company with proprietary software. Using the income approach to project future cash flows, the company’s intangible assets might justify a value above its book value. This kind of valuation has enabled companies to secure going-concern sales instead of being broken up and sold in pieces. Buyers recognize the ongoing revenue potential tied to these assets, as seen in previous successful transactions.

The structure of a deal often depends on the asset mix. When intangible assets dominate, buyers may prefer equity purchases or restructuring deals rather than straightforward asset sales. This is because intangible assets generally hold more value for a business that continues operating than for one being liquidated.

Negotiation strategies and financing plans are heavily influenced by asset types. Disputes over valuations can lead to price adjustments, escrow agreements, or even the collapse of a deal. For intangibles, where valuations are often uncertain, deal structures like earn-outs or contingent payments are commonly used to bridge the gap.

Given these complexities, platforms that specialize in distressed assets have become essential for facilitating these transactions.

Role of Specialized Platforms in Distressed Asset Deals

Traditional brokers often shy away from distressed businesses due to their complicated asset structures. This is where specialized platforms step in. Urgent Exits, for instance, fills this gap by offering a marketplace dedicated to distressed and broker-rejected businesses. The platform connects sellers with buyers seeking undervalued opportunities and advisors skilled in navigating complex transactions.

These platforms understand the unique needs of distressed businesses. Sellers facing financial or operational challenges require quick exits, while buyers are on the lookout for turnaround opportunities. A precise valuation of both tangible and intangible assets is crucial to uncovering true value and identifying risks.

Platforms like Urgent Exits bring together buyers, sellers, and advisors who specialize in distressed asset valuation. This network addresses challenges such as limited comparable sales data and legal issues related to asset transfers. By listing businesses daily, these platforms improve liquidity, reduce forced-sale discounts, and create more transparent pricing. Verified parties can connect directly, streamlining the transaction process.

Best Practices for Buyers, Sellers, and Advisors

Navigating distressed business deals requires careful planning and execution. The following best practices can help safeguard transaction value:

- Engage qualified professionals early. Bringing in appraisers and legal experts from the start ensures all assets, including less obvious ones like customer data or proprietary processes, are properly identified and valued.

- Tailor due diligence to the asset type. For tangible assets, focus on verifying their existence, condition, and ownership. For intangibles, assess legal protections, market demand, and revenue potential. Look at comparable sales in similar distressed scenarios and use industry discount rates as benchmarks.

- Use multiple valuation methods. Combining approaches – such as income, market, and cost – can provide a more accurate picture of value, especially in uncertain situations. For intangibles, this might involve pairing discounted cash flow analysis with industry royalty rates or historical transaction data.

- Consider the highest and best use of assets. This analysis identifies the optimal, legally permissible use of an asset, which can be especially important in distressed situations where current use may not reflect its true value.

- Communicate valuation assumptions clearly. Transparency about the limitations and uncertainties of valuation methods helps manage expectations and builds trust among all parties involved.

- Leverage specialized platforms. Platforms like Urgent Exits expand market reach and provide access to expertise tailored to distressed deals. Sellers gain visibility among motivated buyers, buyers discover unique opportunities, and advisors connect with clients needing complex restructuring and valuation services.

These strategies are particularly important for businesses with a large share of intangible assets. In such cases, traditional valuation methods might fall short, making specialized expertise essential for closing a successful deal. By focusing on accurate valuations and thoughtful practices, stakeholders can bridge the gap between theoretical value and real-world transaction success.

Summary and Main Points

Grasping the nuances between valuing tangible and intangible assets during bankruptcy is crucial for anyone navigating distressed business transactions. Tangible assets – like equipment, inventory, and real estate – are typically more straightforward to appraise. These assets benefit from established markets, comparable sales data, and rely on methods like the market or cost approach.

Intangible assets, however, are a different story. Items such as patents, trademarks, customer relationships, and proprietary technology require intricate income-based valuation methods. These approaches hinge on projected future cash flows, making valuation more complex. In bankruptcy scenarios, intangible assets often sell at steep discounts – frequently fetching less than 32% of their book value due to their dependency on business integration and market demand.

Accurate valuations play a pivotal role in determining creditor recoveries, assessing debtor solvency, and ensuring fairness in reorganizations. Courts often demand expert testimony and multiple valuation methods to ensure assessments are reliable. This is especially important when deciding whether creditors would benefit more from reorganization versus liquidation. These valuation principles directly impact real-world outcomes, as seen in recent examples.

For instance, in August 2022, the patent portfolio of tech company Quirky sold for $1.2 million, despite having a book value of $5 million – a staggering 76% discount. Similarly, in 2023, a struggling retail chain saw its tangible assets sell at 35% below book value, while its brand trademark brought in 60% less than its last appraised value.

A "highest and best use" analysis is critical for valuing both asset types in bankruptcy. This method ensures valuations reflect optimal potential rather than the current distressed state. It considers factors like physical possibility, financial feasibility, and maximum profitability, aligning theoretical valuation with practical outcomes.

Specialized platforms are emerging to address the unique challenges of distressed asset transactions. One example is Urgent Exits, a marketplace exclusively focused on distressed business sales. By listing dozens of new businesses daily, it connects sellers with buyers and experienced advisors. This platform helps reduce forced-sale discounts and creates more transparent pricing for both tangible and intangible assets, improving valuation accuracy and deal success.

To succeed in distressed asset deals, several best practices are essential. Engage experts early, use multiple valuation methods (market, cost, and income approaches), conduct thorough due diligence tailored to the asset type, and leverage specialized platforms to expand market reach. Combining precise valuations with strategic transaction methods bridges the gap between theoretical value and real-world success – especially when intangible assets represent a significant portion of a business’s total value.

FAQs

How are intangible assets like patents and trademarks valued during bankruptcy, and why are they often discounted?

Bankruptcy courts determine the worth of intangible assets – like patents, trademarks, and copyrights – by evaluating their potential to generate future income or their appeal in the market. This often involves looking at licensing agreements, past revenue streams, or market transactions involving similar assets.

However, these assets are often valued at a discount. Why? They can be tricky to sell, their worth might be closely tied to the unique situation of the bankrupt business, and their value often hinges on uncertain future outcomes. Other factors, such as market demand, legal protections, and how much useful life the asset has left, can also play a role in shaping its final valuation.

How are tangible and intangible assets valued differently during bankruptcy proceedings?

During bankruptcy, tangible assets – things like equipment, real estate, and inventory – are usually valued based on their market value, liquidation value, or replacement cost. These assets are relatively straightforward to assess since they have a physical presence and comparable market benchmarks.

On the other hand, intangible assets – like patents, trademarks, goodwill, and customer relationships – are trickier to evaluate. Their value often hinges on factors such as potential future income, market demand, and the specific traits of the business. To estimate their worth, methods like discounted cash flow (DCF) or the relief-from-royalty approach are commonly applied.

Recognizing the differences between these asset types is key to determining the full value of a struggling business during bankruptcy or liquidation.

Why do intangible assets often recover less value than tangible assets in bankruptcy sales, and how can platforms like Urgent Exits help maximize recovery?

When a company faces bankruptcy, intangible assets – like intellectual property or brand value – often recover less of their book value. Why? These assets are tough to evaluate. Their worth hinges on market perception, future potential, or the specific needs of a buyer. On the other hand, tangible assets – such as equipment or real estate – are much easier to appraise. Their resale value is typically more predictable, making them simpler to liquidate during bankruptcy proceedings.

Platforms like Urgent Exits aim to bridge this gap for intangible assets. They connect motivated sellers with specialized buyers and advisors who truly understand the unique nature of these assets. By targeting the right audience, this marketplace increases the chances of securing a fair valuation and expediting the sale process.