When a business faces financial trouble, it typically has two main paths to consider: distressed debt refinancing or bankruptcy. Refinancing is a private negotiation with creditors to adjust loan terms, while bankruptcy is a legal process that can either reorganize or liquidate the business. Both have their pros and cons, and the right choice depends on the company’s situation.

Key Takeaways:

- Refinancing is faster, less expensive, and keeps operations private, but it requires creditor agreement and may not solve deeper issues.

- Bankruptcy provides legal protections and a structured process but is costly, public, and can damage reputation.

Timing and creditor cooperation are critical. Refinancing works best when creditors are willing to negotiate, while bankruptcy is often the only option when agreements can’t be reached or debt structures are too complex. Acting early and seeking expert advice can make a big difference.

What Is Distressed Debt Investing?

1. Distressed Debt Refinancing

Distressed debt refinancing allows businesses to rework their financial obligations without stepping into a courtroom. By negotiating directly with creditors, companies can address financial difficulties while maintaining control over their operations. This approach is not only cost-effective but also quicker and less disruptive than formal bankruptcy proceedings.

Cost

One major advantage of distressed debt refinancing is its affordability compared to bankruptcy. Negotiating with creditors and hiring advisors typically costs tens of thousands of dollars. In contrast, Chapter 11 bankruptcy can rack up legal and court fees in the hundreds of thousands. Bankruptcy also brings additional expenses, such as trustee fees, administrative costs, and potential asset sales. While refinancing avoids these hefty costs, companies should still allocate resources for skilled financial and legal advisors experienced in handling distressed situations.

Timeframe

Speed is another key benefit. Distressed debt refinancing often wraps up within weeks or a few months. Compare that to Chapter 11 bankruptcy, where proceedings can drag on for months or even years due to court schedules, creditor meetings, and legal formalities. This faster resolution is crucial for businesses aiming to maintain relationships and stay competitive in the market.

Impact on Reputation

Refinancing also tends to be less damaging to a company’s reputation and credit standing than bankruptcy. While both options can harm credit ratings, bankruptcy leaves a long-lasting mark, remaining on credit reports for up to 10 years and making future borrowing more difficult. On the other hand, refinancing, when handled strategically, is often seen as a proactive and responsible effort to resolve financial challenges. This approach can help preserve trust and goodwill with suppliers, customers, and lenders.

Control and Flexibility

Perhaps one of the most appealing aspects of distressed debt refinancing is the control it offers. Management stays in the driver’s seat, negotiating directly with creditors to create terms that align with the company’s operational needs and cash flow. Unlike bankruptcy, where court oversight can limit decision-making, refinancing allows leaders to retain strategic flexibility, ensuring the business can adapt and move forward effectively.

2. Bankruptcy

When refinancing isn’t an option, bankruptcy becomes a last resort. Managed under strict federal regulations, it provides legal protections like an automatic stay, but it comes with steep costs, drawn-out proceedings, and significant reputational damage. Let’s break down how these elements play out in practice.

Cost

Bankruptcy is far more expensive than private restructuring. Direct costs – such as legal fees, court expenses, and advisory services – typically range from 3% to 7% of a company’s total assets. For mid-sized Chapter 11 cases, expenses can run between $1 million and $10 million, while more complex cases may exceed $100 million. A striking example is Toys "R" Us, which spent over $200 million on fees alone. And that’s just the start – indirect costs, like lost sales, strained supplier relationships, and the distraction of management, can further disrupt business operations.

Timeframe

The timeline for bankruptcy varies significantly. Chapter 7 cases are generally resolved within a few months, but Chapter 11 proceedings can stretch from six months to several years. The lengthy process, combined with extended negotiations and judicial reviews, often gives competitors the opportunity to swoop in and capture market share.

Impact on Reputation

Bankruptcy filings are public, which means they leave a lasting mark on a company’s reputation. They also show up on credit reports for 7 to 10 years, making it harder to secure future loans or maintain strong business relationships.

Control and Flexibility

One major downside of bankruptcy is the loss of control. Unlike refinancing, where management retains decision-making power, bankruptcy shifts control to external parties. In Chapter 7 cases, a trustee may liquidate the company’s assets. In Chapter 11, major decisions require court approval, which limits operational flexibility – even though the automatic stay temporarily halts debt collections.

Recent Trends

Bankruptcy plays a significant role in corporate defaults, accounting for about 40% of such cases in the U.S. However, it’s not always a lasting fix – approximately 17% of companies that restructure initially end up filing for bankruptcy again within three years. This underscores its prevalence but also its high cost and challenges in resolving financial distress.

Advantages and Disadvantages

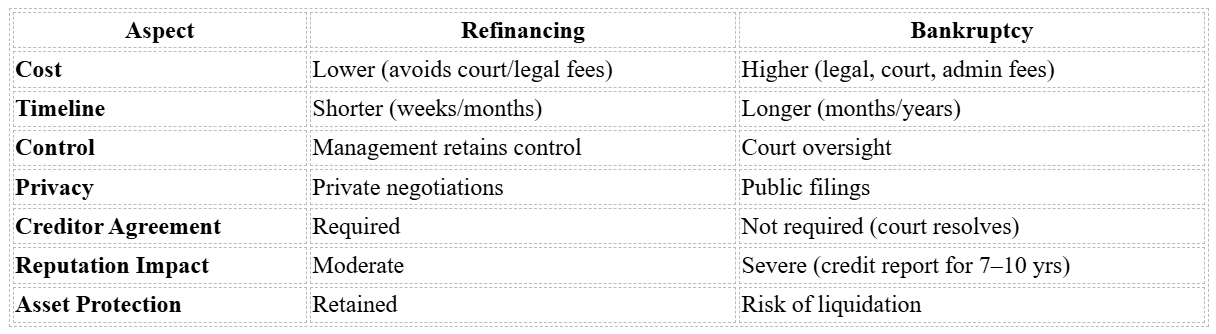

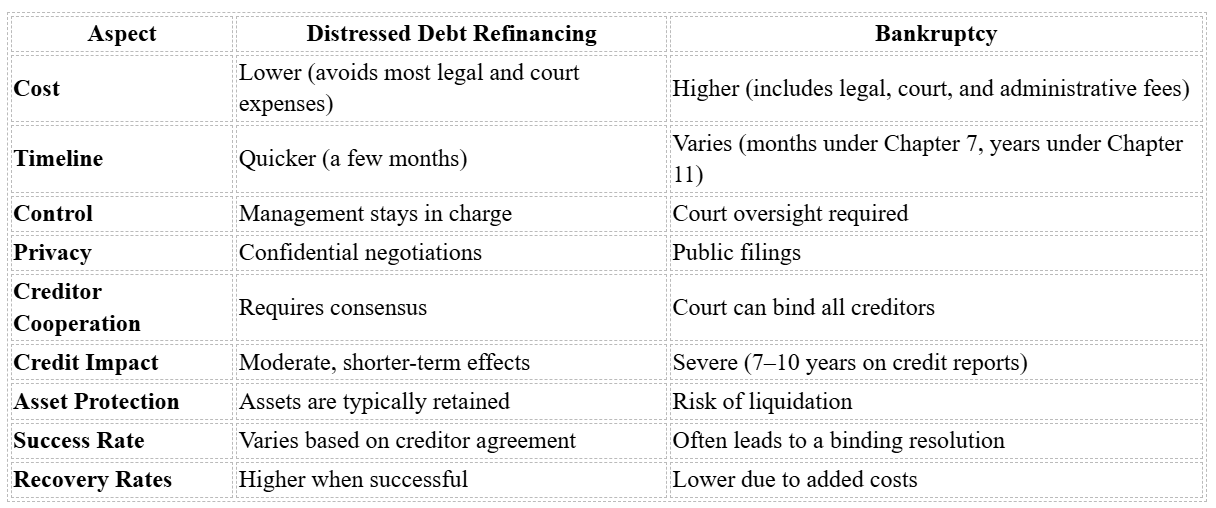

When companies face financial distress, they often find themselves at a crossroads: distressed debt refinancing or bankruptcy. Each option comes with its own set of benefits and challenges, and the right choice depends heavily on a company’s unique situation. Below, we break down the key differences to help clarify these trade-offs.

Distressed debt refinancing is often preferred for its ability to keep operations running smoothly while avoiding hefty legal and court expenses. It’s a quicker process, typically wrapping up within months, as opposed to the lengthy timelines associated with Chapter 11 bankruptcy. Another advantage? Management retains control over day-to-day operations and strategic decisions, and the negotiations usually remain behind closed doors, away from public scrutiny.

But refinancing isn’t without its hurdles. It hinges on getting creditors to agree – a task that can become tricky when dealing with multiple stakeholders with conflicting interests. Plus, it may only solve part of the financial problem, rather than addressing the root causes.

On the other hand, bankruptcy offers a more structured, legal path for tackling debt. The automatic stay stops creditors from pursuing collections, providing immediate breathing room. With the court overseeing the process, all creditors are brought into a unified resolution, ensuring fairness. While Chapter 7 cases can be resolved in months, Chapter 11 reorganizations follow a more detailed, court-guided process.

However, bankruptcy comes at a higher cost, with sizable legal, filing, and administrative fees. Its public nature can tarnish a company’s reputation, with records lingering on credit reports for 7 to 10 years. Management may also lose significant control over operations, and there’s always a chance of asset liquidation.

Here’s a side-by-side comparison of the two approaches:

This comparison highlights the trade-offs companies face when deciding between these two paths. For businesses with a cooperative creditor base and a realistic chance of recovery, refinancing may be the quicker and less costly option. On the flip side, companies dealing with complex debt structures or uncooperative creditors might benefit from the legal protections and comprehensive framework that bankruptcy provides – despite the higher costs and reputational risks.

For businesses navigating these tough decisions, platforms like Urgent Exits can connect them with professionals experienced in both refinancing and bankruptcy. These experts can offer tailored advice, helping companies choose the best course of action. This sets the stage for exploring real-world examples of how businesses have fared with each approach.

Case Studies: Actual Business Outcomes

These case studies highlight how real-world businesses have navigated financial distress, emphasizing the importance of timing, creditor collaboration, and underlying business fundamentals in determining whether recovery or liquidation is the ultimate outcome.

J. Crew‘s Attempt at Restructuring

J. Crew’s story demonstrates both the potential and the limitations of distressed debt refinancing. Back in 2017, the retailer undertook a complex restructuring plan, transferring its intellectual property to a subsidiary to secure new financing. This move helped the company stave off bankruptcy, allowing it to continue operating, protect jobs, and maintain relationships with suppliers and customers.

While this strategy bought J. Crew some time – roughly three years – it wasn’t a permanent fix. Operational challenges and market pressures persisted, and in May 2020, the company filed for Chapter 11 bankruptcy. This case illustrates how refinancing can provide temporary relief and preserve value, but without addressing underlying issues, it may only delay the inevitable.

Nine West‘s Bankruptcy Solution

Nine West Holdings took a different approach, attempting out-of-court restructuring before ultimately filing for Chapter 11 bankruptcy in April 2018. The company’s efforts to refinance were hampered by the complexity of its capital structure and a lack of agreement among creditors. Negotiations dragged on until bankruptcy became the only viable solution.

Through the court-supervised process, Nine West sold off assets, reduced its debt by over $1 billion, and emerged as a smaller, more focused business. This case underscores how bankruptcy can sometimes succeed where voluntary negotiations fail, particularly when dealing with fragmented creditor groups and intricate debt arrangements.

General Motors: A Politically Charged Restructuring

General Motors’ 2009 financial crisis shows how even massive corporations can reach the limits of refinancing. According to a Harvard study, GM initially sought to restructure out of court, but the scale of its debt and the economic downturn made creditor agreement impossible. The company’s financial troubles were simply too overwhelming for private negotiations to resolve.

The government stepped in, facilitating a bankruptcy reorganization that preserved tens of thousands of jobs. While the process was costly and highly publicized, it achieved a level of restructuring that refinancing alone couldn’t deliver. GM’s case highlights how bankruptcy can be a necessary step when financial distress coincides with broader economic challenges.

What the Data Says

According to Fitch Ratings, creditors typically recover more in distressed debt exchanges than in bankruptcy proceedings. This is largely because bankruptcy proceedings often involve significant legal and administrative costs, which can erode asset values. In contrast, out-of-court restructurings tend to preserve more value for distribution.

Trends Across Industries

Different industries show varying outcomes when it comes to distressed debt refinancing. Retail and energy companies often succeed due to the flexibility of their assets, while sectors like airlines – with their high fixed costs and operational complexities – are more likely to end up in bankruptcy.

Timing and Proactive Measures

One recurring theme in these case studies is the importance of acting early. Companies that address financial distress before liquidity is completely drained often achieve better results. For example, a small manufacturing business listed on Urgent Exits in 2024 attracted a turnaround investor, restructured its debt, and avoided bankruptcy entirely. Platforms like these, which connect struggling businesses with investors and advisors, can provide effective alternatives to formal insolvency proceedings – especially for smaller firms with limited access to resources.

Ultimately, successful outcomes hinge on a mix of timing, cooperation among stakeholders, and a solid business model. Businesses with strong operational foundations and collaborative creditors often find refinancing to be a viable solution. On the other hand, companies with complex creditor arrangements or deeper structural issues may need to turn to bankruptcy for a sustainable resolution.

Conclusion

When it comes to distressed businesses, there’s no one-size-fits-all solution. The decision between distressed debt refinancing and bankruptcy hinges on your company’s unique situation, the relationships you have with creditors, and the strength of your business fundamentals.

Refinancing works best when you have a solid core business and cooperative creditors. Research indicates it can preserve as much as $186 million in equity value compared to bankruptcy. This option is most effective when your main issue is a heavy debt load rather than deeper operational problems.

On the other hand, bankruptcy becomes necessary when creditor cooperation isn’t achievable. While it provides legal protections and allows for a comprehensive restructuring, it comes with higher costs and can harm your public credit reputation. However, for businesses with complex creditor arrangements, the structured court process can often succeed where private negotiations fall short.

Timing is critical. Acting early helps preserve liquidity and ensures you maintain a stronger position at the negotiating table. Whether you’re working with creditors to refinance or preparing for bankruptcy, having cash flow and operational flexibility gives you more leverage and options.

Ultimately, the choice between refinancing and bankruptcy must align with your company’s financial health, creditor relationships, and the urgency of your situation. Seeking professional advice is crucial, and platforms like Urgent Exits can connect you with turnaround investors and restructuring experts to guide you through these tough decisions.

The bottom line? Assess your circumstances, act quickly, and pick the strategy that ensures your business’s future. Both refinancing and bankruptcy are tools – it’s all about choosing the right one for your specific needs.

FAQs

What should a business evaluate when choosing between distressed debt refinancing and bankruptcy?

When choosing between distressed debt refinancing and bankruptcy, businesses need to take a close look at their financial health, long-term objectives, and the urgency of their current challenges. Factors like the ability to renegotiate creditor terms, the effect on daily operations, and the chance to maintain ownership and control should weigh heavily in the decision-making process.

Distressed debt refinancing can often provide a faster solution, helping businesses sidestep the stigma and complexity that typically come with bankruptcy. On the other hand, bankruptcy offers a more structured path to debt relief, which might be a better fit for companies facing extreme financial difficulties or legal pressures. Both options come with their own set of advantages and challenges, making it crucial to consult financial and legal experts to determine the best course of action for your unique situation.

What role do creditors play in refinancing compared to bankruptcy?

In refinancing, creditors collaborate with the company to modify the terms of its debt. This could involve extending repayment timelines, lowering interest rates, or altering payment schedules. The goal is to provide the business with some breathing room to prevent financial collapse.

On the other hand, bankruptcy takes a more formal route, with the process managed by a court. Creditors file claims to recover what they’re owed, but asset distribution follows strict legal priorities. Often, creditors receive only a fraction of the original debt, depending on the company’s remaining resources. Compared to refinancing, bankruptcy typically leads to greater financial losses for creditors.

Is it possible for a company to recover from financial distress without declaring bankruptcy, and how important is timing in this process?

Yes, a company can bounce back from financial trouble without filing for bankruptcy, but timing makes all the difference. Acting quickly opens up opportunities like refinancing, restructuring debt, or selling off assets before the situation spirals out of control.

Taking action early helps protect the company’s value and keeps trust intact with creditors, employees, and other stakeholders. On the other hand, waiting too long can shrink the list of options and bring about harsher outcomes.