When businesses face financial trouble, they often choose between two solutions: debt-for-equity swaps or traditional debt restructuring. Both approaches aim to relieve financial stress but differ in their processes and outcomes:

- Debt-for-Equity Swap: Converts debt into ownership stakes. Creditors become shareholders, reducing debt but diluting current ownership.

- Traditional Debt Restructuring: Adjusts debt terms (e.g., lower interest rates, extended repayment periods) without changing ownership.

Key Takeaways:

- Debt-for-Equity Swaps: Reduce liabilities, eliminate interest payments, and improve cash flow but may lead to shareholder dilution and creditor control.

- Traditional Restructuring: Maintains ownership and provides cash flow relief but keeps debt on the books and may only offer short-term fixes.

Choosing the right strategy depends on the severity of financial distress, creditor willingness, and the company’s recovery potential. Platforms like Urgent Exits can connect businesses with experts to guide these decisions.

Debt-for-Equity Swap: Structure, Process, and Outcomes

How Debt-for-Equity Swaps Work

Debt-for-equity swaps are a way for companies to restructure their finances, often during times of financial distress. The process begins with identifying which debts will be converted into equity. From there, the company negotiates with creditors to establish a conversion ratio – this determines how much equity creditors will receive for each dollar of debt they’re owed.

Several factors influence the conversion ratio, including the company’s valuation after restructuring, the market value of its debt, and the negotiating power of various creditor groups. Once the terms are set, the focus shifts to legal execution.

This step requires careful attention to securities laws, shareholder agreements, and obtaining regulatory approvals. Companies may need to amend existing shareholder agreements, decide on the type of shares to issue, and ensure compliance with federal and state securities regulations. Depending on the circumstances, the process may unfold through bankruptcy courts, schemes of arrangement, or out-of-court agreements.

A real-world example of this process is J.Crew’s 2020 restructuring. The company’s lenders converted approximately $1.6 billion of debt into equity, stabilizing its operations and enabling a relaunch under new ownership.

Benefits of Debt-for-Equity Swaps

Debt-for-equity swaps can offer immediate and impactful benefits. One of the most prominent advantages is the improvement of a company’s balance sheet. By converting debt into equity, businesses reduce their leverage and eliminate fixed interest payments, which can significantly ease cash flow pressures. For companies on the brink of collapse, this change can be a lifeline.

A healthier balance sheet also boosts creditworthiness. With lower debt levels, companies become more appealing to potential lenders and investors, opening doors to new financing opportunities.

Another major benefit is the ability to preserve enterprise value. Instead of resorting to liquidation or selling assets at discounted prices, companies can continue operating, maintain customer relationships, and often recover more value for stakeholders during the restructuring process.

General Motors’ 2009 restructuring is a prime example of these benefits. During its bankruptcy, creditors exchanged billions of dollars in debt for equity, enabling the company to emerge with a much stronger financial position.

Risks and Drawbacks

Despite the advantages, debt-for-equity swaps are not without risks. One of the biggest concerns is shareholder dilution. When new shares are issued to creditors, existing shareholders often see their ownership stakes reduced – sometimes drastically. In extreme cases, original shareholders may lose control of the company altogether.

Another challenge is the potential loss of control. Creditors who gain significant equity stakes may push for changes in management or strategic priorities that differ from the original owners’ vision. This shift in governance can lead to disagreements and uncertainty about the company’s future direction.

Negotiations with creditor groups can also be highly complex. Different stakeholders – such as senior lenders, subordinated debt holders, and trade creditors – often have conflicting interests. Reaching an agreement on conversion ratios and share classes can be both time-consuming and costly.

Tax and accounting issues add another layer of difficulty. Debt cancellation income (CODI) can result in significant taxable gains unless specific bankruptcy exceptions apply. Companies must carefully structure these transactions, often with the help of skilled tax advisors, to avoid unexpected liabilities.

Finally, there’s the inherent risk of recovery. Creditors who become shareholders take on equity risk instead of the relative certainty of debt claims. If the company’s turnaround efforts fail, these new shareholders could end up with little to no value, highlighting the gamble involved in such swaps.

What Is a Debt/Equity Swap?

Traditional Debt Restructuring: Methods and Effects

Traditional debt restructuring offers a way to adjust the terms of debt without requiring business owners to give up equity. This approach helps maintain ownership while addressing financial challenges.

Key Restructuring Methods

Traditional debt restructuring relies on a variety of approaches to stabilize finances while keeping ownership intact. A common strategy involves extending loan maturity dates, giving businesses additional time to meet their repayment obligations.

Another effective method is reducing interest rates. By lowering the cost of servicing debt, companies can redirect cash flow toward operations and recovery efforts.

Renegotiating debt covenants is also a widely used tactic. This may include easing financial ratio requirements, modifying reporting obligations, or adjusting operational restrictions. Such changes help businesses avoid technical defaults and retain access to credit lines.

In some cases, creditors might agree to principal forbearance, temporarily suspending principal payments to free up cash for core operations. They may also consider writing off part of the debt, depending on the circumstances.

A notable example of this approach occurred in April 2020 when Hertz Global Holdings successfully negotiated with lenders to extend loan maturities and lower interest rates on $2.8 billion in debt. This provided the company with much-needed liquidity during a critical period.

These methods collectively aim to improve cash flow and provide businesses with breathing room to focus on recovery.

Benefits of Traditional Restructuring

One of the biggest advantages of traditional restructuring is that it allows businesses to retain full ownership and control. Unlike debt-for-equity swaps, owners don’t have to give up shares to creditors, ensuring they maintain decision-making power and the ability to benefit from future growth.

Another key benefit is the potential to strengthen relationships with creditors. Successfully renegotiating debt terms shows a commitment to repayment and transparency, which can enhance long-term partnerships and make it easier to secure future financing.

Traditional restructuring also offers immediate cash flow relief by reducing or deferring payments. This allows management to concentrate on improving operations and executing strategic initiatives.

For instance, in June 2021, Neiman Marcus Group completed an out-of-court restructuring by amending loan covenants and extending maturities on $4.6 billion in debt. This strategy stabilized the company’s cash flow and helped it avoid another bankruptcy filing.

Data supports the effectiveness of these methods. A 2021 study by the American Bankruptcy Institute found that companies using traditional restructuring approaches were 35% more likely to avoid bankruptcy within two years compared to those that didn’t restructure.

Risks and Limitations

While traditional restructuring offers many benefits, it is not without risks. One major concern is the potential for recurring liquidity problems. If operational challenges remain unaddressed, these measures may only provide temporary relief. Extending payment terms or lowering interest rates can help in the short term, but they won’t fix deeper issues like falling revenues, inefficiencies, or competitive disadvantages. In such cases, restructuring may merely delay financial distress rather than resolve it.

Another challenge is the need for voluntary creditor participation. Unlike bankruptcy proceedings, where courts can enforce solutions, out-of-court restructuring depends on creditors agreeing to new terms. If creditors doubt the business’s recovery potential, negotiations can stall or fail altogether.

Studies suggest that while 40–60% of distressed businesses that use traditional restructuring avoid bankruptcy in the short term, long-term survival often hinges on operational improvements and market recovery.

Tax implications can also complicate the process. Debt forgiveness or waivers might trigger taxable income, creating unexpected liabilities that could offset the benefits of restructuring. Companies need to navigate these complexities carefully with the help of experienced tax advisors.

Platforms like Urgent Exits can connect businesses with specialized restructuring advisors and provide marketplaces for buying or selling distressed companies, offering additional options for owners facing tough decisions.

Ultimately, the success of traditional restructuring depends on early action, open communication with creditors, and well-thought-out, data-driven plans. Waiting until liquidity issues become critical often weakens a company’s negotiating position, making it much harder to secure favorable terms.

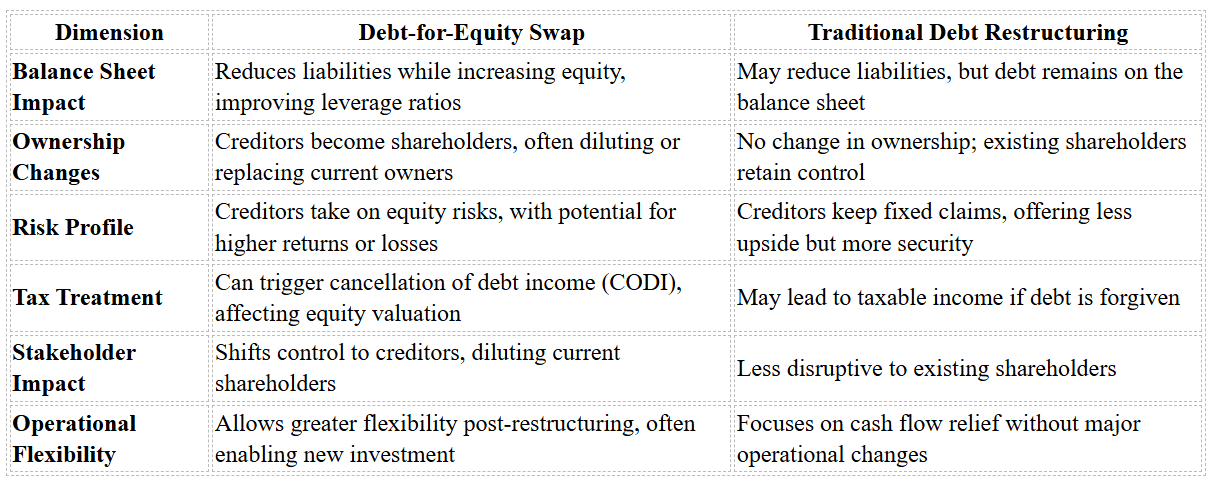

Side-by-Side Comparison: Debt-for-Equity Swap vs. Traditional Debt Restructuring

Key Comparisons

Understanding the differences between debt-for-equity swaps and traditional debt restructuring is essential for stakeholders navigating financial challenges. Each approach impacts a company in unique ways, from balance sheets to ownership dynamics.

Debt-for-equity swaps immediately reduce debt while boosting equity, which improves financial ratios like leverage. In contrast, traditional restructuring adjusts payment terms to ease cash flow pressures but keeps debt on the books. With swaps, creditors transition from lenders to owners, which can lead to governance changes and potential friction within management due to diluted influence.

Tax considerations also play a significant role. Debt-for-equity swaps may create immediate tax liabilities through cancellation of debt income, requiring careful planning. Similarly, traditional restructuring can result in taxable events when portions of debt are forgiven. These factors, combined with ownership changes, inform the decision on which approach to take.

Which Strategy Fits Different Scenarios?

The choice between these two strategies depends on the nature of the financial distress and the goals of stakeholders. Each method suits different circumstances and objectives.

Debt-for-equity swaps are often the best option for companies facing severe financial distress and an inability to service existing debt. This approach is particularly effective when creditors see long-term potential in the business despite its current challenges. For example, companies with unsustainable debt levels but promising growth prospects often benefit from this strategy.

On the other hand, traditional debt restructuring is better suited for businesses dealing with temporary liquidity issues rather than deep operational problems. Companies with solid business models and competent management teams often use this method to secure the breathing room needed for a turnaround. This approach is particularly appealing to family-owned businesses or founder-led companies aiming to preserve ownership and continuity.

Industry specifics also influence the decision. Capital-intensive sectors like energy, retail, and real estate often lean toward debt-for-equity swaps due to their reliance on significant investments. Meanwhile, service-based businesses or those with strong cash flow may prefer traditional restructuring to weather short-term financial challenges.

Another key factor is creditor willingness. Debt-for-equity swaps require creditors who are comfortable taking on equity risk and potentially becoming active in governance. In contrast, traditional restructuring appeals to creditors who prefer to maintain their role as lenders while offering more manageable terms to borrowers.

For businesses weighing these options, platforms like Urgent Exits provide access to specialized restructuring advisors. These professionals can help evaluate the nuances of each strategy and guide companies toward the most suitable solution for their situation.

Acting early is critical. Companies that address financial distress promptly often have more options and stronger bargaining power with creditors. Waiting too long, until liquidity becomes critically strained, can limit choices and force more drastic measures – like a debt-for-equity swap – even when traditional restructuring might have been a viable solution with earlier action.

Use Cases and Practical Considerations

Industry Applications

In the United States, several industries face financial hurdles that often require creative restructuring strategies. Here’s how different sectors approach these challenges:

- The energy sector frequently turns to debt-for-equity swaps during periods of falling commodity prices. By converting debt into equity, energy companies can reduce their financial burdens and prepare for market rebounds.

- In the retail sector, shifts in consumer behavior and intense competition drive companies to restructure. When under severe financial stress, retailers may use swaps to attract fresh capital and stabilize their operations.

- Real estate companies are deeply influenced by market cycles. Some choose debt-for-equity swaps to benefit from potential property value rebounds, while others prefer traditional restructuring, such as adjusting payment terms, when their challenges are short-term.

- Manufacturing businesses often rely on traditional debt restructuring. With solid asset bases and strong customer relationships, they can renegotiate loan terms without needing to give up ownership stakes.

- Hospitality firms, especially those hit hard by the COVID-19 pandemic, typically pursue traditional restructuring to address immediate liquidity needs. However, if deeper financial issues emerge, debt-for-equity swaps may become a viable option.

How Urgent Exits Facilitates Restructuring

These industry-specific challenges highlight the importance of flexible restructuring solutions. Platforms like Urgent Exits play a key role in simplifying the process for distressed businesses. Often, business owners struggle to find the right buyers or advisors to execute their chosen strategies effectively. Urgent Exits bridges this gap by offering an online marketplace tailored to distressed business transactions.

Here’s how it works:

- For Sellers: Business owners can list their distressed companies on the platform, gaining instant visibility among buyers looking for undervalued opportunities. Features like view and save tracking provide insights into buyer interest, helping sellers understand market demand.

- For Debt-for-Equity Swaps: The platform connects owners with advisors skilled in handling complex debt conversions. These include investment bankers, restructuring consultants, and legal experts who specialize in navigating the intricacies of such swaps.

- For Traditional Restructuring: Companies pursuing traditional restructuring gain access to a network of lenders, accountants, and legal professionals who can assist with modifying loan covenants, extending maturities, or adjusting interest rates.

To make the process more efficient, Urgent Exits offers advanced filters, enabling professionals and investors to quickly find opportunities that match their criteria. Direct communication tools further streamline due diligence and negotiation, which is critical for businesses under significant financial pressure.

Conclusion

Key Insights for Stakeholders

Deciding between debt-for-equity swaps and traditional debt restructuring hinges on the severity of financial challenges and what stakeholders prioritize. Debt-for-equity swaps are often the go-to option when a company is heavily burdened by debt and needs immediate relief for its balance sheet. These swaps not only alter financial statements but also shift the dynamics of control and relationships among stakeholders, as real-world examples have shown.

Each approach carries distinct financial implications. Debt-for-equity swaps can significantly cut fixed interest obligations and reduce leverage, but they come with the trade-off of diluting existing shareholders and potentially transferring control to creditors. On the other hand, traditional debt restructuring maintains the current ownership structure, offering relief through extended payment terms or lower interest rates. However, while this approach preserves ownership, it may not fully resolve deeper solvency challenges.

Industry-specific factors also play a role in determining the best course of action. Different sectors may lean toward one strategy over the other based on their operational and financial characteristics. Ultimately, the choice should reflect the company’s recovery potential and creditors’ willingness to accept equity stakes as opposed to modified debt terms.

Tax and accounting considerations add another layer of complexity. Debt-for-equity swaps may trigger cancellation of debt income and require equity revaluation, while traditional restructuring can impact interest expense deductions and enable tax deferrals. Careful planning and professional advice are crucial to structure these deals effectively and navigate regulatory hurdles.

Final Thoughts

Navigating these restructuring strategies requires a clear plan and expert guidance. Whether opting for a debt-for-equity swap or traditional restructuring, success hinges on open communication with stakeholders and a solid understanding of legal and financial nuances. The intricacies of negotiations and the potential impact on ownership make professional expertise essential for protecting stakeholder interests and meeting compliance standards.

For businesses facing these decisions, platforms like Urgent Exits offer tailored solutions. By connecting distressed companies with restructuring professionals – investment bankers, legal experts, and turnaround consultants – Urgent Exits helps businesses tackle the complexities of both debt conversions and traditional restructuring. For those exploring an outright sale instead of restructuring, the platform also links companies with motivated buyers seeking opportunities with turnaround potential.

In today’s unpredictable financial landscape, having access to skilled advisors and specialized resources can be the difference between a successful recovery and prolonged financial struggles. Aligning the right strategies with long-term goals is key to achieving a sustainable turnaround.

FAQs

What should a company consider when deciding between a debt-for-equity swap and traditional debt restructuring?

When choosing between a debt-for-equity swap and traditional debt restructuring, companies need to weigh several key factors, such as the financial impact, potential risks, and the specific reasons behind the need for restructuring.

A debt-for-equity swap converts debt into ownership stakes. While this can ease financial strain and align creditors with the company’s future success, it often comes at the cost of diluting existing shareholders’ equity. On the other hand, traditional debt restructuring focuses on renegotiating loan terms, extending repayment deadlines, or securing new financing. This approach typically helps maintain current ownership structures but might lead to an increase in long-term debt obligations.

Both strategies come with their own set of advantages and challenges. Companies should thoroughly evaluate their financial objectives, consider the interests of stakeholders, and determine which option is more practical to implement before making a final decision.

What impact do debt-for-equity swaps have on a company’s control and decision-making authority?

Debt-for-equity swaps can reshape a company’s control and decision-making processes in a big way. When debt is converted into equity, creditors often step into the role of shareholders, gaining voting rights and a say in important decisions. This transition can reduce the ownership percentages of current shareholders and might even steer the company in a new strategic direction.

While this method can ease financial burdens, it’s not without its challenges. One major concern is the potential for conflicts between new and existing stakeholders, as their interests may not always align. Companies exploring this option need to think carefully about how shifting control fits with their long-term objectives and governance plans.

What are the tax implications of a debt-for-equity swap compared to traditional debt restructuring?

The tax consequences of a debt-for-equity swap versus traditional debt restructuring can differ depending on the situation and applicable tax regulations.

In a debt-for-equity swap, a creditor trades the debt owed to them for equity in the company. For the debtor, this could trigger taxable income if the amount of forgiven debt surpasses the fair market value of the equity issued. On the creditor’s side, the tax outcome often hinges on whether the exchange results in a gain or loss based on the value of the equity received.

With traditional debt restructuring, such as extending payment deadlines or reducing the debt amount, the debtor might still face tax obligations. If a portion of the debt is forgiven, it could be considered taxable income. That said, exceptions – like insolvency or bankruptcy – may reduce or eliminate these tax liabilities.

Because tax laws and individual circumstances play a big role, it’s crucial to consult a tax professional to understand how these scenarios might apply to your specific case.