When businesses face financial difficulties, bankruptcy isn’t the only option. Out-of-court restructuring offers a faster, cost-effective, and private way to renegotiate debt and stabilize operations. Here’s how it works:

- What It Is: A voluntary process where businesses work directly with creditors to adjust debt terms without court involvement.

- Why Choose It: It’s quicker, less expensive, maintains privacy, and helps preserve relationships with stakeholders like suppliers and employees.

- Steps to Prepare: Identify financial trouble early, hire legal and financial advisors, and gather all necessary records (financial statements, debt agreements, etc.).

- Negotiation Tips: Understand stakeholder priorities (e.g., lenders, suppliers, employees) and create realistic, well-documented proposals that address their concerns.

- Finalizing Agreements: Secure approvals and document commitments to ensure clarity and accountability.

Out-of-court restructuring is a practical way to regain financial stability without the complexities of bankruptcy. Early action, clear communication, and thorough preparation are key to success.

What Are The Alternatives To Debt Restructuring In Bankruptcy? – Learn About Economics

Preparation Steps Before Restructuring

Before starting negotiations with creditors and stakeholders, businesses need to lay the groundwork for a successful out-of-court restructuring. This preparation phase is critical – it can mean the difference between a smooth recovery and a failed attempt that leads to bankruptcy. Time is of the essence, so act decisively and thoroughly.

Recognize Financial Distress Warning Signs

The first step is identifying the early signs of financial trouble. Cash flow problems are often the initial indicator. If a company struggles to meet payroll, pay suppliers on time, or cover basic operating expenses, it’s a clear signal that action is needed. Missed loan payments or frequent requests for payment extensions also highlight deeper financial issues.

Another red flag is declining performance metrics. Consecutive quarters of falling revenue, rising debt-to-equity ratios, or weakening working capital are all concerning trends. For instance, if receivables remain unpaid beyond normal aging periods or inventory turnover slows significantly, these operational issues require immediate attention.

Covenant violations on loans are another critical warning sign. Loan agreements often include financial covenants to act as an early alert system. Breaching terms like debt service coverage ratios, exceeding leverage limits, or failing to maintain liquidity can trigger lenders to demand accelerated payments or restrict credit access.

The key is to address these warning signs early – before they escalate into a full-blown crisis. Waiting until bankruptcy is imminent leaves companies with fewer options and less leverage in negotiations.

Hire Advisors and Contact Key Stakeholders Early

Getting the right advisors on board early can make all the difference. Start by engaging legal advisors with expertise in restructuring. These professionals can navigate creditor rights, intercreditor agreements, and liability issues while ensuring the company shares necessary information with creditors without compromising its position.

Financial advisors are equally important. They bring expertise in cash flow modeling, business valuations, and restructuring strategies. Their role includes preparing detailed financial projections that creditors require and helping to evaluate the benefits of an out-of-court solution compared to bankruptcy.

If possible, involve industry experts familiar with your sector. Their knowledge of market conditions, operational improvements, and recovery timelines can add credibility to your restructuring plan, making stakeholders more likely to trust your proposals.

The company’s management team must also be fully engaged from the outset. Their transparency and active participation in negotiations are essential for building trust with stakeholders. Early communication with lenders, creditors, major suppliers, bondholders, and key customers is critical. In regulated industries, involving government agencies at the right time may also be necessary.

Timing is everything. Stakeholders are generally more open to restructuring discussions when approached proactively, rather than after a crisis has already erupted.

Gather Financial and Business Records

Thorough documentation is the backbone of any restructuring effort. Start with complete financial statements, including audited reports from the past three years, monthly financials for the current year, and detailed cash flow projections for the next 12-18 months. Accuracy is crucial – creditors will examine these documents carefully.

Next, compile and review all debt agreements and loan documents. This includes not only primary loan terms but also security agreements, guarantees, intercreditor arrangements, and any amendments. Understanding payment schedules, collateral positions, and covenant requirements is essential for identifying potential negotiation points.

Other key records include customer contracts, lease agreements, and compliance documents. This might involve tax returns, regulatory filings, pending lawsuits, and environmental compliance records. These documents help uncover liabilities and provide a clearer picture of current operations.

Finally, prepare management reporting packages that highlight key performance indicators, budget-to-actual comparisons, and operational metrics. These reports demonstrate that management understands the business and has a plan to turn things around.

Having this documentation ready not only speeds up due diligence but also shows creditors that the company is serious about resolving its financial challenges. Once this groundwork is complete, the next step is engaging with creditors and stakeholders to negotiate a restructuring plan.

Creditor and Stakeholder Negotiations

Once you’ve done your homework, it’s time to move into direct negotiations. This step is all about presenting clear, actionable proposals that balance the needs of creditors and stakeholders. The key to success? Understanding what each party values most and offering solutions that address their priorities.

Identify Stakeholder Priorities

Not all stakeholders are motivated by the same goals, so recognizing their specific concerns is crucial. For example:

- Secured lenders focus on protecting their collateral. They often want detailed cash flow projections and regular updates to ensure their security remains intact during the restructuring process.

- Unsecured creditors are typically more concerned with recovering as much as possible. They might be open to extended payment terms or partial debt forgiveness if it means avoiding greater losses.

- Trade creditors may prioritize maintaining the business relationship, especially if your company is a key customer.

- Employees and unions care about job security, benefits, and consistent payroll. Their cooperation is essential for keeping operations stable.

- Key customers and suppliers want assurance that your company can continue delivering products or services and honor future commitments.

- Equity holders, while secondary to debt holders, can still have influence – particularly in closely held companies.

Meeting with each major stakeholder group individually can help you uncover their specific concerns and constraints. These conversations provide the insights needed to craft targeted proposals that address their core needs.

Create and Present Restructuring Proposals

Once you’ve identified stakeholder priorities, the next step is to develop proposals that align with those needs. Restructuring plans should be realistic, well-documented, and clearly demonstrate why they’re a better option than bankruptcy. Start with a strong business plan that outlines how the company will return to profitability, whether through operational improvements, cost savings, or revenue growth.

Here are some common strategies to consider:

- Deferred payments: This could involve extending payment terms or temporarily postponing principal payments while continuing to pay interest.

- Forbearance agreements: These provide temporary relief by suspending certain covenant breaches or payment defaults, often in exchange for meeting specific milestones and providing regular updates.

- Composition agreements: Creditors may agree to accept reduced payment amounts in exchange for releasing some claims. This approach works well when bankruptcy would likely result in even lower recoveries.

- Debt-for-equity swaps: Creditors trade some of their debt for an ownership stake, aligning their interests with the company’s long-term success.

- Standstill agreements: These temporarily prevent creditors from taking collection actions while negotiations are ongoing.

Every proposal should include detailed financial projections that show how the company will meet its restructured obligations. Running scenario analyses can also help demonstrate the plan’s resilience under different conditions.

Establish Timelines and Manage Expectations

Setting clear deadlines and maintaining open communication are essential for keeping negotiations on track. Start by creating a timeline with specific milestones, such as when initial proposals are due and when stakeholder feedback is expected. Be sure to account for any board or union approval requirements in your schedule.

Transparency is equally important. If you anticipate challenges – like delays in operational improvements or tough financial periods – communicate these issues promptly. Being upfront about potential hurdles helps manage expectations and builds trust.

It’s also wise to have contingency plans in place. If negotiations stall, understanding your options (including bankruptcy procedures) can help maintain momentum. However, avoid using bankruptcy as a threat – it’s better to focus on collaborative solutions.

Finally, keep stakeholders engaged with regular progress updates. Share financial performance metrics and operational highlights to show that the business is still moving forward. Flexibility is key during this process, as negotiations often involve multiple rounds of proposals and counterproposals. Stay adaptable while steadily working toward final agreements.

Agreement Completion and Implementation

Once negotiations are finalized, it’s time to formalize the commitments through legally binding documents. This step ensures that everyone involved has a clear understanding of their responsibilities and sets the stage for honoring those commitments. Essentially, this phase transforms negotiated plans into enforceable agreements.

Document Agreements and Secure Approvals

Clear and thorough documentation is the backbone of any successful out-of-court restructuring. At the heart of this process is the Restructuring Support Agreement (RSA). This key document outlines the agreed-upon framework for debt resolution and provides a timeline for the reorganization process. Alongside the RSA, a Restructuring Term Sheet is essential for detailing the specific terms of the restructuring and recapitalization transactions.

Some of the critical documents required include:

- Subscription Agreement

- Proxy Statement for seeking stockholder approvals

- Amendments to existing debt agreements

- Amended and Restated Investor and Registration Rights Agreement

- Issuance of new warrants

- Exchange Agreement for converting notes into shares

- Amended and Restated Certificate of Incorporation to authorize additional shares or implement a reverse stock split

- Release Agreement

It’s crucial to secure unanimous consent from key creditors and obtain shareholder approvals for significant changes. These steps ensure a smooth transition from planning to implementation.

Pros and Cons of Out-of-Court Restructuring

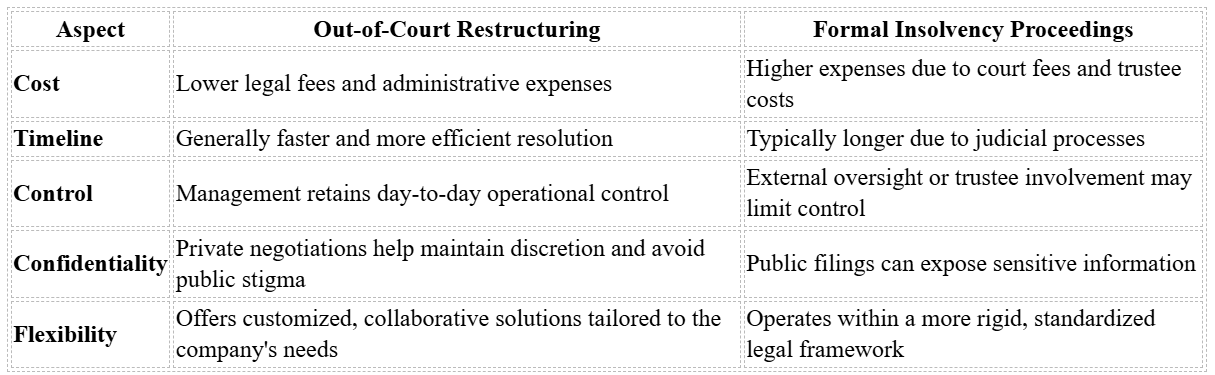

When weighing recovery strategies, it’s essential to understand the trade-offs between out-of-court restructuring and formal insolvency proceedings. Out-of-court restructuring allows companies to renegotiate debt while maintaining value and control, offering a different approach compared to the structured environment of formal insolvency.

One of the biggest benefits of out-of-court restructuring is its cost-effectiveness. By avoiding hefty legal fees and administrative expenses, companies can redirect resources toward stabilizing their operations. Additionally, the process is typically faster since it bypasses the delays often associated with court proceedings.

Another major advantage is that management retains control over daily operations. This continuity not only supports the business but also helps maintain employee morale and strengthens trust with vendors and customers. Moreover, because negotiations are handled privately, the company can avoid the reputational damage that often comes with public insolvency filings.

In short, out-of-court restructuring offers a practical and efficient alternative to bankruptcy, enabling companies to address financial challenges while preserving their operational and reputational integrity.

Using Platforms for Distressed Businesses

Once restructuring agreements are in place, leveraging digital platforms can be a game-changer for businesses facing financial challenges. These platforms provide essential tools to connect distressed businesses with buyers, investors, and expert advisors, streamlining both market engagement and operational tasks.

How Urgent Exits Supports Restructuring

Urgent Exits is a specialized marketplace designed specifically for distressed businesses. It simplifies the process of connecting sellers with motivated buyers and experienced advisors, catering to businesses that traditional brokers might overlook due to financial difficulties.

For business owners pursuing out-of-court restructuring, Urgent Exits offers a quick and efficient way to list your business – taking just minutes to get started. The platform also provides live engagement tracking, which is crucial during fast-moving negotiations. This feature gives you real-time insights into market interest, helping you demonstrate viable exit options to creditors and strengthening your position in negotiations.

Additionally, Urgent Exits connects users with a network of specialized advisors, including M&A lawyers, exit planners, consultants, and turnaround experts. These professionals bring the expertise needed to navigate the complexities of restructuring. By boosting visibility and speeding up decision-making, Urgent Exits integrates seamlessly into the restructuring process.

Online Marketplace Benefits

Platforms like Urgent Exits offer a range of benefits that align with and enhance traditional restructuring efforts. Their centralized nature eliminates the hassle of juggling multiple brokers or advertising channels, allowing you to concentrate on the critical aspects of restructuring.

These platforms often include secure tools for document sharing, version control, and automated workflows, making due diligence more efficient. With features like data analytics, you can track buyer engagement and assess cash flow scenarios, enabling faster and more informed decisions. Some platforms even utilize predictive analytics to forecast market trends, helping you pinpoint the best timing for asset sales or business transfers.

Security is another key advantage. Advanced measures like access controls, encryption, watermarking, and multi-factor authentication safeguard sensitive information during negotiations. This ensures confidentiality while still allowing access to stakeholders who need it.

For businesses planning asset sales as part of their restructuring strategy, digital platforms can provide valuable market validation by identifying buyers ready to act quickly. This data not only strengthens your negotiating position with creditors but may also uncover opportunities for higher recovery values.

Automated compliance features further simplify the process, ensuring that asset sales or business transfers meet regulatory standards and minimizing the risk of complications. Detailed audit trails and access logs offer the documentation required for stakeholder reporting and legal compliance, making the entire process smoother and more transparent.

Key Points and Takeaways

A successful out-of-court restructuring process relies on several guiding principles that offer distressed businesses a practical alternative to formal bankruptcy. This approach not only streamlines recovery but also preserves business relationships and operational flexibility.

The first step is early recognition of financial distress. Identifying challenges early and assembling a skilled advisory team lays the groundwork for effective negotiations. This preparation builds trust and credibility, making your restructuring proposal more appealing to stakeholders.

One of the biggest advantages of out-of-court restructuring is its efficiency. It saves both time and money by avoiding lengthy court delays while ensuring the business remains operational. Additionally, it helps maintain critical relationships with customers, suppliers, and employees – relationships that are often strained during formal bankruptcy proceedings.

Modern technology has further simplified this process. Platforms like Urgent Exits connect businesses with qualified buyers and specialized advisors, offering real-time market insights. These tools not only improve negotiation leverage with creditors but also help businesses navigate complex restructuring scenarios more effectively.

Once agreements are reached, documentation and follow-through become essential. A successful restructuring doesn’t end with a signed deal – it requires consistent performance tracking and contingency planning. Businesses that treat the agreement as the start of a new operational chapter, rather than the conclusion of their struggles, are those that thrive in the long term.

Lastly, your ability to show value and maintain stakeholder confidence is a critical factor. Keeping stakeholders engaged and reassured throughout the process can mean the difference between a successful out-of-court resolution and the need for court intervention. By adhering to these principles, you not only sustain trust but also position your business for a stronger future.

FAQs

What is the difference between out-of-court restructuring and bankruptcy, and how does it affect a company’s control over its operations?

Out-of-court restructuring is a private negotiation process where a company collaborates directly with its creditors to address financial difficulties, bypassing court involvement entirely. This method allows the company’s management to maintain greater control over daily operations and strategic decisions, offering a more flexible and discreet way to resolve financial issues.

On the other hand, bankruptcy proceedings, such as Chapter 11, are court-supervised. While this process may limit management’s autonomy due to legal oversight, it does come with certain legal protections. For instance, the automatic stay halts creditor actions temporarily, giving the company breathing room to reorganize and formulate a recovery plan.

The main distinction between these two approaches lies in the balance of control and transparency. Out-of-court restructuring prioritizes operational independence and confidentiality, whereas bankruptcy provides legal protections but under stricter court supervision.

What are the best ways for businesses to communicate with stakeholders during an out-of-court restructuring to build trust and ensure collaboration?

Clear and consistent communication plays a crucial role in building trust and encouraging collaboration during an out-of-court restructuring. Make it a priority to keep stakeholders informed with regular updates delivered through their preferred channels – whether that’s in-person meetings, emails, or virtual platforms. Being upfront about the process and its objectives can ease uncertainties and foster cooperation.

It’s also important to present a unified message about the restructuring’s goals and potential benefits. Consistency in communication across all levels of your organization reinforces clarity and alignment. Create opportunities for open dialogue by inviting feedback and addressing concerns quickly. This kind of two-way communication not only deepens trust but also ensures stakeholders feel heard and involved throughout the process.

How can digital platforms streamline the out-of-court restructuring process and improve creditor negotiations?

Digital platforms are transforming the out-of-court restructuring process, making it faster and more streamlined. With real-time communication and collaboration tools, business owners and advisors can securely share information with creditors without delays. These platforms also take the headache out of document management by organizing materials efficiently and ensuring everyone involved has easy access to what they need.

On top of that, advanced features like AI-powered analysis can pinpoint the most effective settlement strategies, while online mediation services offer a faster and more affordable way to resolve disputes. Together, these tools help businesses cut down on time and expenses while boosting the success of their negotiations.