2025 is a tough year for businesses. Rising interest rates and stricter credit conditions are causing financial strain across sectors. Here’s the situation in a nutshell:

- Revenue concerns: 35% of small businesses report struggles in Q3 2025, the highest since 2021.

- Sector impact: Manufacturing (+16%) and professional services (+14%) are hit hardest.

- Micro-business challenges: 44% face significant financial hurdles.

- Revenue and profit declines: 47% of businesses see lower revenues, with half reporting reduced profits.

Despite these challenges, opportunities in distressed businesses are growing. Private credit managers are stepping in as traditional banks retreat, making distressed M&A deals more common. Tools like Urgent Exits, an online marketplace for distressed businesses, and experienced brokers are helping buyers and sellers navigate this volatile market. Investors willing to act quickly can find undervalued assets, especially in struggling sectors like retail.

The key takeaway? Acting fast and using the right tools – whether online platforms or brokers – can help businesses and investors make the most of this challenging but opportunity-rich environment.

1. Urgent Exits

Urgent Exits stands out as the only marketplace exclusively focused on buying and selling distressed businesses. This specialization enables swift decision-making, a critical advantage in today’s challenging financial environment.

Accessibility for Buyers and Sellers

The platform eliminates many of the usual obstacles that slow down transactions involving distressed businesses. Sellers can list their businesses within minutes, skipping the need for broker approval. This streamlined process provides a faster alternative to traditional methods, which often fail to accommodate the urgency these situations demand.

For buyers, Urgent Exits offers unlimited daily access to browse listings of distressed businesses. Advanced filtering and saving options make it easier to pinpoint undervalued opportunities. Additionally, the platform’s direct contact feature allows buyers to immediately connect with verified sellers, minimizing delays that could jeopardize time-sensitive deals.

Speed of Transactions

In a market shaped by rising interest rates and tighter credit, speed is everything. Urgent Exits delivers dozens of new listings every day, ensuring a steady flow of opportunities for buyers. Sellers grappling with increasing debt costs can list their businesses quickly, addressing financial pressures before they worsen. Buyers, in turn, can act fast to secure deals before market conditions shift further or competing offers emerge. This is especially relevant as distressed M&A activity in sectors like retail is expected to stay strong through 2025. The platform’s emphasis on speed creates a foundation for expert advisory support during follow-up transactions.

Support for Advisors

Urgent Exits also serves as a valuable resource for advisors such as M&A lawyers, exit planners, consultants, appraisers, lenders, accountants, and liquidators. These professionals can connect directly with sellers in urgent need of expertise or buyers seeking turnaround investments. The platform’s tools make it easy for advisors to identify and contact clients, allowing them to step into deals that require specialized knowledge in areas like restructuring, valuation, or legal compliance.

Market Focus

By concentrating solely on distressed businesses, Urgent Exits creates a marketplace where every participant understands the unique challenges of these transactions. Unlike general business-for-sale platforms, it caters specifically to non-traditional listings, ensuring that sellers attract the right buyers and buyers can focus on undervalued assets. Additionally, its focus on the U.S. market aligns with local business practices, legal standards, and the dollar-denominated transactions that dominate American distressed business activity. This tailored approach allows the platform to address the specific needs of its market participants effectively.

2. Business Brokers

When it comes to speed, online platforms have an edge over traditional brokers, who often struggle to keep up with the fast-paced demands of today’s distressed sales market. Their methods rarely align with the urgency required in these situations.

Accessibility for Buyers and Sellers

Traditional brokers tend to shy away from listing distressed assets. This leaves sellers with urgent needs in a tough spot, often without proper representation. The rigorous screening process brokers use can delay timely sales, creating a gap that alternative channels, like platforms such as Urgent Exits, are stepping in to fill.

In 2025, a Midwest manufacturing firm on the brink of financial collapse was rejected by multiple traditional brokers before finally finding one willing to handle its distressed sale.

This is a common scenario. Brokers often prioritize stable businesses with predictable valuations over the complexity of distressed situations.

For buyers, brokers do offer pre-screened opportunities, but these are usually less distressed assets. Those looking for deeply undervalued deals with significant turnaround potential might find traditional brokers falling short in serving this niche.

Speed of Transactions

The current economic climate, shaped by monetary tightening, has stretched the typical closing time for brokered distressed sales from 60–90 days to 90–120 days. This is largely due to more intensive evaluation processes and reduced buyer liquidity.

However, experienced brokers can speed things up by pre-qualifying buyers and leveraging their established networks of lenders and advisors. These connections help them navigate valuation challenges and timing obstacles more effectively.

Support for Advisors

Business brokers often work hand-in-hand with advisors to ensure that distressed transactions meet all legal, financial, and regulatory requirements. They collaborate with M&A lawyers, accountants, and restructuring consultants to improve outcomes for both buyers and sellers.

While not all deals succeed, brokers report higher success rates when pre-qualified buyers and integrated advisory teams are involved. These factors can make a significant difference, even as overall transaction volumes decline.

Market Focus

Traditional brokers usually concentrate on industries with high transaction volumes. Their approach to distressed businesses, however, varies widely. During times of monetary tightening, brokers often see increased activity in sectors sensitive to interest rates and consumer spending, such as retail, manufacturing, hospitality, and healthcare.

Brokers specializing in distressed transactions typically target small to mid-sized enterprises where brokered sales are more practical. They often impose minimum revenue thresholds, which can exclude many severely distressed opportunities. Compared to digital marketplaces, this selectivity highlights a shift in how distressed assets are managed in today’s challenging economic conditions.

Advantages and Disadvantages

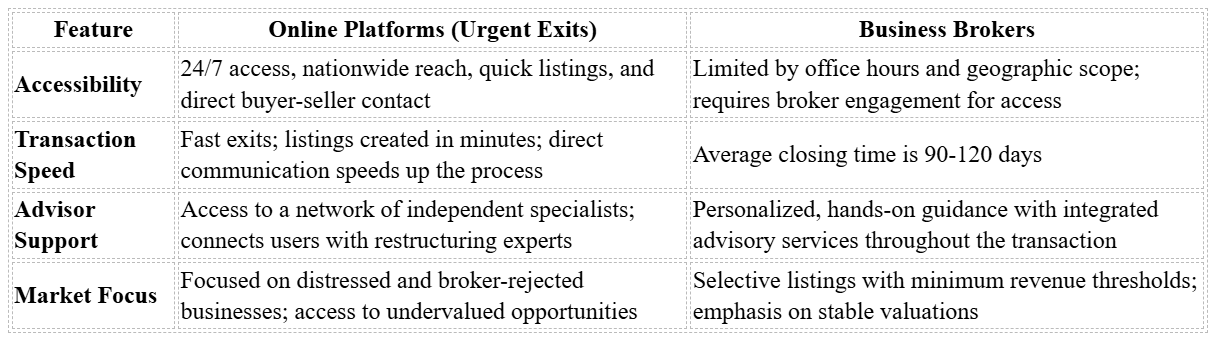

When comparing online platforms like Urgent Exits with traditional business brokers, it’s clear that each approach has its own strengths and limitations. Understanding these differences can help buyers, sellers, and advisors choose the option that aligns best with their specific circumstances, especially during periods of financial pressure.

Online platforms are all about speed and accessibility. Sellers can list their businesses within minutes and connect with buyers across the country without being limited by geography. This instant access is a huge advantage for businesses facing urgent liquidity needs or strict time constraints. Plus, these platforms often feature listings for businesses that brokers may have rejected, offering buyers access to undervalued opportunities. The direct communication between buyers and sellers also helps expedite transactions.

That said, online platforms come with some challenges. The lack of comprehensive business information can increase risks for buyers, who must handle due diligence on their own. Without the benefit of face-to-face negotiations, critical details may get lost, potentially affecting the outcome of the deal. And while platforms do provide access to independent advisors, the support may not match the personalized, hands-on approach that brokers offer.

On the other hand, traditional business brokers bring a more tailored experience to the table. They guide clients through the entire process, offering detailed business valuations, targeted marketing plans, and skilled negotiation support. Their expertise and established networks help connect buyers with opportunities that align with their goals, while their oversight minimizes transaction risks. Brokers also manage complex tasks like due diligence, legal documentation, and closing procedures, which is especially crucial for distressed transactions requiring specialized knowledge.

However, working with brokers has its downsides too. Their stricter listing criteria often exclude highly distressed or unconventional businesses. Transactions typically take longer, with an average closing time of 90-120 days, and the manual processes involved can further extend that timeline. Additionally, brokers charge significantly higher fees compared to online platforms, and their reach is often limited to local or regional markets, which may reduce exposure to a broader audience of potential buyers.

Here’s a side-by-side comparison to illustrate the key differences:

Ultimately, the decision between online platforms and traditional brokers hinges on the urgency and complexity of the transaction. During times of monetary tightening, when financial pressures are heightened, the speed and accessibility of online platforms can be a critical advantage for businesses seeking quick exits or time-sensitive opportunities.

Conclusion

The current wave of monetary tightening has opened the door to a massive distressed market, with $500 billion in high-yield bond maturities looming through 2028. This creates a pressing need to choose the right strategy to navigate these opportunities effectively.

In today’s distressed market, speed is often the key to success. Acting quickly can help secure value before market conditions worsen or competing offers gain traction. As outlined earlier, the strategy you select should match the urgency and complexity of your situation. For scenarios requiring swift action – such as broker-rejected businesses or urgent exits – platforms like Urgent Exits provide rapid access to specialized buyers and advisors. On the other hand, traditional brokers may be better suited for complex negotiations, high-value deals, or situations where confidentiality is critical.

With high-yield default rates forecasted at 2%-3% in 2025 and corporate bankruptcy filings projected to rise nearly 50% above historical averages by early 2025, the distressed market is expected to remain active. Matching your transaction’s specific needs with the right tools is essential to navigating this environment effectively.

In some cases, combining strategies might be the smartest move. For example, using online platforms like Urgent Exits for initial exposure while engaging specialized advisors for complex restructuring can offer the flexibility and speed needed in this shifting market. As private credit managers increasingly fill the gap left by traditional banks, this dual approach can provide the agility necessary to close deals efficiently.

Given the challenges and opportunities ahead, the distressed business market is set to remain active through at least 2025. Acting decisively with the right approach can help you capitalize on these evolving opportunities.

FAQs

What’s the best way for investors to find undervalued opportunities in distressed businesses during times of monetary tightening?

Investors looking to tap into hidden opportunities might find value in distressed businesses, especially those with the potential to bounce back through recovery or restructuring. The key is to focus on companies that have strong underlying fundamentals but are facing temporary challenges, such as rising interest rates or stricter financial conditions.

Platforms like Urgent Exits simplify this process by linking buyers with sellers eager to offload distressed businesses. These platforms help investors spot assets that might not get much attention in mainstream markets but could offer substantial growth or profit when managed effectively.

What are the main benefits of using Urgent Exits to buy or sell distressed businesses?

Urgent Exits simplifies the process for sellers looking to list distressed businesses, whether they’re facing financial difficulties or operational hurdles. The platform ensures these sellers can connect with motivated buyers efficiently. For buyers, it opens the door to businesses priced below market value that may offer opportunities for growth or a successful turnaround.

The platform also links users with seasoned professionals, including appraisers, consultants, and legal experts. These advisors provide support with valuations, restructuring, and other critical aspects of managing distressed business transactions. This approach creates an all-in-one solution, making it easier to handle the complexities involved in buying or selling struggling businesses.

How do rising interest rates and tighter credit conditions affect distressed M&A transactions?

Rising interest rates and tighter credit conditions can have a big impact on distressed M&A deals, shaping both the challenges and the opportunities involved. For sellers facing financial strain, these factors might force them to speed up the sale of their businesses, often accepting lower valuations to avoid deeper losses or even insolvency.

On the flip side, buyers might find chances to pick up undervalued businesses with strong turnaround potential. But securing financing for these acquisitions can become tougher, pushing buyers to explore alternative funding options or more creative deal structures. While this adds layers of complexity to the process, it can also make the rewards greater for investors who come prepared.