When a real estate firm faces financial distress, liquidation valuation helps estimate the minimum value recoverable from selling assets. Unlike fair market value, liquidation value reflects urgency, often leading to lower prices. Forced sales may recover as little as 25% of market value, while orderly liquidation over 6–9 months yields higher returns. This process is crucial for bankruptcy, asset sales, or restructuring decisions.

Key Takeaways:

- Liquidation Value: The amount recoverable from selling physical assets under financial stress.

- Methods: Asset-based (balance sheet evaluation) and market-based (comparable sales).

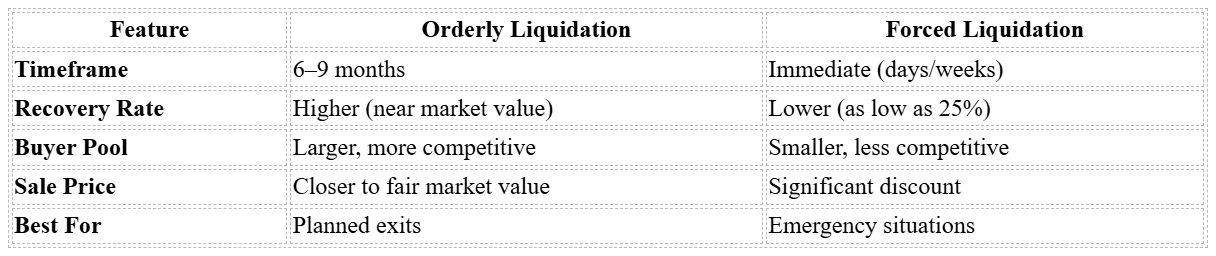

- Orderly vs. Forced Liquidation: Orderly sales take longer but recover more; forced sales are quicker but fetch lower values.

- Factors Influencing Value: Market demand, legal issues, and sale urgency.

Professionals like appraisers, auctioneers, and legal advisors can help maximize recovery. Platforms like Urgent Exits connect sellers with buyers and advisors for efficient transactions.

Liquidation Valuation Methods for Real Estate Firms

When real estate firms face financial distress, they typically rely on two main methods to estimate asset recovery. Both approaches have their strengths, depending on the firm’s assets, market conditions, and how quickly the sale needs to happen.

Asset-Based Valuation Method

This method starts by examining the company’s balance sheet and evaluating each property or asset. Assets like commercial buildings, residential properties, land, and equipment are listed, and their book values are adjusted based on market conditions, depreciation, and overall condition.

Recovery rates are then applied to estimate how much of the book value can realistically be recovered. For example, a commercial building with a book value of $2 million might have a recovery rate of 60% in an orderly liquidation. That would result in a liquidation value of $1.2 million.

The condition of the property plays a big role. A well-maintained or recently renovated building will likely retain more value than one in poor repair. Similarly, location matters – a property in a high-demand urban area will generally fetch a higher price than one in a declining or oversaturated market.

Market-Based Valuation Method

This approach looks outward, using sales data from comparable properties to estimate value. Adjustments are made for distress and urgency, which are common in liquidation scenarios. Unlike the asset-based method, this one doesn’t rely on internal book values, making it useful when there’s sufficient recent sales data for similar properties.

However, challenges arise when comparable sales data is limited, especially for unique or highly customized properties. These types of assets often attract fewer buyers and may require substantial modifications, which can further reduce their value. For more standardized properties – like residential units or standard office spaces – the market-based method tends to be more effective.

One critical factor to account for is the "fire-sale discount." Properties sold under distress often go for less than similar assets sold in normal market conditions. Adjustments must be made to reflect this urgency and the reduced negotiating power of the seller.

Orderly vs Forced Liquidation

The type of liquidation – orderly or forced – has a major impact on recovery rates and the choice of valuation method.

Orderly liquidation allows assets to be sold over a reasonable timeframe, often 6–9 months. This typically results in higher recovery rates, closer to fair market value. On the other hand, forced liquidation involves selling assets quickly, often within days or weeks, leading to steep discounts, sometimes as low as 25% of market value.

For example, the Payless bankruptcy demonstrated how factors like asset type, market conditions, and urgency can significantly influence liquidation outcomes.

Strong market demand and a healthy economy can help boost recovery rates, even during liquidation. Conversely, weak demand or economic downturns can drive prices down, especially in forced sales. Timing, therefore, becomes a critical element in deciding which approach to take.

To improve outcomes, even under tight deadlines, some real estate firms turn to platforms like Urgent Exits. These platforms connect distressed sellers with motivated buyers and advisors, potentially speeding up transactions and expanding the buyer pool.

Factors That Affect Real Estate Liquidation Value

Several factors play a critical role in determining how much can be recovered when liquidating real estate assets. Understanding these elements is essential for making informed decisions, as they influence both valuation approaches and the final recovery amount.

Market Conditions and Buyer Demand

The local economy has a significant impact on real estate liquidation outcomes. Factors like employment rates, population trends, and regional development directly affect buyer interest in distressed properties. For instance, properties in thriving urban areas like New York or San Francisco tend to hold their value better, while those in struggling economies or oversaturated markets may require steeper discounts to sell. Locations with strong infrastructure, growing suburbs, or proximity to logistics hubs often attract more buyers compared to similar assets in weaker areas. Metrics such as vacancy rates, absorption rates, and recent comparable sales can offer useful insights into expected recovery values. These indicators also play a key role in shaping valuation strategies.

Legal and Regulatory Issues

Legal and regulatory considerations heavily influence how real estate assets are liquidated. U.S. bankruptcy laws, for example, dictate different processes depending on the chapter filed. Chapter 7 often involves selling assets individually, while Chapter 11 may allow for transactions that preserve more value, such as selling the business as a going concern. Lien priorities determine how creditors are paid, while zoning restrictions can limit potential buyers by restricting property use. Environmental compliance issues, such as contamination or unresolved liabilities, may lead to "as-is" sales at lower prices. Additionally, state-specific due diligence requirements can slow down transactions and discourage buyers when legal complexities arise. These legal hurdles, combined with market conditions, significantly affect the recovery value.

Time Limits and Sale Urgency

The timeline for selling a property often becomes the most influential factor in determining recovery amounts. When time is limited, challenges multiply. For example, a property with environmental concerns might attract reasonable offers if buyers have enough time for due diligence. But in a forced sale scenario, where transactions must happen quickly, recovery amounts are typically lower. Court-ordered deadlines in bankruptcy cases can push for rapid sales, often leading to proceeds that fall short of what could be achieved through a more deliberate process. Under such pressure, assets may be sold to the first available buyer, even if better offers could arise with more time. To address these challenges, professional advisors often recommend scenario planning to explore different outcomes based on market conditions and sale timelines.

Platforms like Urgent Exits aim to ease some of these timing pressures by connecting sellers of distressed properties with motivated buyers and professionals experienced in quick transactions.

sbb-itb-84c8851

How to Conduct Real Estate Liquidation Valuation

Performing a liquidation valuation for distressed real estate requires a structured approach to ensure accurate and realistic assessments. This process is crucial for determining what stakeholders can expect to recover, especially given the urgency often involved in such sales. Here’s a breakdown of the key steps:

List and Categorize All Assets

The first step in a reliable valuation is creating a detailed inventory of all assets owned by the firm. This goes beyond simply listing properties – it includes documenting all tangible assets that could be sold.

For real estate holdings, each property should be described thoroughly. Include details such as the full address, square footage, year of construction, current condition, occupancy status, and any renovations or structural issues. For instance, a property like 456 Oak Street could be noted as a 25,000 sq ft office building, built in 1995, with 80% occupancy and leases expiring in 2026.

Beyond properties, other assets like office furniture, vehicles, specialized software, and tenant improvements should also be cataloged. Each item should have an estimated value attached.

It’s critical to document ownership status and any encumbrances for each asset. Properties with clear titles generally sell more easily than those with liens, easements, or unresolved legal disputes. Identifying mortgages, tax liens, mechanic’s liens, or other claims early in the process is essential, as these factors directly influence marketability and recovery amounts.

By maintaining detailed records from the start, potential roadblocks can be identified and addressed before they disrupt the sale process.

Determine Asset Recovery Values

Once all assets are cataloged, assign realistic recovery values by adjusting standard valuations to reflect the distressed nature of the sale.

Local comparable sales can provide a baseline for market values, but these often need to be adjusted downward for liquidation scenarios. For example, a property that might typically sell for $1,200,000 could instead bring in $900,000 to $1,000,000 in a distressed sale.

Recovery percentages vary based on asset type and market conditions. Commercial properties in strong markets might recover 70–80% of their appraised value, while specialized properties or those in weaker areas could see recovery rates as low as 25–50%. Factors like a property’s physical condition and marketability also play a role – issues such as deferred maintenance or environmental concerns can further reduce values.

The timeline for the sale is another critical factor. Properties marketed over a reasonable period, typically 6–9 months, tend to achieve higher prices. In contrast, forced sales requiring immediate action might only recover 25% of market value.

Calculate Final Net Liquidation Value

The final step is determining the net amount available for distribution after accounting for obligations and expenses. This involves subtracting liabilities and costs from the gross asset recovery value.

Start by listing all outstanding debts, prioritizing them according to legal requirements. Secured debts, like mortgages, are typically paid first, followed by tax obligations and then unsecured creditors. For example, if a firm expects to recover $2,100,000 from asset sales but owes $1,400,000 in loans and other obligations, the available funds are significantly reduced.

Additionally, liquidation expenses must be factored in, including broker commissions (usually 3–6% of sale prices), legal fees, accounting costs, auctioneer fees, transfer taxes, and property maintenance during the sale period. Using the same example, subtracting $1,400,000 in liabilities and $100,000 in expenses from $2,100,000 leaves a net liquidation value of $600,000.

It’s wise to develop multiple scenarios based on varying sale timelines and market conditions. This allows stakeholders to understand potential outcomes and make informed decisions about whether to proceed with liquidation or explore alternatives.

Platforms like Urgent Exits can simplify this process by connecting firms with experienced appraisers, legal experts, and buyers familiar with distressed transactions. Working with qualified professionals and motivated buyers can help improve valuation accuracy and maximize recovery amounts.

Practical Tips for U.S. Real Estate Liquidations

Recovering the most value from distressed real estate assets in the U.S. requires more than just knowing how to assess their worth – it demands a well-thought-out strategy. The difference between minimal returns and a stronger recovery often lies in the execution.

Working with Professional Advisors

Bringing in seasoned professionals can make all the difference when navigating the complexities of real estate liquidations. For credible and defensible property valuations, rely on MAI-certified appraisers. These experts account for the distressed nature of the property and can stand by their assessments if creditors challenge them.

Hiring auctioneers with experience in commercial real estate can also significantly boost recovery rates. Different property types – whether retail, office, industrial, or mixed-use – require tailored marketing efforts, so choose auctioneers who specialize in your specific asset class.

Legal advisors with expertise in bankruptcy and real estate law are essential, too. They ensure compliance with federal Chapter 7 regulations and state-specific rules, handle creditor notifications, and manage court filings. They can also identify and address potential title, lien, or environmental issues that could derail a sale.

To avoid misunderstandings, establish clear fee structures and define the roles of all advisors from the outset.

Using Online Marketplaces

Traditional real estate channels often fall short when it comes to selling distressed properties, as they tend to have longer timelines and cater to conventional buyers. Online marketplaces like Urgent Exits offer a faster, more focused alternative. These platforms connect sellers with buyers who understand liquidation scenarios, enabling quick listings, competitive bidding, and access to specialized professionals.

Online platforms cast a wider net, reaching buyers across different regions who are ready to act quickly. This broader audience often leads to more competitive bidding and better sale outcomes. However, success depends on realistic pricing and full transparency. Buyers in these scenarios expect detailed property descriptions, clear title information, and honest disclosure of any challenges.

While online tools are invaluable, addressing the unique hurdles of distressed assets is equally critical.

Solving Common Problems

To maximize recovery, creative marketing and proactive problem-solving are key.

For specialized properties like medical facilities or manufacturing plants, the pool of potential buyers may be limited. In these cases, focus on highlighting alternative uses or redevelopment opportunities. For example, a former medical facility might attract interest from educational institutions or office users if marketed with these possibilities in mind.

Clearing up issues like liens, title disputes, or environmental concerns early on can significantly enhance the property’s appeal. Transparency with stakeholders is also crucial – set realistic expectations about recovery rates and provide regular updates on marketing progress and buyer interest. This helps maintain confidence and prevents pressured sales at lower prices.

Time constraints imposed by courts or creditors can be another challenge. Start pre-marketing efforts as early as possible to identify potential buyers and advisors. This preparation allows for smoother, more organized sales even under tight deadlines.

To refine your approach, track key metrics such as recovery rates, time-to-sale, marketing costs per property, and the number of qualified bids. These insights can help you improve your strategy for future liquidations.

Conclusion

Liquidation valuation serves as a crucial tool for real estate firms facing financial challenges or preparing for worst-case scenarios. By providing a baseline recovery value, it equips stakeholders – creditors, investors, and decision-makers – with a realistic view of potential outcomes.

The methods used, whether asset-based or market-based, and the choice between orderly and forced liquidation, play a pivotal role in determining recovery rates. While orderly sales often approach market value, forced sales typically result in significant discounts.

Factors like market conditions, legal complexities, and time constraints heavily impact the final recovery amounts. These considerations set the stage for practical strategies explored later in this discussion.

The liquidation valuation process demands a systematic approach. This involves estimating recovery rates based on current market realities and the urgency of the sale, then deducting liquidation costs and liabilities to arrive at the net liquidation value.

Main Points to Remember

Partnering with professionals and utilizing specialized platforms like Urgent Exits can significantly improve liquidation outcomes.

Expert advice is essential for maximizing recovery. Professional appraisers deliver accurate property valuations, while skilled auctioneers and legal advisors help navigate the complexities of regulations.

Online platforms like Urgent Exits provide a modern alternative to traditional real estate channels. They connect sellers with buyers who are familiar with liquidation scenarios and can act quickly. These platforms also offer access to a network of specialists – appraisers, lenders, consultants, accountants, lawyers, and liquidators – who are experienced in handling distressed assets.

Success in real estate liquidation comes down to preparation, setting realistic expectations, and utilizing the right expertise and tools. By focusing on accurate valuations and strategic planning, stakeholders can maximize recovery even in challenging situations.

FAQs

What is the impact of choosing between asset-based and market-based valuation methods on the liquidation value of real estate assets?

The method you choose – asset-based or market-based – can make a big difference when determining the liquidation value of real estate assets.

The asset-based approach zeroes in on the tangible and financial assets of a firm, subtracting liabilities to calculate its net worth. This method works well for properties in distress or firms with a lot of physical assets. On the other hand, the market-based approach relies on comparable sales and market trends, capturing the current demand and pricing landscape in the real estate market.

Which method is best? That depends on factors like the financial condition of the firm, the state of its assets, and what’s happening in the market. For distressed real estate firms, platforms such as Urgent Exits can connect sellers with buyers and advisors who specialize in liquidation, offering a streamlined and well-informed process.

How can real estate firms maximize recovery during a forced liquidation?

Maximizing recovery during the forced liquidation of real estate properties demands a well-planned approach. The first step is to carry out a detailed valuation to establish the fair market value of the properties. This ensures prices are attractive to buyers while still reflecting the true worth of the assets.

It’s also wise to collaborate with seasoned professionals, such as appraisers, auctioneers, or consultants who have experience handling distressed properties. Their knowledge can guide you in choosing the most effective liquidation strategies, helping you sell faster and reduce potential losses. At the same time, maintaining transparency in your marketing efforts is crucial. Clear and honest communication can draw in serious buyers and prevent unnecessary delays in the process.

For a streamlined solution, platforms like Urgent Exits can be invaluable. They connect sellers with motivated buyers and advisors who specialize in distressed assets, making it easier to close deals quickly and recover as much value as possible.

How do legal and regulatory issues affect the liquidation process and recovery rates for real estate firms?

Legal and regulatory challenges can heavily influence how real estate firms navigate the liquidation process and the amount they ultimately recover. Adhering to local, state, and federal laws is essential because any misstep – like zoning law violations, unresolved liens, or issues with property regulations – can lead to setbacks, fines, or even costly legal battles. These complications not only slow down the process but can also eat into the recovery value of the assets.

Bankruptcy laws and creditor claims are also key factors, often shaping how assets are divided among stakeholders. To navigate these complexities, it’s crucial to have a solid grasp of the legal landscape. Partnering with seasoned professionals, such as attorneys or appraisers, can help reduce risks and streamline the liquidation process, improving financial outcomes in the long run.