When businesses face financial trouble, loan maturity extensions can provide extra time to repay debt and avoid default. This approach is especially helpful when refinancing isn’t an option. Here’s what you need to know:

- What It Is: Loan maturity extensions adjust repayment timelines, interest rates, or loan terms to help businesses manage debt.

- Why It’s Used: Rising interest rates, tighter lending, and financial pressures make extensions a preferred alternative to foreclosure or liquidation.

- How It Helps: Businesses gain time to stabilize, improve cash flow, or secure new financing without immediate default.

- Challenges: Extensions can increase overall costs, require lender negotiations, and often signal financial distress to future creditors.

Key examples include the "blend and extend" strategy, where loan terms are extended with adjusted interest rates. While not a permanent fix, extensions can keep businesses afloat during tough times. Acting quickly with a clear recovery plan and open communication with lenders is crucial to securing favorable terms.

Problems Faced by Distressed Businesses

When businesses face financial distress, understanding the causes and potential fallout of inaction is crucial. This knowledge helps owners decide if pursuing loan maturity extensions is the right move to keep operations running.

Main Causes of Financial Distress

Declining cash flows can destabilize a business almost immediately. Falling sales reduce revenue, making it difficult to cover essential expenses like debt payments, payroll, and day-to-day operations.

Rising operating costs add to the strain. Higher expenses for labor, raw materials, utilities, and rent shrink profit margins, leaving businesses struggling to manage fixed costs, especially when revenue is already dropping.

High debt levels can become a trap. Businesses that borrowed heavily during favorable conditions may find their debt-to-equity ratios unsustainable. When refinancing isn’t an option, these companies face restricted flexibility and growing financial pressure.

Market shifts – such as technological advancements or regulatory changes – can render long-standing business models obsolete. For instance, traditional retailers often struggle to compete with e-commerce platforms, leading to declining sales and mounting financial challenges.

The commercial real estate sector, particularly the office segment, is facing unique challenges. High vacancy rates and reduced demand have led to concentrated defaults in portfolios. Multifamily property owners who secured loans at ultra-low interest rates in 2021–2022 are now grappling with significantly higher debt servicing costs as those loans come due.

If these issues aren’t addressed, they can escalate rapidly, as outlined below.

What Happens When Businesses Do Nothing

Failing to act on financial distress often makes matters worse. Foreclosure becomes increasingly likely as missed payments pile up, prompting lenders to take recovery actions. In such cases, businesses may be forced into distressed asset sales, often at below-market prices. These "fire-sale" transactions diminish value that could have been preserved through proactive measures like restructuring.

Additionally, businesses risk losing operational control. Lenders may seize collateral, sell assets at steep discounts, or assign receivers to oversee daily operations. For example, small retail chains that fail to restructure or secure extensions often face rapid liquidation, employee layoffs, and eventual closure. A few missed payments can quickly spiral into a situation where owners lose both leverage and options.

Lender and Regulatory Limits

External pressures often compound financial struggles. Regulatory bodies like the FDIC and SEC require lenders to verify that loan extensions don’t mask deeper insolvency issues. This leads banks to adopt a cautious stance, balancing exposure management with strict capital requirements. In many cases, these regulatory hurdles push lenders toward foreclosure, even when alternative solutions might be more viable.

The current financial landscape adds another layer of difficulty. Over the next two years, $1.2 trillion in commercial real estate debt is set to mature. This massive refinancing need, combined with rising interest rates and tighter lending standards, creates a challenging environment for borrowers seeking traditional refinancing options. On top of that, compliance with detailed documentation and reporting requirements can slow the approval process, limiting the relief options available to struggling businesses.

These financial and regulatory pressures highlight why acting promptly to secure loan maturity extensions can be a critical step toward recovery.

Types of Loan Maturity Extensions and How They Work

For businesses facing financial challenges, understanding the different types of loan maturity extensions can be a game-changer. Each option is designed to address specific liquidity and operational hurdles, giving companies a chance to stabilize and recover. Choosing the right extension type isn’t just about temporary relief – it’s about creating a pathway to long-term recovery.

Different Extension Options

Temporary forbearance provides immediate breathing room during short-term financial crises. With this arrangement, lenders agree to hold off on legal actions, such as foreclosure or asset seizure, for a specific period. This gives borrowers the time to address their financial issues without additional pressure. It’s particularly effective for businesses that are fundamentally sound but need time to recover from setbacks like losing a major client or dealing with a sudden market disruption.

Interest-only periods reduce monthly cash flow burdens by allowing businesses to pause principal payments and only cover interest. While this approach eases immediate financial strain, the principal remains untouched, meaning the full debt still needs to be repaid down the line.

Blend and extend strategies are often used in commercial real estate. This method combines the current loan interest rate with prevailing market rates to create a new blended rate, while also extending the loan’s term. For instance, InnovateTech successfully extended a $50 million loan by three years using this approach. The deal included a slight rate increase and additional reporting requirements, enabling the company to manage its debt while continuing to invest in its growth initiatives.

Qualifying for Extensions

To secure an extension, businesses need to prove that their financial troubles are temporary and solvable. Lenders want to see clear evidence that the difficulties stem from short-term challenges – such as market downturns, natural disasters, or other disruptions – rather than deeper, systemic issues. Providing detailed documentation of the hardship can strengthen the case for an extension.

A well-thought-out recovery plan is essential. This plan should outline realistic cash flow projections and specific actions to resolve underlying problems. Lenders need assurance that borrowers are making meaningful changes and that external conditions or business fundamentals support the likelihood of recovery.

For commercial loans, lenders often reassess the entire loan during the extension process. They’ll evaluate whether the project is adding value and whether loan-to-value ratios are improving. Borrowers must demonstrate measurable progress, not just promises of better days ahead.

Transparent and proactive communication with lenders is key. Borrowers who maintain open dialogue and address issues head-on are more likely to secure favorable extension terms than those who wait until default becomes unavoidable.

Lenders also assess financial metrics like cash reserves, cash flow projections, and repayment commitment. For real estate or project-based loans, progress timelines and value creation are critical factors in the decision-making process.

Negotiating and Documenting Extensions

Loan extension negotiations often go beyond just adjusting the maturity date. Lenders may also revise interest rates, payment schedules, collateral requirements, and reserve levels as part of the extension package.

Monetary cure periods for extensions typically range from 4 to 6 months, while non-monetary cure periods may be more flexible, depending on the terms negotiated. These timelines help set realistic expectations for both parties.

The documentation process is a crucial step. Extensions require formal amendments to the original loan agreements, clearly outlining the new terms, any additional reporting requirements, modified covenants, and updated collateral arrangements. Unlike verbal agreements, these written amendments are legally binding and enforceable.

Borrowers should also be prepared for additional costs, such as extension fees, updated appraisals, or legal documentation expenses. Factoring these costs into the overall financial plan ensures the extension remains a viable solution.

To secure favorable terms, borrowers need to demonstrate how the additional time will lead to improved loan performance. Whether it’s through increasing property values, business recovery, or enhanced repayment capacity, lenders want to see tangible progress. Borrowers who can show clear milestones and measurable improvements are more likely to negotiate better extension terms.

In today’s lending climate, many lenders are more open to offering extended loan packages, especially for borrowers with solid financial fundamentals. Detailed documentation and a clear recovery strategy can go a long way in building trust and securing the support needed to move forward.

Pros and Cons of Loan Maturity Extensions

Loan maturity extensions can offer a lifeline for businesses grappling with financial challenges. While they provide immediate relief by staving off default, they also come with potential long-term consequences that demand thoughtful consideration.

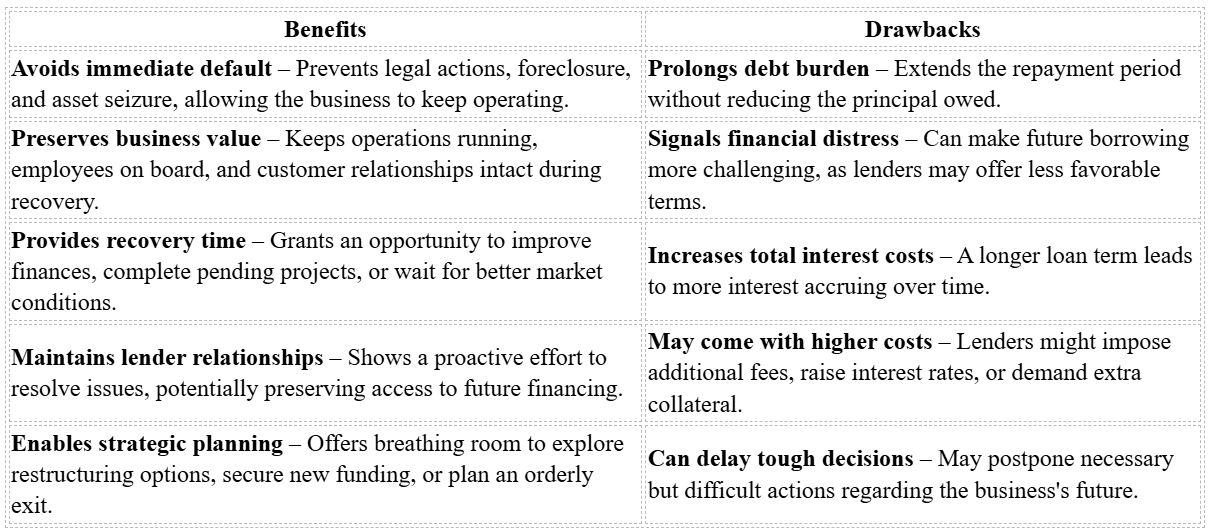

Benefits vs. Drawbacks

Deciding whether to extend a loan’s maturity involves balancing its advantages against its possible downsides:

These trade-offs highlight the immediate benefits and challenges that come with loan maturity extensions.

Real-world examples shed light on these dynamics. For instance, a developer secured a three-month extension to finish a project and avoid default. While this provided critical time, it also increased the overall interest costs. Extensions often come with stricter conditions, like enhanced financial reporting requirements or borrowing limits, which can reduce flexibility and signal distress to future lenders. Such measures are more effective when financial troubles are temporary – stemming from issues like market downturns, natural disasters, or project delays – rather than deeper structural problems within the business.

The current economic landscape has made loan maturity extensions more common. With approximately $1.2 trillion in U.S. commercial real estate debt set to mature in the next two years, many lenders now favor extensions over forced sales or foreclosures. This approach helps avoid bankruptcies and minimizes the loss of value.

Clear communication and a well-thought-out recovery plan can significantly improve the terms of an extension. Platforms like Urgent Exits connect struggling businesses with seasoned advisors, offering guidance during turbulent times. While not a permanent solution, loan maturity extensions can provide the critical time needed to stabilize and potentially turn a distressed business around.

sbb-itb-84c8851

Marketplace Solutions for Distressed Businesses

When extending loan maturities isn’t an option, distressed businesses often need alternative ways to address their financial struggles. This is where specialized online marketplaces step in, offering quicker and more tailored solutions compared to traditional business sale channels.

How Urgent Exits Works

Urgent Exits serves as a dedicated platform for businesses in distress, simplifying the typically drawn-out and complicated process of selling or restructuring into just a few days.

The process is designed to be user-friendly. Business owners can list their operations within minutes and monitor buyer activity to gauge interest and refine their exit strategies.

One standout feature of Urgent Exits is its direct communication system. Unlike traditional brokerage methods that involve multiple intermediaries, this platform allows sellers to connect directly with serious buyers. This streamlined approach eliminates delays, which is critical for businesses facing tight deadlines, like looming loan maturity dates.

Additionally, Urgent Exits connects sellers with a network of specialized advisors, including M&A lawyers, consultants, exit planners, and restructuring experts. These professionals bring expertise in distressed debt scenarios, offering guidance on debt negotiations, business valuations, and turnaround strategies. With new businesses listed daily, the platform creates a dynamic marketplace where motivated buyers are actively seeking undervalued opportunities.

This combination of features transforms a challenging situation into a more manageable one, offering practical and timely solutions for businesses in need.

Benefits for Distressed Businesses

One of the biggest advantages of Urgent Exits is speed. The platform drastically reduces the time it takes to complete a transaction – from months to mere days – making it a lifeline for businesses under tight financial pressure.

Another major benefit is access to qualified buyers. These are investors who specialize in distressed assets and turnaround opportunities, meaning they understand the complexities involved and are prepared to act quickly.

Transparency and control are also key. Sellers can track buyer interest in real time, adjust their strategies based on feedback, and maintain open communication throughout the negotiation process. The platform’s advisor network is another critical asset, offering expert support for debt restructuring, loan modifications, valuations, and operational strategies.

For businesses that traditional brokers might reject due to financial instability, Urgent Exits provides an inclusive alternative. The marketplace fosters creative deal-making, with buyers often willing to assume existing debt, negotiate directly with lenders, or craft solutions tailored to address imminent financial challenges.

Legal and Regulatory Requirements

Extending a loan isn’t as simple as it sounds. It requires strict adherence to both federal and state laws. The process becomes even trickier for businesses facing financial challenges, where timing and proper documentation can make or break a restructuring effort.

U.S. Legal Rules

In the U.S., loan maturity extensions are governed by a mix of federal and state regulations. On the federal side, laws like the Truth in Lending Act (TILA), Equal Credit Opportunity Act (ECOA), and Fair Debt Collection Practices Act (FDCPA) play a role. However, the real heavy lifting often falls to state-specific contract laws, which can differ widely depending on the jurisdiction.

For businesses operating in regulated industries, there’s an extra layer of oversight. Banks, for instance, must comply with Consumer Financial Protection Bureau (CFPB) guidelines, while certain loans may fall under the jurisdiction of the Office of the Comptroller of the Currency (OCC). If the loan involves commercial mortgage-backed securities (CMBS), the rules get even tighter. These loans must align with pooling and servicing agreements and often require approval from special servicers or trustees.

The U.S. tax code also offers a "safe harbor" rule for debt modifications. Under this rule, payment deferrals don’t count as significant modifications as long as the deferred payments occur within the lesser of five years or half the original loan term. This provision helps businesses avoid tax penalties during restructuring.

State laws add another layer of complexity. Many states have specific rules for notices, disclosures, and filings, particularly when loans are secured by real property. These state-specific requirements mean businesses must pay close attention to local laws to remain compliant.

Timing and Documentation Requirements

Timing is everything when it comes to loan extensions. Agreements must typically be finalized before the original loan matures to avoid triggering default provisions. If the loan has already defaulted, the situation becomes more complicated, often requiring forbearance agreements or full loan modifications rather than a simple extension.

The paperwork involved is extensive. Every extension requires a signed agreement that clearly outlines the updated maturity date, revised payment terms, any changes to interest rates, and additional covenants or conditions. This agreement must reference the original loan documents and specify how the extension alters the existing terms.

In some cases, amendments to promissory notes, security agreements, or other related documents may be necessary. For CMBS loans, the special servicer typically oversees these changes, following procedures outlined in the pooling and servicing agreement. If the loan is secured by real property, the updated documents may also need to be filed with state or local authorities.

Keeping thorough records is critical. This includes not only the agreement itself but also all related communications and financial evaluations. These records can be vital if the extension is later contested or if the business ends up in bankruptcy proceedings.

Getting Approvals

The approval process can vary widely depending on the loan structure and the parties involved. For loans with a single lender, getting the creditor’s consent is usually straightforward. But for syndicated loans or those involving multiple lenders, unanimous agreement may be required from all parties.

Once the necessary paperwork is in place, securing approvals from creditors and regulators becomes the next hurdle. For secured loans, lienholders or other secured creditors may need to approve the extension, especially if it affects their collateral. Businesses with multiple classes of debt – such as senior and subordinated lenders – must coordinate carefully to avoid conflicts.

For CMBS loans, the process is even more complex. Extensions often require approval from the special servicer, the trustee, and compliance with the pooling and servicing agreement. Borrowers may need to provide evidence, such as refinancing commitments or purchase agreements, to gain approval. These decisions involve multiple stakeholders and demand detailed documentation.

In cases where loans are part of securitization or trust structures, regulatory or trustee approvals may also be required. Bankruptcy adds yet another layer of complexity. Extensions in these cases need court approval and must align with the Bankruptcy Code. Additionally, extensions for distressed businesses are closely scrutinized to ensure they don’t unfairly favor one creditor over others, which could be seen as a preferential transfer or fraudulent conveyance.

Cross-default provisions in other loan agreements can further complicate matters. Extending one loan might inadvertently trigger default clauses in other agreements, requiring additional creditor discussions and approvals. A thorough review of all existing debt obligations is essential to avoid these pitfalls.

Navigating these legal and regulatory requirements is critical for businesses looking to restructure and regain financial stability. Proper planning, documentation, and coordination are key to ensuring a smooth process.

Using Loan Maturity Extensions for Business Recovery

Main Points Summary

Loan maturity extensions can serve as a lifeline for businesses navigating financial challenges. By extending loan terms, businesses gain time to stabilize operations and chart a recovery plan. However, success hinges on swift, strategic action.

Acting quickly is key. Open, documented communication with lenders – backed by realistic financial forecasts and a clear recovery strategy – can increase the chances of securing favorable adjustments. These may include interest rate reductions or temporary interest-only payments. The ultimate goal is to transition a loan from non-performing to re-performing, which usually requires 6–12 months of consistent payments under the revised terms.

Navigating the legal and regulatory framework is another critical piece. Federal and state compliance, including proper documentation and timely approvals, ensures the extension process stays on track and avoids unnecessary delays.

That said, extensions often come with trade-offs. Businesses may face higher interest rates, fees, or stricter covenants that could limit flexibility moving forward. Balancing these costs against the risks of default, foreclosure, or liquidation is essential to making an informed decision.

These considerations highlight the urgency of taking immediate, well-planned steps.

Next Steps for Distressed Businesses

For businesses in financial distress, the first step is a thorough and honest financial assessment. This means preparing detailed financial statements, cash flow projections, and identifying actionable steps to improve operations. Early engagement with lenders, paired with strong financial planning, builds on the strategies discussed earlier.

Specialized advisors can play a crucial role in this process. Their expertise can help businesses negotiate terms, ensure compliance, and structure extensions in a way that minimizes long-term costs while maximizing near-term relief.

In cases where traditional restructuring isn’t enough, alternative solutions may offer a way forward. Platforms like Urgent Exits connect distressed businesses with buyers looking for undervalued opportunities and advisors skilled in turnaround strategies. These marketplace solutions can help facilitate asset sales to generate cash flow, support loan extensions, or even enable a controlled exit.

FAQs

How can businesses negotiate effectively with lenders to extend loan maturity terms?

To negotiate better terms for a loan maturity extension, businesses need a clear plan and thorough preparation. Begin by taking a close look at your financial situation and pinpointing the specific reasons behind your request. Be upfront with your lender – share detailed financial records, cash flow forecasts, and a repayment plan that shows you’re serious about meeting your obligations.

Timing is key here. Reaching out early, before issues grow, can make a big difference. Lenders are generally more willing to cooperate when they see proactive communication. Highlight any actions you’ve taken to improve your financial standing, and stay open to exploring alternative solutions. Building trust and maintaining a constructive, collaborative approach can go a long way in securing terms that work for both sides.

What risks should businesses consider before using loan maturity extensions as a long-term financial solution?

Loan maturity extensions can offer short-term breathing room for businesses dealing with distressed debt, but they aren’t without potential downsides. One major issue is the risk of accumulating higher interest costs over time, which can put extra pressure on cash flow and increase the total debt load. On top of that, relying too much on these extensions might delay crucial restructuring or operational adjustments, possibly making financial problems worse down the line.

Businesses need to weigh these options carefully to ensure that an extension fits into their overall financial plan. Seeking expert advice can make a big difference in navigating these complex decisions. Platforms like Urgent Exits can help by connecting businesses with seasoned advisors who specialize in restructuring and distressed debt solutions.

How do regulations affect the process of extending loan maturity for distressed businesses?

When businesses face financial difficulties and seek a loan maturity extension, regulatory requirements become a key factor in the process. Lenders are obligated to follow federal and state laws, which often demand an in-depth evaluation of the borrower’s financial health and the likelihood of repayment under the new terms.

For businesses, this translates into preparing a comprehensive set of financial documents, presenting a solid recovery strategy, and collaborating with advisors who are well-versed in the regulatory framework. Successfully navigating these steps can provide businesses with the breathing room they need to regain stability and plan for the future.