When businesses struggle financially, loan workouts and covenant violations often become critical topics. A loan workout involves renegotiating loan terms to help borrowers avoid default, while covenant violations occur when borrowers fail to meet requirements in their loan agreements. Here’s what you need to know:

- Loan workouts can adjust repayment schedules, extend terms, or lower interest rates to benefit both borrowers and lenders.

- Loan covenants are rules in loan agreements (e.g., maintaining financial ratios or limits on debt). Breaching these can trigger "technical defaults."

- Causes of covenant violations include cash flow issues, declining revenues, or external economic factors.

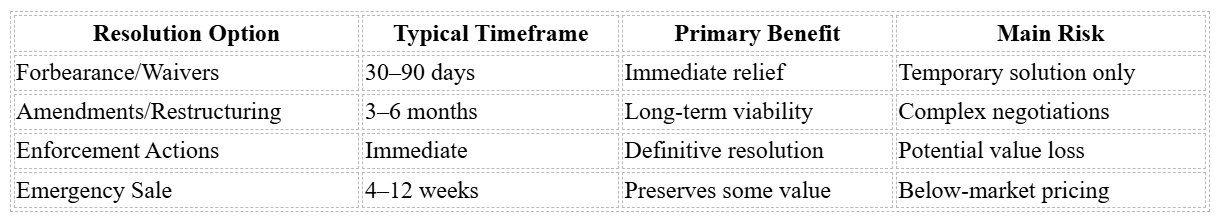

- Resolution options range from temporary fixes (forbearance agreements) to long-term restructuring or emergency sales.

Acting quickly, documenting breaches, and engaging professional advisors are key steps to resolving these issues. Platforms like Urgent Exits can connect borrowers with advisors or buyers, helping businesses recover value or transition ownership efficiently. The goal is to protect both borrower and lender interests while avoiding costly enforcement actions.

Steps to Address a Covenant Violation

When a covenant violation occurs, taking swift and organized action can mean the difference between a smooth resolution and a costly enforcement process. Both borrowers and lenders benefit from following a structured plan that emphasizes transparency, open communication, and timely professional guidance.

Identifying and Recording the Breach

The first step is to confirm the breach. Carefully review the loan documents to determine which covenant has been violated and understand the specific terms and conditions involved. Avoid making assumptions – gather clear evidence of when the breach occurred and its details.

Accurate and thorough documentation is crucial for resolving the issue effectively. Record the date and nature of the violation, collect relevant financial statements, and save any correspondence that sheds light on the situation. If external factors have influenced performance, make sure to document them as well. This level of precision lays a solid foundation for broader financial recovery efforts.

In distressed situations, financial records may be incomplete or unreliable. To avoid missteps, double-check all data and cross-verify the numbers to ensure your documentation provides an accurate picture of the company’s financial position.

Once the breach is documented, the focus should turn to engaging with stakeholders.

Talking with Stakeholders

After confirming and documenting the breach, the next priority is transparent communication. Both borrowers and lenders should promptly inform key stakeholders, including internal teams, legal counsel, and financial advisors. Clear communication fosters trust and helps prevent misinformation or panic, both of which can complicate the resolution process.

During these discussions, address the potential impacts of the breach and outline the initial steps for resolving it. This requires an honest assessment of the challenges while emphasizing a collaborative approach. Borrowers and lenders working together to find solutions can often avoid the need for enforcement measures.

Acting quickly is essential – delays can exacerbate the situation, increase legal risks, and reduce the options available for resolution. Early and open dialogue paves the way for involving professional advisors.

Hiring Professional Advisors

Bringing in experienced professional advisors early in the process can significantly improve the chances of a successful resolution. Specialists such as M&A lawyers for legal matters, restructuring professionals for turnaround strategies, and consultants or exit planners for strategic guidance offer valuable expertise.

For instance, Urgent Exits connects borrowers with advisors who specialize in distressed situations. These experts facilitate effective communication between borrowers and lenders while helping to craft practical resolution strategies.

Professional advisors often act as intermediaries, ensuring that all parties – especially in complex situations involving multiple stakeholders – can work toward maximizing value and minimizing risks. Their involvement is particularly helpful when operational challenges add layers of complexity to the resolution process.

Options for Resolving Covenant Violations

Once you’ve documented the situation and engaged key stakeholders, the next step is to explore potential solutions. Borrowers and lenders, often with input from advisors, consider resolution options by weighing factors like the severity of the breach, financial stability, and overall risk tolerance. Each approach comes with its own set of trade-offs, requiring careful thought about timing, costs, and long-term outcomes.

Forbearance Agreements and Waivers

Forbearance agreements provide temporary relief by pausing a lender’s enforcement rights. This gives borrowers breathing room to address underlying issues while keeping credit facilities accessible. However, these agreements often come with strings attached – such as stricter reporting requirements, added fees, or adjusted interest rates. On the other hand, waivers offer permanent forgiveness for a specific breach, but they usually come with tighter conditions.

Take Lifetime Brands, Inc., for example. Instead of facing immediate enforcement, they renegotiated their credit line with HSBC by extending its maturity and tweaking covenants. The lender’s own financial health can also influence their willingness to offer such accommodations. Stronger institutions are more likely to extend these options, while lenders under financial strain may opt to tighten credit or accelerate loan repayment.

Amendments and Restructuring

If a short-term fix won’t cut it, amendments or restructuring may be the way forward. These solutions involve renegotiating key loan terms – like repayment schedules, interest rates, and covenants – and may require additional collateral or guarantees. This process typically involves close collaboration with financial and legal advisors to craft a plan that demonstrates a realistic path to recovery.

While restructuring can take several months, it often preserves more value than immediate enforcement actions and helps maintain a working relationship between borrowers and lenders. The key is to back up renegotiation efforts with solid financial projections and operational improvements.

Loan Acceleration and Enforcement Actions

When breaches are unresolved or severe, lenders might escalate matters by accelerating the loan – demanding full repayment immediately. If this happens, enforcement actions like foreclosure, asset seizure, or bankruptcy proceedings can follow. These actions carry heavy consequences for borrowers, including asset loss and damaged credit ratings.

Statistics show that borrowers with less financially stable lenders face a 20-percentage-point higher likelihood of loan commitment reductions, with average loan sizes shrinking by 25–30% after violations. While legal remedies can be both costly and drawn out, the mere threat of acceleration often pushes borrowers to engage in restructuring talks.

For businesses on the brink of enforcement actions, platforms like Urgent Exits can connect them with buyers and advisors who specialize in distressed situations. Emergency sales through these platforms typically close within four to 12 weeks – much faster than the standard six to eighteen months for traditional transactions. While these sales often come at a discount, they can still preserve more value compared to bankruptcy or liquidation.

The best resolution strategy depends on the specific situation, but open communication and early action are critical. Engaging professional advisors and addressing issues proactively can improve the chances of preserving value for everyone involved. Choosing the right approach not only resolves the immediate problem but also helps maintain the borrower–lender relationship, which is a recurring theme throughout this guide.

Negotiation Methods for Borrowers and Lenders

When dealing with covenant breaches, successful workout negotiations require a strategic, collaborative approach. The aim is to move away from confrontation and find common ground that preserves value and strengthens relationships. When borrowers and lenders come to the table armed with solid data and realistic expectations, the chances of reaching a mutually beneficial outcome increase significantly.

Getting Ready for Negotiations

Preparation is everything when it comes to effective workout negotiations. Borrowers need to gather detailed financial documentation, such as recent financial statements, cash flow forecasts, and an explanation of what led to the covenant breach. This groundwork not only demonstrates responsibility but also builds credibility.

In addition to financial documentation, borrowers should develop alternative repayment plans and test their projections under different scenarios. This signals to lenders that the management team is taking the situation seriously and has carefully considered potential recovery paths. On the other side, lenders should conduct their own analysis of the borrower’s business viability and collateral value to assess their level of risk.

Professional advisors can play a critical role in these discussions. Restructuring consultants, accountants, and legal experts bring a level of objectivity that’s often hard to achieve in emotionally charged situations. They help steer conversations toward practical solutions rather than blame, ensuring that negotiations remain focused on facts.

Timing also matters. Borrowers who begin preparations at the first sign of trouble – not after receiving a default notice – demonstrate good faith and give both sides more time to explore creative solutions. Early action often sets the stage for smoother negotiations.

With thorough preparation and expert guidance, the focus can shift to refining the core terms of the workout.

Key Points for Discussion

One of the central aspects of negotiations is modifying covenants. Both parties need to agree on revised financial ratios that reflect the borrower’s current situation while still offering the lender adequate protection. This might involve adjusting debt-to-equity ratios, minimum cash reserves, or EBITDA thresholds to levels that are achievable for the borrower.

Interest rates are another common discussion point. Lenders may seek higher rates to compensate for increased risk, while borrowers often push for lower rates to ease cash flow pressures. The final agreement typically strikes a balance between the lender’s need for a return and the borrower’s ability to meet payment obligations.

Collateral arrangements may also need to be restructured. Lenders might request additional guarantees or security interests in previously unencumbered assets. Borrowers should be ready to negotiate what they can reasonably offer without jeopardizing their ability to operate effectively.

Clear repayment schedules are crucial. Options like extended amortization periods can reduce monthly payments, while balloon payments can defer principal repayment, giving the borrower time to stabilize. The goal is to align repayment terms with the borrower’s projected cash flow while reassuring the lender of eventual repayment.

Finally, both parties must agree on communication protocols and reporting requirements. Lenders often want more frequent updates during workout periods, but borrowers should negotiate terms that provide transparency without overwhelming their management teams with administrative tasks.

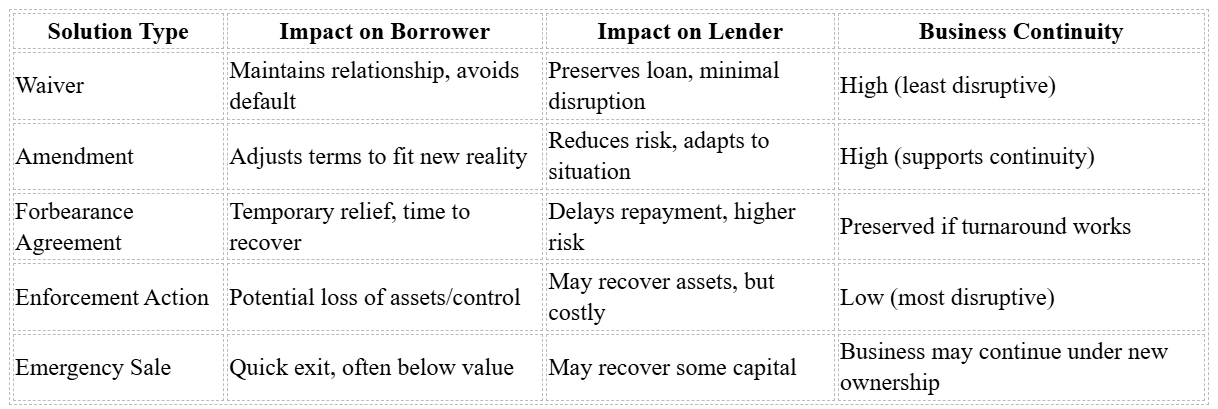

Comparing Workout Solutions

Each workout approach comes with its own set of trade-offs, and understanding these can help both parties identify the best path forward. Here’s a breakdown of common solutions:

Waivers are often the simplest solution for technical or temporary breaches. They allow borrowers to move forward without changing the loan’s core terms. However, lenders may require additional protections or fees to agree to a waiver.

Amendments, on the other hand, are more comprehensive. They adjust loan terms to reflect the borrower’s current challenges and can create a more sustainable structure. This approach works best when both parties believe in the borrower’s ability to recover.

Forbearance agreements provide temporary relief, giving borrowers time to stabilize while delaying repayment. However, they come with higher risks for lenders and require careful monitoring.

Enforcement actions are the last resort. While they give lenders maximum control, they often result in significant legal costs and business disruption. Even the threat of enforcement can push borrowers to engage more seriously in negotiations.

In cases where enforcement seems inevitable, platforms like Urgent Exits can connect borrowers with buyers and advisors specializing in distressed situations. These emergency sales, often completed in 4 to 12 weeks, can preserve more value than bankruptcy proceedings and offer quicker recovery for lenders.

Ultimately, the best outcomes arise when both parties recognize their shared goals. Lenders want their money back, and borrowers want to save their businesses. Achieving these goals requires a sustainable business model and debt terms that both sides can realistically support.

Using Platforms and Advisors for Distressed Businesses

When a business faces covenant violations, the stakes are incredibly high. The clock is ticking, and survival often hinges on how quickly and effectively the situation is managed. Traditional methods of finding advisors or buyers can take weeks – time that distressed businesses simply don’t have. This is where specialized platforms come into play, offering a lifeline by connecting businesses with the right expertise and resources in record time.

These platforms are designed to address the unique and urgent needs of distressed businesses. They bring together sellers, buyers, and advisors who specialize in navigating the complexities of covenant breaches, workout negotiations, and turnaround strategies.

Using Urgent Exits for Professional Support

Urgent Exits acts as a one-stop platform for businesses grappling with covenant violations. It connects borrowers with a network of seasoned professionals, including restructuring consultants, appraisers, legal experts, accountants, and more – each with a focus on distressed business scenarios.

For borrowers, this platform simplifies the daunting task of finding qualified help. Instead of spending precious time searching and vetting advisors, businesses can quickly access specialists who have proven experience in managing similar challenges. Whether the need is legal counsel to negotiate waivers, financial experts to prepare workout proposals, or consultants to craft turnaround strategies, Urgent Exits has it covered.

Here’s how it works: Borrowers list their business details, and the platform matches them with advisors who submit proposals tailored to their situation. This not only ensures that borrowers connect with professionals who understand their industry and financial challenges but also allows them to compare services and pricing before making a decision. The process is designed to be fast and efficient, bridging the gap between immediate advisory needs and long-term strategies.

Lenders also benefit from the platform. They can tap into the network to obtain independent assessments of a borrower’s restructuring plan or enlist third-party monitoring for compliance. This objective input helps lenders make better decisions about approving workout agreements or pursuing alternative actions.

Marketplace Solutions for Distressed Businesses

Urgent Exits isn’t just about connecting businesses with advisors – it also serves as a marketplace for distressed business transactions. When workout negotiations stall or a quick sale becomes the best option, the platform links sellers with buyers who specialize in distressed acquisitions.

Sales on the platform typically close within 4 to 12 weeks, offering a critical advantage in situations where time is of the essence. The buyer network includes private equity firms, family offices, and individual investors who are ready to act swiftly and have experience handling distressed deals.

For lenders, this marketplace can be a game-changer. Instead of navigating lengthy foreclosure proceedings, they can use the platform to facilitate a quick sale, often recovering more value than traditional enforcement methods. The transparent listing process also allows lenders to monitor buyer interest and engagement, providing real-time insights into market demand.

The platform supports every stage of the transaction. Direct communication tools enable buyers and sellers to negotiate terms without unnecessary delays. Buyers can filter listings to find opportunities that align with their investment goals, often at below-market prices reflecting the urgency of the sale.

Additionally, the platform offers a wealth of educational resources. These materials cover topics like valuing distressed businesses, navigating legal requirements, and crafting negotiation strategies. By equipping borrowers, lenders, and advisors with this knowledge, the platform empowers them to make smarter decisions throughout the process.

In distressed situations, assembling the right team quickly is often the difference between recovery and collapse. Urgent Exits understands this urgency and provides a centralized solution for accessing advisors, buyers, and investors. Whether a business needs expert guidance, emergency funding, or a complete sale, the platform ensures all the necessary tools are just a few clicks away.

Conclusion: Key Takeaways for Handling Covenant Violations

Dealing with covenant violations calls for quick action, clear communication, and strategic decision-making. The line between recovery and collapse often hinges on how promptly stakeholders address the issue and the quality of professional guidance they secure.

One critical step is early documentation – it’s the foundation of any successful resolution. Acting quickly is equally important. Delays can worsen the situation, narrowing the range of potential solutions.

Bringing in restructuring consultants, legal advisors, and financial experts early in the process can make a significant difference. These professionals not only provide valuable expertise but also help reassure lenders, creating a pathway for solutions that maximize value for everyone involved. Collaborative approaches often yield better results than punitive measures like liquidation or bankruptcy.

Flexibility is another key aspect. Negotiating forbearance agreements, waivers, or amendments can often lead to better outcomes than rigid enforcement actions. In some cases, emergency sales may preserve more value than traditional foreclosure methods, offering a quicker and more effective resolution. Specialized platforms, such as Urgent Exits, have become vital in these situations, facilitating fast sales – often within 4 to 12 weeks – when time is of the essence.

The post-pandemic rise in distressed business sales presents both challenges and opportunities. Buyers focusing on distressed assets are actively seeking undervalued businesses. While these sales often happen below market value, mechanisms like earn-outs and debtor warrants allow sellers to benefit from potential future recoveries. This approach strikes a balance between meeting immediate liquidity needs and preserving long-term value.

Ultimately, successful management of covenant violations depends on viewing the issue as a collaborative effort rather than a confrontation. Open communication, early engagement with qualified professionals, and the use of specialized platforms create a strong foundation for better outcomes. Together, these strategies act as a roadmap for navigating covenant violations effectively, ensuring stakeholders are positioned for success regardless of the resolution path chosen.

FAQs

What are the main reasons behind covenant violations, and how can businesses prevent them?

Covenant violations often stem from financial difficulties, such as shrinking revenue, unexpected costs, or cash flow problems. Operational hiccups, like project delays, or external pressures, such as market downturns or economic instability, can also play a role.

To stay ahead of these challenges, businesses should keep a close eye on their financial health and maintain transparent communication with lenders. Regularly reviewing loan agreements and fully understanding covenant terms can help spot potential red flags early on. If a violation seems imminent, it’s crucial to approach the lender promptly to explore options like adjusting terms or requesting temporary waivers to avoid further issues.

How can professional advisors help manage loan workouts and address covenant violations?

Professional advisors are essential when it comes to managing loan workouts and addressing covenant violations. Specialists like appraisers, lenders, consultants, accountants, lawyers, auctioneers, and liquidators lend their expertise to both borrowers and lenders during restructuring efforts.

These professionals help assess financial situations, negotiate terms, and ensure all legal and financial requirements are met. Their knowledge can simplify complex processes, reduce risks, and develop solutions that benefit everyone involved.

What are the benefits and challenges of using Urgent Exits to address distressed business situations?

Urgent Exits is a platform designed to help sellers of distressed businesses quickly connect with buyers. For sellers, it provides a quick and efficient way to exit tough situations, while buyers get access to businesses that may offer turnaround potential and growth opportunities.

Beyond just connecting buyers and sellers, the platform also links users with professionals like appraisers, lenders, and consultants who specialize in restructuring and other services. While the platform simplifies the process, it’s important for users to thoroughly evaluate each opportunity and consult with experts to make well-informed decisions.