In bankruptcy, intellectual property (IP) assets – like patents, trademarks, copyrights, and trade secrets – can significantly impact a company’s financial recovery. Proper valuation is critical to ensure fair distribution among creditors and maximize recovery. However, IP assets are challenging to assess due to their intangible nature and dependency on business operations.

Here’s a quick breakdown:

- IP Types: Patents (technology-driven, licensing potential), trademarks (brand recognition), copyrights (creative works), and trade secrets (confidentiality-dependent).

- Valuation Methods:

- Income Approach: Focuses on future income potential (e.g., royalties).

- Market Approach: Compares to recent sales of similar assets.

- Cost Approach: Estimates based on the cost to recreate the asset.

- Key Challenges: Incomplete records, legal disputes, market volatility, and time pressure in bankruptcy proceedings.

- Legal Framework: U.S. Bankruptcy Code (e.g., Section 365(n)) governs IP rights, with specific rules for owned vs. licensed assets.

- Best Practices: Engage expert appraisers, maintain detailed records, and use online marketplaces like Urgent Exits for faster transactions.

Accurate IP valuation during bankruptcy requires a structured approach, legal understanding, and expert input to navigate complexities and secure the best outcomes for creditors and stakeholders.

Legal Framework for IP Valuation in Bankruptcy

In this section, we dive into the legal framework that shapes how intellectual property (IP) is valued during bankruptcy. Since IP assets often hold significant value, understanding the laws that govern their treatment is essential for accurate assessment. The U.S. Bankruptcy Code lays out the rules for managing IP in bankruptcy, while federal and state laws determine how creditors are protected.

IP Treatment Under U.S. Bankruptcy Code

One of the key provisions in the U.S. Bankruptcy Code is Section 365(n), which directly addresses how executory contracts involving IP are handled during bankruptcy. This section allows licensees to retain their rights to use the IP, even if the debtor decides to reject the contract during bankruptcy proceedings. However, it’s important to note that Section 365(n) does not cover trademarks or foreign IP, which can complicate valuation efforts.

Additionally, Section 101(35A) defines what qualifies as intellectual property under bankruptcy law, including trade secrets, patents, copyrights, and trademarks. High-profile cases, such as Kodak’s 2012 bankruptcy, highlight the importance of these provisions, particularly when disputes arise over securing interests in patent portfolios.

Another critical aspect is the automatic stay provision in bankruptcy. This can temporarily halt IP infringement claims against the debtor while also treating the debtor’s own infringement claims as part of the bankruptcy estate.

Securing IP Rights and Creditor Protection

For creditors, ensuring their IP-related interests are secured is a top priority before and during bankruptcy. This often involves filing a UCC-1 financing statement with the appropriate state authority. For some types of IP, creditors may also need to record their interests with the United States Patent and Trademark Office (USPTO). Timing is everything – delays in perfecting these interests can lead to significant risks. For instance, in Nortel’s 2009–2011 bankruptcy, its patent portfolio fetched $4.5 billion, demonstrating the value of timely and strategic filings.

IP is frequently used as collateral in financing arrangements. In some cases, lenders may secure superpriority liens on these assets, which require court approval but provide enhanced creditor protection.

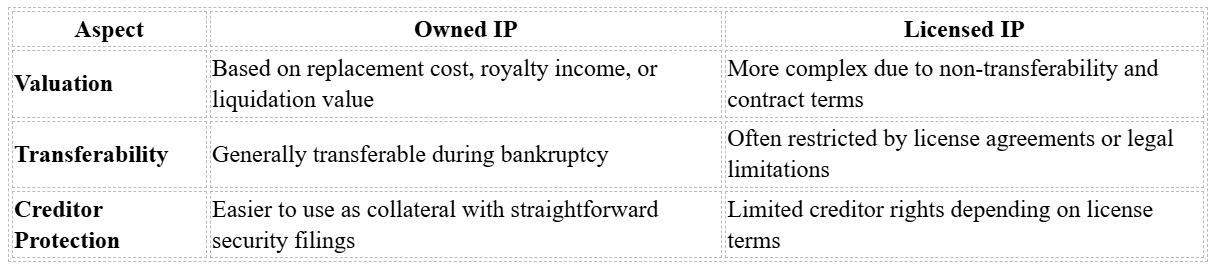

Owned vs. Licensed IP: Valuation Differences

The valuation of IP in bankruptcy varies significantly depending on whether the asset is owned outright or licensed. Owned IP is often easier to value and transfer, while licensed IP presents unique challenges due to contractual restrictions.

Licensed IP is subject to additional legal and contractual hurdles. For example, Section 365(n) protects licensee rights, potentially limiting the estate’s ability to terminate or transfer licenses. These restrictions often result in lower valuations for licensed IP compared to owned IP. Moreover, bankruptcy courts frequently rely on federal or state IP laws to resolve disputes over assets not explicitly covered by the Bankruptcy Code.

Bankruptcy trustees and creditors’ committees also play a crucial role in managing IP assets. They must often seek court approval for the sale or licensing of major IP assets.

As intangible assets become increasingly valuable, the legal framework surrounding IP in bankruptcy continues to evolve. A solid understanding of these laws is essential for accurately valuing and managing IP during bankruptcy proceedings.

Step-by-Step Guide to Valuing IP Assets

Valuing intellectual property (IP) during bankruptcy requires a structured approach that considers the unique nature of intangible assets and the challenges of distressed financial situations. This process involves three key steps, each building on the previous one to create valuations that can stand up to scrutiny from courts and creditors.

Step 1: Identify and Document IP Assets

The first step is creating a detailed inventory of all IP assets. This isn’t just about listing patents and trademarks – it means thoroughly identifying every intangible asset that might hold value for creditors.

Start by cataloging patents, trademarks, copyrights, trade secrets, and any related agreements. Review relevant documentation, such as patent and trademark registrations, licensing agreements, assignment records, and internal databases. This ensures a comprehensive understanding of the debtor’s IP portfolio.

Include input from key stakeholders like legal counsel, IP managers, and business unit leaders to verify ownership and uncover any hidden or complex licensing arrangements. Pay close attention to chain of title issues and any encumbrances, such as liens or claims against the assets. Reviewing UCC filings, security agreements, and prior assignments helps clarify what creditors can realistically claim.

Once all IP assets are identified and documented, the next step is selecting the appropriate valuation method.

Step 2: Choose Your Valuation Method

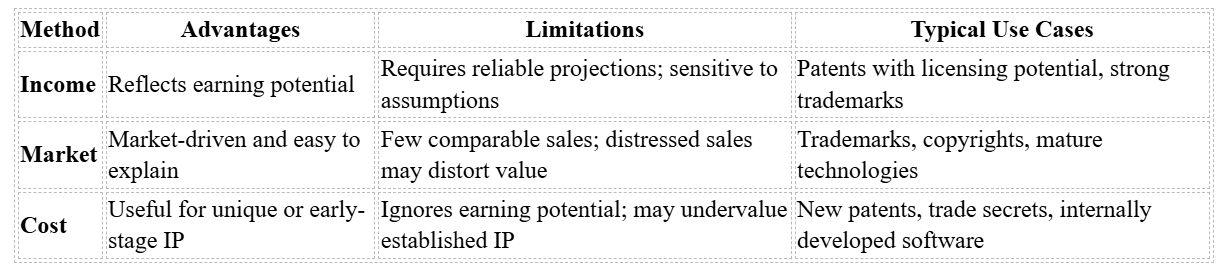

After documenting the IP portfolio, it’s time to determine the most suitable valuation method. In bankruptcy cases, methods must account for the distressed nature of the situation. Three primary approaches are commonly used:

- Income approach: Estimates value based on future income streams (e.g., royalties/licensing fees) discounted to their present value. This is ideal for IP generating consistent revenue.

- Market approach: Compares the IP to recent sales of similar assets. It provides market-based valuations that are straightforward to present to courts and creditors.

- Cost approach: Calculates value based on the cost to recreate or replace the asset. This is often used for unique or early-stage IP.

The choice of valuation method significantly impacts the outcome for creditors. Secured creditors, who have priority claims on specific assets, often benefit from higher valuations, especially when the income or market approach is applied. By contrast, unsecured creditors may receive less, particularly when conservative valuations or forced-sale discounts are used. For example, during the Kodak bankruptcy, secured creditors gained more from patent sales due to higher valuations, while unsecured creditors received less than anticipated.

In contentious bankruptcy proceedings, expert appraisals and third-party insights are invaluable. These professionals provide objective valuations, apply necessary adjustments, and can even serve as expert witnesses if disputes arise. For instance, during the Cengage Learning bankruptcy, valuation experts contributed to monetization strategies and offered testimony in court.

Once the valuation method is finalized, it’s critical to adjust the results for the realities of bankruptcy sales.

Step 3: Apply Bankruptcy-Specific Adjustments

The final step is adapting the base valuation to reflect the unique conditions of bankruptcy sales. These adjustments often lower the realizable value compared to standard valuations but are necessary to estimate actual recovery amounts.

- Forced-sale discounts: These typically range from 10% to 30% and account for the urgency and constrained timelines of bankruptcy sales. Unlike voluntary transactions, bankruptcy sales are under court-imposed deadlines that may not align with favorable market conditions.

- Marketability challenges: Buyers may hesitate to purchase IP from a bankrupt entity due to concerns about title issues, ongoing litigation, or the stability of licensing arrangements. These risks often lead to lower offers.

- Asset impairment: Financial distress or market shifts can erode the value of IP. For example, technology patents may lose value as the underlying technology becomes outdated, and trademarks can suffer if the brand’s reputation declines during bankruptcy.

Real-world cases illustrate these adjustments. In the Kodak bankruptcy, digital imaging patents were initially valued using the income approach, but the final sale price was reduced due to forced-sale discounts and market hesitancy. Similarly, during the Nortel bankruptcy, the patent portfolio’s value dropped by over 50% due to the urgency to sell and a lack of interested buyers.

Discounts on IP sales in bankruptcy can range from 30% to 70% below fair market value, depending on the circumstances. Documenting all assumptions, methodologies, and data sources used in these adjustments is essential for defending the valuation against creditor or court challenges and maintaining transparency throughout the process.

sbb-itb-84c8851

Common Challenges and Best Practices

Even with a structured approach to valuation, bankruptcy proceedings come with their own set of hurdles. Navigating these challenges while applying effective strategies can lead to more accurate valuations and better outcomes for everyone involved.

Typical Valuation Challenges

One of the biggest hurdles in IP valuation during bankruptcy is incomplete or outdated records. Many companies fail to maintain thorough documentation of their intellectual property (IP), including ownership details, licensing agreements, and chain of title records. This lack of clarity makes it harder to verify ownership and rights, which, in turn, reduces the appeal and value of these assets. For example, missing patent assignments or unclear licensing terms can scare off potential buyers or lead to legal disputes after the sale, further diminishing the assets’ worth.

Legal disputes also complicate valuations. Whether it’s disagreements over ownership, infringement claims, or contested licenses, these issues can drag out the valuation process and create uncertainty about the enforceability of the IP. In many cases, court intervention is required to resolve these disputes, which makes potential buyers wary of inheriting legal headaches along with the assets.

Another challenge is market volatility, especially in technology sectors. A patent tied to a fast-evolving industry can lose value quickly if the underlying technology becomes obsolete or if market demand shifts.

Encumbrances, such as liens or prior security interests, can also complicate the transfer of clear ownership. Delayed or incomplete filings of security interests can create confusion among creditors and slow down the bankruptcy process. When multiple creditors claim rights to the same IP, determining priority becomes a long and complex task, often reducing the recovery amounts.

Finally, the time pressure of bankruptcy proceedings adds another layer of difficulty. Unlike voluntary asset sales, bankruptcy operates on court-imposed deadlines, leaving little room for thorough due diligence or waiting for optimal market conditions. This urgency often leads to rushed valuations, and general bankruptcy professionals may lack the specialized knowledge needed to accurately assess IP assets.

To tackle these challenges, it’s essential to follow best practices that reduce risks and help maximize asset recoveries.

Best Practices for Accurate Valuation

Hiring experienced IP appraisers is a key step. These professionals not only bring technical expertise in valuing IP assets but also understand the unique demands of bankruptcy proceedings. Their objective valuations can withstand scrutiny from creditors and courts, making them an invaluable part of the process.

Keeping detailed, up-to-date records of all IP assets is another critical practice. This includes maintaining documentation for patents, trademarks, licensing agreements, assignments, and security interests. Regular audits can help identify valuable IP early and prevent oversights that might lower asset value later.

In the Montgomery Ward bankruptcy, professionals faced the challenge of valuing trademarks, brand names, and software licenses with incomplete documentation. By assembling a team of IP experts, conducting a thorough audit, and using market comparables, they successfully packaged and sold the assets, maximizing creditor recovery.

Collaborating with legal, restructuring, and industry experts is equally important. A multidisciplinary team can address potential issues – like title disputes or market timing – before they impact asset values. Legal advisors can resolve ownership conflicts, restructuring professionals can strategize sales, and industry experts can provide insights that improve valuation accuracy.

Perfecting security interests early simplifies the valuation process and protects creditor claims. Proper documentation from the start reduces confusion about ownership and creditor priority during bankruptcy proceedings.

Beyond these immediate steps, understanding the remaining life and overall value of an IP portfolio is crucial for accurate assessment.

Assessing Remaining Life and Portfolio Value

To fully gauge an asset’s worth, it’s important to evaluate its remaining useful life and the broader value of the portfolio.

Analyzing an asset’s remaining life involves looking at its legal duration (e.g., patent expiration), commercial relevance, and susceptibility to technological obsolescence. For instance, a patent with only a few years left before expiration is less valuable than one with a decade of enforceability. In fast-moving industries like artificial intelligence, a software patent might lose relevance long before its legal expiration, while pharmaceutical patents often retain value throughout their full term.

When valuing portfolios, it’s helpful to segment assets by type – such as patents, trademarks, or copyrights – and assess them individually before considering their combined value. This approach avoids overestimating the portfolio by allowing strong assets to overshadow weaker ones. It also supports better decision-making for sales.

Using a mix of valuation methods – like income, market, and cost approaches – helps ensure a balanced and accurate assessment of the portfolio. Some IP assets may work together to create greater value as a group, while others might be redundant or even conflict with each other. Identifying these dynamics is key to avoiding missteps in valuation.

Tailoring the valuation approach to the asset’s purpose – whether for internal use, licensing, or sale – further refines the process. For example, a patent portfolio with high internal use value might have limited licensing potential, which would affect how it’s marketed and priced during bankruptcy.

Lastly, conducting apportionment analyses ensures fair value allocation across diverse assets. This is especially important when different creditors hold claims to different types of IP within the same portfolio. Proper apportionment avoids arbitrary allocations and ensures creditors receive their fair share based on actual asset values.

Using Online Marketplaces for IP Asset Transactions

When intellectual property (IP) assets are part of bankruptcy proceedings, traditional sales methods often fall short in meeting the urgency these situations demand. Online marketplaces have stepped in as game-changers, offering a faster, more efficient way to connect sellers, buyers, and advisors. These platforms are reshaping how IP transactions are handled during bankruptcy, helping streamline the process and improve outcomes.

How Online Marketplaces Help

Online marketplaces serve as centralized hubs where sellers can list distressed IP assets, buyers can discover potential opportunities, and advisors can connect with clients who need specialized guidance. These platforms simplify communication, offer advanced search tools, and link users with professionals experienced in bankruptcy-related IP transactions. The speed of these platforms is especially valuable in bankruptcy cases, where time is often a luxury. Plus, by cutting out multiple intermediaries, transaction costs are lowered, and transparency is improved.

Unlike traditional sales methods that might take months to find qualified buyers, online marketplaces can showcase IP assets to a wide audience within days. This quick exposure is crucial when court-imposed deadlines are tight. Additionally, the network effect of these platforms draws in specialized buyers who actively seek undervalued IP assets. This targeted audience gives sellers access to a pool of buyers who understand the unique value of distressed IP. Platforms like Urgent Exits are a prime example of how these digital tools are transforming IP asset sales.

Urgent Exits Features and Benefits

Urgent Exits is a dedicated online marketplace tailored for distressed businesses, making it an ideal platform for bankruptcy-related IP transactions. It brings together three essential groups: sellers who need to act quickly, buyers looking for undervalued IP opportunities, and advisors with expertise in restructuring and bankruptcy.

For sellers, Urgent Exits offers a simple, user-friendly interface that allows them to list distressed IP assets in just minutes. This speed is critical in bankruptcy scenarios, where quick action is often required. Sellers can also track performance metrics like buyer views and saves, providing real-time insights into market interest. Direct communication with serious buyers and access to specialized advisors further enhances the selling process.

Buyers benefit from tools like targeted search options and advanced filters, which make it easier to find undervalued IP assets that meet their specific needs. With new listings added daily, buyers can save promising opportunities and streamline due diligence and negotiations by working directly with verified sellers.

Advisors, including appraisers, restructuring experts, and bankruptcy attorneys, also gain valuable opportunities through Urgent Exits. The platform connects them with motivated clients, enabling them to assist in properly identifying, valuing, and transferring IP assets in compliance with U.S. Bankruptcy Code requirements. Additionally, the platform’s analytical tools support better decision-making for all parties involved .

Key Takeaways for IP Valuation in Bankruptcy

Here’s a breakdown of the most important points to consider when valuing intellectual property (IP) during bankruptcy proceedings:

Understand the legal landscape. The U.S. Bankruptcy Code plays a central role in determining how IP assets are handled. A key distinction lies between owned and licensed IP, as this can significantly affect how valuations are approached. Additionally, ensuring security interests are properly perfected – such as through UCC-1 financing statements – is crucial. Without this step, disputes can arise, potentially diminishing the overall value of the assets.

Use multiple valuation methods. The income, market, and cost approaches each offer valuable perspectives, but in bankruptcy scenarios, adjustments are often necessary. For example, higher discount rates account for the uncertainty of distressed sales, while shorter timeframes reflect the urgency of the situation. When market data is scarce, creative solutions become essential. Combining these methods helps provide a more accurate valuation and strengthens your position in the face of court or creditor scrutiny .

Act early and document everything. Start by keeping detailed records and bringing in skilled appraisers as soon as possible. Delays can erode asset value, so early action is key. With intangible assets now making up over 84% of the S&P 500’s value – compared to just 17% in 1975 – thorough documentation has never been more important .

Leverage technology for efficiency. Platforms like Urgent Exits are reshaping how distressed IP is bought and sold. These online marketplaces connect sellers with specialized buyers quickly, offering transparency and speed that traditional methods often lack. When court-imposed deadlines loom, the ability to list assets and monitor buyer interest in real time can significantly affect sale outcomes.

Bring in the experts. Working with experienced appraisers and staying proactive in communication with all parties can turn undervalued IP into meaningful recoveries for creditors. Understanding the unique risks tied to bankruptcy is just as important as leveraging the right expertise.

At the heart of it all, these principles matter most: precision drives value, legal compliance safeguards interests, and strategic use of tools and expertise ensures the best possible results for everyone involved.

FAQs

How do different methods for valuing intellectual property (IP) assets affect creditor outcomes during bankruptcy?

Valuing intellectual property (IP) assets during bankruptcy plays a key role in determining how creditors recover their claims. The method chosen for valuation can lead to different outcomes, as it depends heavily on the type of IP and the current market environment.

Three common approaches are used: income, market, and cost. The income approach focuses on the future revenue the IP is likely to generate, making it a solid choice for assets with steady earning potential. The market approach looks at comparable IP assets that have recently been sold, offering a snapshot of current market demand. On the other hand, the cost approach calculates what it would take to recreate the asset, making it particularly useful for one-of-a-kind or highly specialized IP.

Picking the right method is critical. It ensures the valuation is fair, helps creditors recover as much as possible, and keeps the bankruptcy process transparent.

What legal challenges arise when valuing licensed versus owned intellectual property during bankruptcy?

Valuing licensed intellectual property (IP) in a bankruptcy scenario can be tricky. Unlike owned IP, which comes with straightforward ownership rights, licensed IP is tied to contractual obligations that can complicate its valuation. These agreements often include terms like royalty rates, exclusivity clauses, and termination conditions – all of which can influence the perceived worth of the IP. On top of that, bankruptcy laws can create unique challenges, as the rights of licensors and licensees may vary, potentially sparking disputes or imposing restrictions on transferring the license.

Owned IP, while simpler to evaluate in some respects, isn’t without its own challenges. Factors like current market demand, risks of infringement, and the remaining useful life of the IP still need to be carefully assessed. Whether dealing with licensed or owned IP, enlisting the help of skilled appraisers and legal experts is essential to arrive at an accurate and fair valuation during the bankruptcy process.

How can platforms like Urgent Exits simplify the process of selling intellectual property assets during bankruptcy?

Urgent Exits simplifies the sale of intellectual property (IP) assets during bankruptcy by offering a specialized marketplace tailored for distressed businesses. It allows sellers to list their IP assets quickly, putting them in front of a focused audience of buyers actively looking for valuable opportunities at competitive prices.

Beyond the marketplace, the platform connects sellers with seasoned professionals – appraisers, lawyers, and auctioneers – who provide expert guidance on valuing and marketing IP assets. This blend of resources and expert support helps sellers get the most out of their assets while reducing delays and complications in the bankruptcy process.