Distressed M&A deals are fast-moving acquisitions involving companies under financial pressure. These transactions allow buyers to purchase assets or businesses at discounted prices but come with unique risks and challenges. Here’s what you need to know:

- What defines distressed M&A: Companies facing financial hardship sell assets or entire businesses to avoid bankruptcy or closure. These deals often operate on tight deadlines.

- Why companies become distressed: Common causes include operational missteps, excessive debt, economic downturns, or industry shifts.

- Why buyers pursue these deals: Buyers can acquire undervalued assets, expand market reach, or find turnaround opportunities.

- Key risks and considerations: Buyers must evaluate whether financial issues are temporary or permanent, assess liabilities, and navigate complex legal frameworks like Section 363 bankruptcy sales.

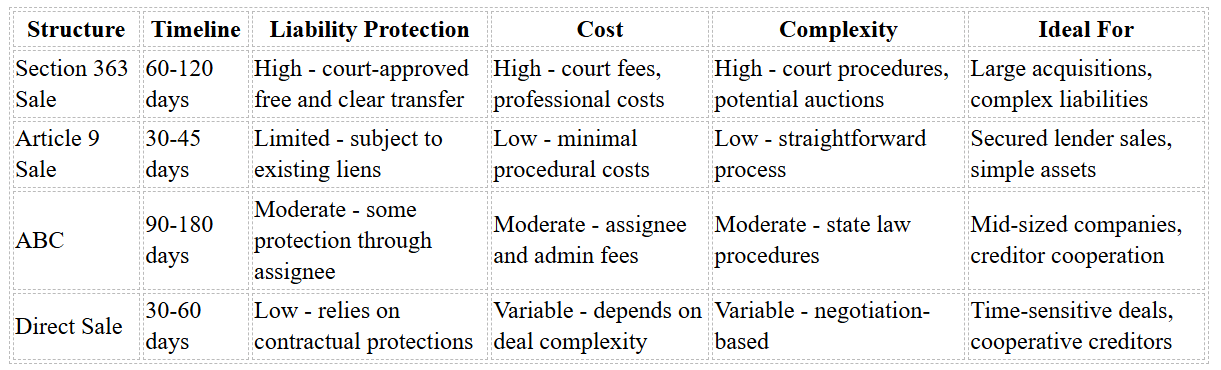

- Deal structures: Options include court-supervised bankruptcy sales, Article 9 foreclosures, assignments for the benefit of creditors (ABCs), or direct negotiated sales.

- Due diligence: Focus on financial health, customer retention, employee stability, debt structure, and potential liabilities. Act quickly but thoroughly.

- Post-acquisition: Success depends on immediate stabilization, addressing root problems, and deciding between a full turnaround or asset liquidation.

Distressed M&A deals require speed, expertise, and careful risk management. Buyers who prepare effectively and act decisively can capitalize on these opportunities while minimizing potential downsides.

Assessing distressed businesses requires a unique approach compared to traditional mergers and acquisitions. The urgency of financial difficulties and tight timelines create distinct challenges – but for buyers who can act quickly, they also present opportunities to identify businesses with turnaround potential versus those that might be beyond recovery.

The evaluation process boils down to three key questions: What caused the distress? Can the problems be solved? And is the remaining value worth the investment and associated risks? Let’s explore these aspects in more detail.

Identifying the Root Causes of Financial Distress

Cash flow issues can often obscure deeper problems, making it essential to dig into the root causes of a company’s struggles. The first step is understanding whether the distress stems from short-term market disruptions or more fundamental flaws in the business. For instance, a manufacturing company facing supply chain setbacks would need a completely different solution than one struggling due to outdated technology.

Operational inefficiencies, like excessive overhead or poor inventory management, might be addressed through strategic restructuring – provided the company has the right resources and leadership in place. Debt analysis is equally critical. A business with solid operations but an unmanageable debt load could benefit from financial restructuring. On the other hand, a company grappling with both operational and financial challenges may face a much steeper road to recovery. Additionally, a loss of market position – such as declining customer retention – can point to deeper, systemic issues.

Once the root causes are clear, the next step is determining whether the problems are fixable or indicative of a permanent decline.

Temporary Problems vs. Permanent Decline

One of the most important distinctions to make is whether the distress is temporary or signals a terminal decline. Temporary issues often involve solvable operational challenges, manageable debt, or short-term market downturns. In such cases, the company may still hold onto its core strengths, such as competitive advantages and loyal customer relationships. Debt restructuring – like negotiating better interest rates or extending repayment terms – can also indicate that creditors and stakeholders see potential in the business.

However, permanent decline is a different story. When a company’s business model becomes obsolete, it loses market share irreversibly, or the industry undergoes structural changes that eliminate demand for its products or services, recovery becomes far less likely. Understanding industry trends is critical here. A setback in one sector might just be a temporary hurdle, while in another, it could signal the end of the road.

Key indicators of turnaround potential include strong leadership, effective customer retention strategies, and a clear recovery plan with measurable milestones. On the flip side, vague strategies or overly optimistic projections often hint at problems too entrenched to fix.

Understanding Transaction Structures

The legal framework you choose can make all the difference in a distressed M&A deal. Unlike standard acquisitions, distressed transactions often involve companies grappling with bankruptcy or teetering on the edge of insolvency. Each structure comes with its own timelines, liability protections, and procedural requirements, all of which can significantly influence your risk exposure and the likelihood of closing the deal.

The key consideration here is whether the distressed company has already filed for bankruptcy or is still operating outside of court oversight. This distinction affects everything – from how quickly the deal can close to the liabilities you might inherit as the buyer. Let’s break down the main transaction structures, starting with court-supervised Section 363 sales.

Section 363 Bankruptcy Sales

When a company files for Chapter 11 bankruptcy, Section 363 of the U.S. Bankruptcy Code becomes the primary tool for selling assets. This court-supervised process offers strong liability protection but requires navigating federal bankruptcy procedures.

The process begins when the debtor company (or sometimes its creditors) files a motion with the bankruptcy court to sell assets. The court must approve the sale, ensuring a "free and clear" transfer of assets. This means you acquire the assets without most of the seller’s existing liabilities, liens, or encumbrances – a level of protection that’s hard to achieve with other transaction types.

However, the Section 363 process isn’t quick. It typically takes 60 to 120 days, factoring in mandatory creditor notices, potential objections, and auctions if multiple bidders are involved. While auctions can drive up the purchase price, they also ensure legal legitimacy. Additionally, the court may require a "stalking horse" bidder to set a baseline price and terms, which can complicate things if you’re not the initial bidder.

One major advantage of Section 363 sales is the certainty they provide. Once the court approves the sale and the appeal period (usually 14 days) expires, the transaction is tough to undo. This legal finality is especially valuable when acquiring distressed assets that might otherwise face ongoing litigation or creditor disputes.

Out-of-Court Sale Options

Not every distressed deal goes through bankruptcy court. Many companies pursue out-of-court restructurings, which can be faster and less costly but often come with reduced liability protections.

- Article 9 Sales: Under the Uniform Commercial Code, lenders can foreclose on collateral when a company defaults on secured debt. These sales are quick – often completed in 30 to 45 days – and don’t involve court approval. However, buyers typically acquire assets subject to existing liens and may inherit liabilities that would be avoided in a Section 363 sale.

- Assignments for the Benefit of Creditors (ABCs): This approach strikes a balance between bankruptcy and direct sales. In an ABC, the distressed company assigns its assets to an independent assignee who liquidates them for creditor repayment. While less complex and costly than bankruptcy, ABCs still provide some creditor protection. Popular in states like California, this process can take 90 to 180 days.

- Direct Negotiated Sales: These are the fastest option, often completed in 30 to 60 days, but they require careful structuring to limit liability exposure. Direct sales involve negotiations between the seller and buyer, often with creditor consent. While speed is a clear advantage, the lack of court approval increases risks, including potential creditor challenges or claims of fraudulent transfer.

Comparing Different Sale Structures

Each transaction structure has its own strengths and weaknesses. Here’s a comparison to help you decide which might work best for your deal:

Timelines often dictate the choice of structure. For companies burning through cash or losing customers rapidly, the speed of a direct sale may outweigh the liability protections of a Section 363 process. On the other hand, if the target has environmental liabilities, product liability issues, or a complex debt structure, the additional time for a court-supervised sale may be worth it.

Costs also vary widely. Section 363 sales often involve significant fees for attorneys, financial advisors, and court-appointed professionals – ranging from $500,000 to $2 million or more for complex deals. Direct sales may involve lower professional fees but could require higher purchase prices to secure creditor cooperation or more extensive contractual protections to address liability concerns.

Finally, certainty is a critical factor. Section 363 sales provide the highest level of finality, making them appealing for buyers looking to avoid post-closing disputes. Out-of-court transactions, while faster, carry higher risks of creditor challenges or claims of improper valuation.

Ultimately, the right structure depends on the seller’s circumstances and your acquisition goals. Companies already in bankruptcy will lean toward Section 363 sales, while those seeking to avoid the stigma of bankruptcy may prefer out-of-court options. By understanding these structural differences, you can negotiate more effectively and steer clear of unexpected challenges during the transaction.

Fast-Track Due Diligence Process

Traditional due diligence typically takes 90–180 days, but distressed transactions often shrink this window to just 30 to 60 days. Whether it’s due to a company’s worsening financial health, competitive pressures, or court-imposed deadlines, there’s little time to scrutinize every detail. Instead, you need a targeted and efficient approach to uncover deal-breaking risks while still gathering critical insights.

Priority Areas for Due Diligence Review

When time is limited, focus on the areas that pose the biggest risks to your investment or could drastically alter the deal’s financial outlook.

Start with the financial condition and cash flow. Understand how much cash the company is burning each month and whether it can stay afloat until the deal closes. Request daily cash flow reports for the last 90 days and weekly projections for the next 60 days. Look for unusual cash outflows, rising burn rates, or emergency cost-cutting measures already in play. Verify whether current liquidity is enough to meet the company’s immediate operational needs.

Next, assess customer relationships and revenue stability. In distressed situations, customers often leave at the first sign of trouble, worried about service disruptions or warranty issues. Analyze customer concentration, churn rates, and contract terms that allow early termination. Pay particular attention to the top 10 customers – losing even one could accelerate the company’s decline.

Employee retention and key personnel are critical for any turnaround. Distressed companies often see valuable employees leave due to job security concerns. Identify key team members and check whether retention agreements or change-of-control clauses are in place. Review compliance with the WARN Act, as mass layoffs require 60 days’ notice and can create costly liabilities if mishandled.

Outstanding litigation and contingent liabilities can derail a deal entirely. Focus on legal cases where potential damages exceed $100,000 or where injunctions could disrupt operations. Pay special attention to environmental liabilities, as these often survive asset purchases and cannot be discharged in bankruptcy.

Lastly, evaluate the debt structure and creditor relationships. Map out all secured and unsecured debt, including any cross-default clauses that could trigger early repayment demands. Understanding creditor priorities will help you determine whether the purchase price leaves enough value for creditors to support the transaction.

Warning Signs That Should Stop a Deal

Certain red flags are so severe that they should make you walk away, no matter how tempting the deal might seem. Identifying these deal killers early can save you from costly mistakes.

Fraudulent transfer risks are a major concern. If the company has made significant payments to insiders, shareholders, or related entities within the past two years, those transactions could be reversed by a bankruptcy trustee or creditors. Watch for unusual dividends, management bonuses, asset transfers, or shareholder payments made while the company was insolvent.

Major customer defections are another red flag. If the company has lost more than 25% of its revenue in the past six months or if its largest customers have already terminated contracts, the remaining business may not be viable. Customer losses often snowball once word spreads about financial instability.

Environmental contamination or regulatory violations can lead to liabilities far exceeding the purchase price. Cleanup costs can run into millions and often cannot be discharged in bankruptcy. If environmental assessments uncover contamination or if the company faces enforcement actions from the EPA or state agencies, the risks may outweigh the potential benefits.

Ongoing criminal or regulatory actions can also make a deal untenable. If the company or its leadership is facing criminal charges, regulatory sanctions, or license revocations, the business may not survive, no matter your turnaround efforts.

Finally, deteriorating operational metrics may indicate a company in terminal decline. Consistently shrinking gross margins, loss of market share, or a lack of stabilization in key metrics could mean you’re acquiring a fundamentally broken business – not one that’s temporarily distressed.

Using Advisors for Efficient Due Diligence

Given the need for speed, involving experienced advisors can streamline your due diligence process. General corporate advisors without distressed M&A experience may waste time getting up to speed and overlook critical issues that specialized professionals would catch immediately.

Bankruptcy and restructuring lawyers are invaluable for navigating the complexities of distressed deals. They’re well-versed in fraudulent transfer laws, preference payment risks, and bankruptcy protections. A skilled bankruptcy attorney can quickly assess the debtor’s exposure to preference claims, whereas a general corporate lawyer may take days to do the same.

Restructuring consultants and turnaround professionals are experts at diagnosing operational problems and finding quick cash flow improvements. With experience across numerous distressed companies, they can benchmark performance against industry standards and pinpoint whether the issues are fixable or indicate deeper flaws in the business model.

Industry-specific experts bring targeted insights that general advisors may lack. For instance, a manufacturing consultant can evaluate equipment conditions, supply chain risks, and operational efficiencies much faster. Similarly, they can provide rapid market intelligence and competitive analysis that would take weeks to develop internally.

Environmental consultants and technical specialists are essential if the business involves manufacturing, chemicals, or real estate. A Phase I environmental assessment can often be completed in 5 to 10 days, giving you an early warning about contamination risks and allowing you to adjust the deal structure or pricing if necessary.

To manage multiple advisors effectively, ensure clear communication and role definitions. Use daily check-ins, shared document repositories, and clearly outline each advisor’s deliverables and deadlines. While this coordination requires upfront effort, it eliminates duplicated work and ensures no critical detail is missed.

Though advisor fees may seem high, they’re a small price to pay for mitigating risks. Spending $100,000 on thorough due diligence is far cheaper than the financial fallout of acquiring a company with hidden liabilities or unresolvable problems. In distressed M&A deals, a well-executed fast-track due diligence process is essential for minimizing risk and setting the stage for a successful turnaround.

Deal Structure and Negotiation Tactics

Distressed deals come with unique challenges, especially when sellers are under severe liquidity pressure and unable to offer full warranties. To navigate these complexities, buyers need to adopt faster, risk-conscious strategies and alternative protections. Let’s break down the key aspects of these transactions, including payment terms, warranty limitations, and how buyer protections differ from traditional deals.

Payment Terms and Pricing Structures

In distressed transactions, cash payments are often preferred because they address the seller’s urgent need for liquidity. However, in bankruptcy sales, court oversight of proceeds can limit flexibility in how payments are structured.

Pricing in these deals tends to reflect discounts, but those lower prices come with potential risks, such as hidden liabilities. To mitigate these risks, buyers may need to provide substantial upfront deposits or agree to break-up fees. In cases where assets are auctioned through court-supervised processes, competitive bidding can drive up the final price, adding another layer of complexity.

Buyer Protections When Warranties Are Limited

When sellers can’t offer full warranties, buyers must rely on other methods to safeguard their investment. One common approach is the use of escrow accounts, where a portion of the purchase price is held temporarily to cover any liabilities or misrepresentations discovered after closing.

Warranty insurance is another option, though it tends to be more expensive and comes with additional exclusions in distressed deals. Buyers also frequently negotiate for an exclusive period of due diligence, which allows them to reassess the deal or withdraw altogether if unfavorable conditions arise.

Choosing an asset purchase structure over a stock purchase can help limit exposure to liabilities. In distressed deals, warranty periods are typically shorter than in traditional transactions, so buyers must act quickly if issues surface. Indemnification provisions, like caps and deductibles, are often customized to reflect the seller’s limited ability to provide comprehensive protections.

Buyer Protections: Distressed vs. Normal M&A

Distressed transactions demand a different approach compared to standard M&A deals. Shorter timelines mean warranty periods are more limited, and indemnification provisions are less robust, making swift and thorough due diligence essential.

Ultimately, success in distressed M&A depends on strategic deal structuring and creative ways to manage risk. These tailored negotiation tactics not only address the unique challenges of distressed transactions but also set the foundation for smoother post-acquisition operations.

Post-Acquisition Turnaround Management

After the deal is finalized, the real work begins. The post-acquisition phase requires immediate and decisive action to stabilize the business and address the issues identified during due diligence. Time is of the essence, as delays can lead to further operational decline. Success hinges on directly tackling the root causes of distress while building momentum for recovery.

First 90 Days Action Plan

The first three months are critical in shaping the trajectory of a turnaround. The focus should be on improving cash flow right away. This could mean cutting non-essential expenses, speeding up collections, and concentrating resources on the most profitable areas of the business.

Realigning the workforce is another priority. Retain top talent by offering incentives and replace underperformers to strengthen leadership from the get-go. Establish clear performance benchmarks and accountability to ensure everyone is aligned with the recovery goals.

Reassuring key stakeholders – like customers and suppliers – is equally important. Renegotiate payment terms, confirm the continuity of services, and address any concerns about the business’s future. This is especially crucial because distressed companies often face skepticism, and new ownership needs to demonstrate stability and commitment.

A detailed turnaround plan with clear deadlines and responsibilities is essential. Avoid spreading resources thin by focusing on the primary issues causing financial distress. Once the initial stabilization is achieved, evaluate whether to pursue a full turnaround or explore asset liquidation.

Turnaround Strategy vs. Asset Liquidation

Not every distressed acquisition can be saved. The structure of the deal often determines whether a turnaround is feasible. Buyers must assess whether the business has the potential for recovery or if liquidating assets would yield better returns. This decision hinges on factors like market conditions, the availability of skilled management, and the capital required for rehabilitation.

Turnaround strategies work best when the core business model is still sound but has been derailed by operational problems. This approach often requires investments in working capital, better management systems, or even new technology. Buyers pursuing this path need both the financial resources and operational expertise to execute the plan effectively.

On the other hand, asset liquidation might be the best option for businesses in irreversible decline or where the cost of rehabilitation outweighs the potential benefits. In these cases, the focus shifts to maximizing the value of assets like intellectual property, customer lists, or real estate. Making this decision early is critical, as each path demands different resources and management approaches.

Once a strategy is chosen, continuous monitoring of performance becomes essential.

Tracking Performance and Success Metrics

Measuring progress through key performance indicators (KPIs) is vital during a turnaround. Cash flow improvement is often the most telling metric, as it directly reflects the business’s ability to sustain itself and invest in growth.

"Success of a turnaround strategy is gauged through Financial, Operational, and Market-Driven KPIs like Revenue Growth, Profit Margins, Cash Flow, Inventory Turnover, Customer Satisfaction, and Market Share, aligning with strategic goals for sustainable growth."

– Flevy Management Insights Q&A

Customer retention rates can reveal how well the business is managing relationships and rebuilding trust. A high churn rate early on might indicate deeper issues that need immediate attention. Similarly, tracking employee turnover can show whether workforce stability is improving or if additional retention efforts are needed.

Operational metrics like inventory turnover and production efficiency often show signs of improvement before financial results do. These early indicators help gauge whether the turnaround is on track. McKinsey research highlights cash generation and profit margins as two of the most critical metrics for measuring turnaround success. Regularly reviewing these indicators allows for timely adjustments to the strategy.

Financial forecasting is another crucial element. Buyers should create detailed business plans that estimate cash flow and assess whether the investment will meet acceptable return thresholds. These forecasts help determine whether additional capital is needed or if the strategy requires modification.

Legal Risks and Compliance Requirements

After employing tailored negotiation strategies, buyers must now navigate distinct legal challenges to safeguard their investments. Distressed M&A transactions come with unique legal risks that don’t typically arise in traditional deals. The seller’s financial distress can expose buyers to potential litigation and unforeseen liabilities. Addressing these risks with the right legal strategies is crucial for a successful acquisition.

Fraudulent Transfer and Successor Liability Risks

Fraudulent transfer claims are a major concern in distressed M&A deals. Creditors may argue that the sale was designed to hinder debt collection. Under both federal bankruptcy law and state fraudulent transfer statutes, courts can reverse transactions deemed fraudulent – especially when assets are sold at a price far below market value or when the seller doesn’t receive reasonably equivalent value in return. Courts often evaluate whether the seller was insolvent at the time of the transaction or if the deal left them with insufficient capital. Even buyers acting in good faith can face clawback actions.

Successor liability is another critical issue. This legal principle can make buyers responsible for the seller’s debts and obligations, even in asset purchase deals. The risk varies by jurisdiction, but factors like continuing the seller’s operations, retaining key employees, or maintaining customer relationships can trigger successor liability.

To reduce these risks, buyers should ensure the purchase price aligns with fair market value by using professional appraisals. A solvency opinion from a financial expert can also demonstrate that the seller remained solvent after the transaction. Opting for court-supervised bankruptcy sales can provide stronger legal protections compared to out-of-court deals. These steps highlight the importance of a sound legal framework, which we’ll explore further under Bankruptcy Code Protections.

Bankruptcy Code Protections and Court Approval

The U.S. Bankruptcy Code offers critical protections for buyers in court-approved sales under Section 363. These transactions allow assets to be transferred "free and clear" of most liens, claims, or encumbrances, giving buyers a clean slate. However, court approval requires adherence to strict procedures that safeguard creditor rights. For instance, the debtor must prove that the sale benefits the estate, and creditors must be notified and given a chance to object. An auction process or evidence that the sale price reflects fair value is typically required.

The Bankruptcy Code also includes provisions to protect good faith purchasers, reducing the chances of a completed sale being overturned. Additionally, the automatic stay provisions shield buyers from creditor collection actions during the bankruptcy case, providing valuable time for due diligence and closing the deal.

WARN Act and Bulk Sales Law Compliance

The Worker Adjustment and Retraining Notification (WARN) Act imposes obligations on employers with 100 or more employees to provide 60 days’ advance notice before plant closures or mass layoffs. In distressed M&A transactions, both buyers and sellers must assess potential WARN Act liabilities early in the due diligence process.

The WARN Act defines a mass layoff as one affecting at least 50 employees at a single location, provided they make up at least 33% of the workforce. Plant closures lasting over six months also trigger WARN requirements. Failure to comply with the Act can lead to steep penalties, making it essential for buyers to evaluate these liabilities and include related compliance costs in their planning.

State bulk sales laws add another layer of complexity. These laws, based on the Uniform Commercial Code, require notifying creditors before selling a significant portion of a business’s inventory outside regular operations. While many states have repealed these laws, they remain in effect in places like California, Maryland, and Georgia. Noncompliance can result in transfers being voided for certain creditors, leaving buyers exposed to additional claims. To manage these risks, buyers may need to compile creditor lists, send notices, or hold proceeds in escrow.

Leveraging court-approved bankruptcy sales and clearly assigning responsibilities are key strategies to minimize risks. Engaging experienced legal counsel early in the process is essential to identify potential issues and implement effective solutions. Aligning compliance efforts with a strong legal strategy can significantly reduce acquisition risks.

Key Success Factors for Distressed M&A

When it comes to distressed M&A deals, preparation isn’t just important – it’s the foundation of success. Unlike traditional acquisitions, these deals operate on tight schedules, sparse information, and elevated risks. To succeed, buyers need to combine preparation, speed, and expertise seamlessly.

Preparation is Non-Negotiable

In distressed situations, buyers who plan ahead have a clear edge. Securing capital early – whether through credit lines, cash reserves, or reliable partners – can make all the difference in competitive scenarios. When opportunities arise, there’s no time to debate investment strategies or return expectations. Setting acquisition criteria in advance ensures swift decision-making when the clock is ticking. Once the groundwork is laid, the next step is assembling a team of specialists.

Build a Team of Experts

Distressed transactions are complex, so having the right professionals on hand is crucial. Experienced M&A attorneys, forensic accountants, and industry experts bring the skills needed to handle the unique challenges of these deals. From navigating intricate bankruptcy procedures to conducting fast-paced due diligence, these specialists are indispensable when time and precision are critical.

Speed Without Sacrificing Quality

Acting quickly doesn’t mean cutting corners. Successful buyers rely on standardized processes, like due diligence checklists and decision frameworks, to streamline their efforts. These tools allow teams to focus on the specifics of each deal without wasting time reinventing workflows. The goal is to make informed decisions swiftly, while maintaining a thorough analysis of the risks and opportunities.

Flexibility in Deal Structures

Distressed M&A often requires buyers to adapt to the seller’s constraints. Unlike traditional deals, where terms are heavily negotiated, distressed transactions may involve limited warranties, unconventional payment terms, or unique closing conditions. Buyers who can craft creative solutions while safeguarding their interests tend to perform better than those who stick to rigid demands.

Early Post-Closing Planning

Integration planning shouldn’t wait until after the deal closes – it needs to start during due diligence. The first 90 days post-closing are critical for stabilizing a distressed acquisition. Smart buyers develop detailed plans for integration and turnaround early, focusing on retaining key employees, implementing operational improvements, and prioritizing essential vendor relationships. This proactive approach builds on the risk assessments conducted during the deal phase.

Risk Tolerance and Contingency Planning

Distressed acquisitions come with inherent uncertainties, and unexpected challenges often arise after the deal is done. Buyers who excel in this space maintain robust capital reserves and operational flexibility to address surprises. They also incorporate contingencies into their financial projections and prepare backup plans for various scenarios.

Ultimately, success in distressed M&A requires treating these transactions as their own discipline. The compressed timelines and heightened risks demand a level of preparation and execution that goes beyond the norm. Buyers who dedicate the right resources and expertise to this process are the ones who thrive.

FAQs

What are the key benefits and drawbacks of using Section 363 bankruptcy sales in distressed M&A transactions?

Section 363 bankruptcy sales come with several important advantages for distressed M&A transactions. One major benefit is that buyers can acquire assets free and clear of liens, claims, and other encumbrances. This ensures a clean transfer and reduces the risk of inheriting unwanted liabilities. On top of that, these sales often present opportunities to purchase assets at potentially lower prices due to the distressed circumstances surrounding the deal.

That said, there are some challenges to keep in mind. The auction process can be unpredictable, with the possibility of overbidding or losing out to competing buyers. Additionally, navigating the formal bankruptcy procedures can be both time-consuming and expensive. It requires detailed planning and close collaboration with legal and financial advisors. Even with these hurdles, Section 363 sales remain an effective way to acquire distressed assets with a high degree of security and efficiency.

What steps can buyers take to reduce the risks of successor liability and fraudulent transfer claims in distressed M&A deals?

When aiming to minimize the risks tied to successor liability, it’s wise for buyers to establish a single-purpose entity. This approach helps separate the acquired assets from any lingering obligations of the distressed business. Additionally, conducting thorough due diligence is key to identifying and addressing any hidden liabilities before finalizing the deal.

In the case of fraudulent transfer claims, ensuring that transactions reflect fair market value or provide "reasonably equivalent value" is critical. Transfers that seem undervalued could face challenges under state laws or the Bankruptcy Code. To navigate these complexities, it’s essential to carefully structure the transaction and seek guidance from seasoned legal professionals to reduce potential risks.

What are the key steps to take in the first 90 days after acquiring a distressed business to ensure a successful turnaround?

In the first 90 days of taking over a distressed business, your main focus should be on stabilizing its core operations and tackling urgent challenges. Begin by diving into the company’s cash flow to understand where money is coming in and going out. Pinpoint operational inefficiencies that could be draining resources, and work on building trust with key stakeholders – this includes employees, customers, and suppliers.

After that, take a close look at the management team and the financial structure. Are there gaps in leadership? Does the financial setup support the company’s recovery? If changes are needed, now is the time to make them. Develop a clear, actionable integration plan that emphasizes managing risks while keeping long-term goals in sight. By acting decisively and strategically during this critical phase, you’ll lay the groundwork for turning the business around.