When a business faces financial trouble, it often has two bankruptcy options: Chapter 11 (reorganization) or Chapter 7 (liquidation). Chapter 11 allows businesses to restructure debts and keep operating, while Chapter 7 involves shutting down and selling assets to repay creditors. Here’s a quick breakdown:

- Chapter 11: Focuses on recovery and continuing operations. Management stays in control, debts are reorganized, and creditors are repaid over time.

- Chapter 7: Focuses on closure. Operations stop, assets are sold, and creditors are paid from the proceeds.

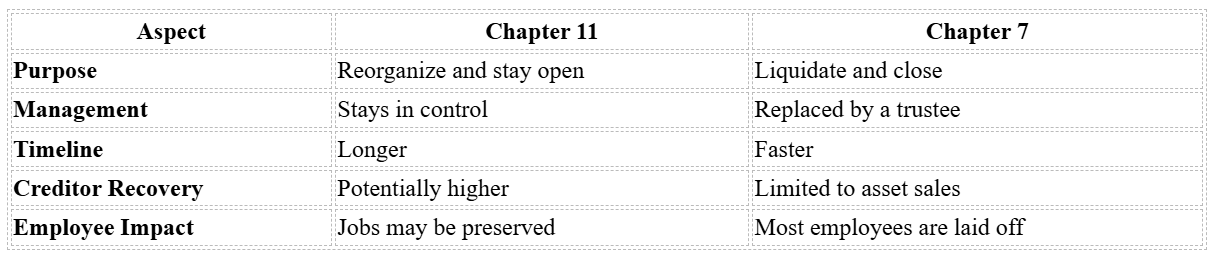

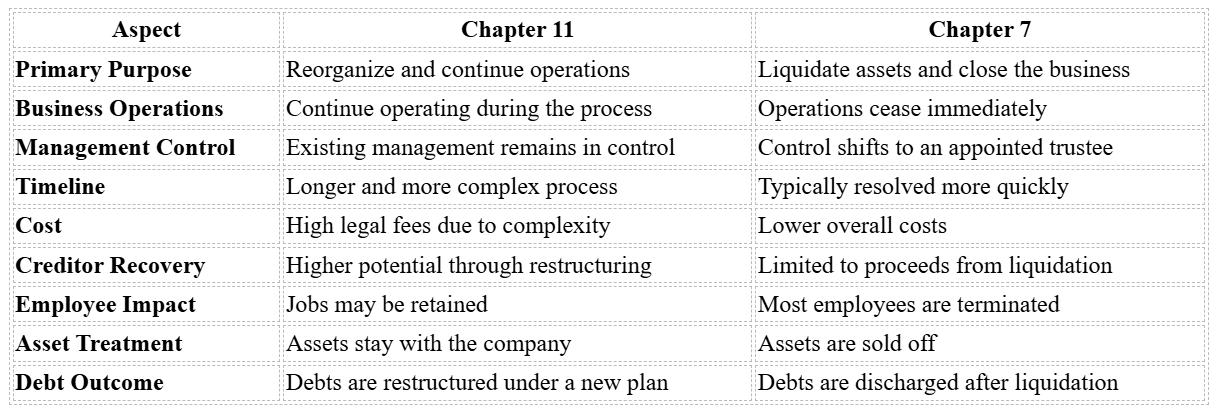

Quick Comparison:

The choice depends on whether the business has a chance to recover or needs to shut down entirely. Both processes impact creditors, employees, and stakeholders differently.

What Is The Difference Between Chapter 7 And 11 Bankruptcy? – CountyOffice.org

Chapter 11 Bankruptcy: Business Reorganization

Chapter 11 bankruptcy offers a critical option for businesses struggling financially but still showing potential for recovery. Unlike liquidation, which focuses on shutting down and selling off assets, Chapter 11 lets companies keep operating while reorganizing their debts. Essentially, it provides breathing room to restructure and work toward profitability, all while continuing day-to-day operations.

The idea behind Chapter 11 revolves around rebuilding instead of closing shop. This approach benefits more than just the business owners – it helps employees keep their jobs, ensures suppliers retain a buyer for their goods, and often allows creditors to recover more than they would in a liquidation scenario.

Here’s a closer look at the key aspects that make Chapter 11 a tool for business recovery.

Key Features of Chapter 11

One standout feature of Chapter 11 is the Debtor-in-Possession Status. When a company files for Chapter 11, its existing management usually stays in control of operations and assets. They remain in charge of the business’s daily activities but now operate under the court’s supervision. For major decisions, like selling assets or signing significant contracts, they need court approval.

Another important component is the automatic stay, which takes effect as soon as the bankruptcy is filed. This legal safeguard halts all collection efforts, lawsuits, and foreclosure actions against the business. It essentially freezes creditor actions, giving the company time to focus on restructuring without the immediate threat of losing assets or facing legal battles. This protection can last months or even years, depending on the case.

At the heart of Chapter 11 is the court-approved reorganization plan. The company has an initial 120-day exclusive window – extendable up to 18 months – to propose a plan for restructuring its debts and operations. This plan outlines how creditors will be paid, when payments will occur, and how the business will generate enough revenue to meet its obligations going forward.

Unlike liquidation, Chapter 11 allows for ongoing business operations during the process. This means the business can keep generating revenue while it works through its financial issues. However, any transaction outside the normal course of business, like selling a major asset or entering a significant new agreement, must first be approved by the court.

Chapter 11 also enables businesses to reject unfavorable contracts or leases. If certain agreements are dragging the company deeper into financial trouble, this mechanism provides a way to terminate those obligations, offering a chance to reset and move forward.

When to Consider Chapter 11

Understanding these features helps clarify when Chapter 11 might be the right choice for a business.

Chapter 11 works well for businesses that are fundamentally sound but facing temporary financial challenges. For example, companies under pressure from creditors or experiencing short-term cash flow problems can use Chapter 11’s protections to regroup and plan for recovery.

Seasonal businesses or those hit by temporary economic downturns can also benefit. Take a retail chain with strong brand recognition but struggling due to tough market conditions. Chapter 11 could allow it to renegotiate rent, close unprofitable locations, and emerge stronger when the economy rebounds.

For companies with valuable assets, Chapter 11 can be a better alternative to liquidation. Imagine a restaurant chain with prime real estate locations. Selling off those properties at discounted prices might not yield as much value as continuing operations and gradually paying creditors over time.

The success of Chapter 11 often hinges on the presence of supportive stakeholders. When suppliers agree to keep providing goods, major customers stay committed, and employees remain engaged, the chances of a successful reorganization improve significantly. Without this kind of support, even the best restructuring plans can falter.

Chapter 7 Bankruptcy: Asset Liquidation

Chapter 7 bankruptcy is often referred to as "straight bankruptcy" or "liquidation bankruptcy." It’s a process designed to convert a company’s assets into cash to pay off creditors. Unlike Chapter 11, which focuses on keeping a business operational while restructuring its debts, Chapter 7 is all about shutting down operations and distributing any remaining value to creditors. This isn’t about recovery – it’s about closure. The goal is to wrap things up in a way that’s fair and follows the law, ensuring creditors get as much as possible while adhering to legal priorities.

This type of bankruptcy is typically pursued by businesses that no longer have the resources, market position, or support to continue. While it signifies the end of the business, Chapter 7 provides a structured and legal way to handle the closure. Here’s a closer look at how the process works.

Key Features of Chapter 7

One of the most notable aspects of Chapter 7 is the appointment of a trustee. Once a trustee is brought in, they take full control of the business and its assets. Unlike Chapter 11, where the company’s existing management often stays in charge, Chapter 7 removes the original owners and management from decision-making entirely. The trustee is responsible for overseeing the liquidation process, which includes selling off assets and distributing the proceeds.

The trustee has broad authority to dig into the company’s financial history. They can investigate transactions, recover assets that were improperly transferred, and even challenge payments made before the bankruptcy filing. If necessary, they can take legal action to reclaim money or property for the bankruptcy estate.

Operations typically shut down quickly. There’s usually only a short window to complete any outstanding orders or ensure assets are preserved before they’re sold. Employees are laid off, contracts are terminated, and the focus shifts entirely to selling off assets.

The liquidation process involves selling everything the company owns, from inventory and equipment to real estate and intellectual property. The trustee’s job is to secure the best possible prices, whether through auctions, private sales, or bulk transactions. How long this takes depends on the complexity of the assets involved.

When it comes to distributing the proceeds, federal law sets strict priorities. Secured creditors are paid first, using the proceeds from the sale of assets tied to their loans. Next, administrative expenses related to the bankruptcy case are covered. After that, priority unsecured claims – such as employee wages and benefits – are addressed. Lastly, general unsecured creditors (like suppliers) get whatever is left, which is often only a small fraction of what they’re owed.

While Chapter 7 does include an automatic stay to temporarily halt collection efforts, this is short-lived since the primary focus is liquidation rather than ongoing operations.

When to Consider Chapter 7

Chapter 7 is often the best option for businesses that can no longer stay afloat. Unlike Chapter 11, which aims to restructure and keep the company running, Chapter 7 is a practical solution when continuing operations simply isn’t feasible.

This path is ideal for businesses that can’t generate enough cash flow to cover their basic expenses, even with major restructuring. Companies that are rapidly burning through cash with no realistic chance of turning things around often find Chapter 7 to be the most straightforward way to address their financial issues.

For businesses with liquid assets or easily sellable inventory, Chapter 7 can sometimes provide better returns for creditors than a drawn-out restructuring process. For instance, a retail business with a large inventory but declining sales might recover more value by liquidating quickly rather than trying to stay operational while losing money.

When key stakeholders pull their support, Chapter 7 often becomes unavoidable. If major customers stop placing orders, suppliers demand upfront payments, or lenders refuse additional funding, the business loses the foundation needed to survive. Without this support, even the best restructuring plans are likely to fail.

Chapter 7 can also be a good option for companies facing significant legal liabilities, such as product liability claims or cleanup costs, especially when market conditions make recovery unlikely. It allows for an orderly resolution of creditor claims without the added burden of trying to fix an unfixable situation.

Finally, businesses in declining industries may find Chapter 7 to be the most logical choice. Instead of dragging things out and accumulating more debt, Chapter 7 provides a way to wind down operations and preserve whatever value remains for creditors.

For business owners, Chapter 7 can also offer personal relief. While losing the business is undoubtedly difficult, the process provides closure and allows owners to move forward without the stress and financial strain of trying to save a failing enterprise. It’s a tough decision but often the right one when there’s no realistic path to recovery.

Chapter 11 vs Chapter 7: Key Differences

Chapter 11 and Chapter 7 offer two distinct legal paths for handling overwhelming debt. While both are designed to address financial difficulties, their purposes, processes, and outcomes are fundamentally different.

Comparison Table: Chapter 11 vs Chapter 7

Main Differences Explained

The key distinction between Chapter 11 and Chapter 7 lies in their goals. Chapter 11 focuses on restructuring debt to allow a business to continue operations, while Chapter 7 involves shutting down the business and selling its assets to settle debts.

Management control is another critical point of divergence. Under Chapter 11, the existing management stays in charge as a "debtor in possession", overseeing day-to-day operations while navigating the restructuring process. In contrast, Chapter 7 shifts control to a court-appointed trustee, who takes over the liquidation process.

Costs and timelines also vary significantly. Chapter 11 is a lengthy and complex process that often incurs high legal fees, reflecting the detailed negotiations and planning involved. Chapter 7, on the other hand, is simpler and typically resolves much faster, making it less expensive overall.

When it comes to creditor recovery, Chapter 11 generally provides a better chance for creditors to recoup their claims through reorganization plans. Chapter 7, however, limits creditor recovery to the proceeds from liquidated assets, which often represent only a fraction of the original debt.

The impact on employees and stakeholders is another area where these chapters differ. Chapter 11 can help preserve jobs and maintain ongoing business relationships, offering a lifeline to employees and partners. Conversely, Chapter 7 usually results in immediate layoffs and the termination of contracts as the business shuts down.

For businesses involved in mergers and acquisitions (M&A) under financial distress, these differences present unique opportunities. Chapter 11 cases may attract buyers interested in acquiring a functioning operation with an established customer base and market presence. On the flip side, Chapter 7 situations appeal to those looking for specific assets or equipment at discounted prices. Platforms like the Urgent Exits marketplace cater to both scenarios, connecting sellers with buyers based on their goals – whether it’s acquiring a going concern or purchasing assets.

Lastly, the choice between Chapter 11 and Chapter 7 has far-reaching implications for a company’s financial future and long-term strategy. Chapter 11 allows businesses to maintain their brand, market position, and operational capacity, which can be crucial for future growth. In contrast, Chapter 7 provides a clean slate by resolving debts but at the cost of the business’s assets and market presence. These differences not only shape bankruptcy outcomes but also influence strategic decisions in distressed M&A situations.

Effects on Distressed Business Transactions

Bankruptcy proceedings can significantly reshape how distressed business transactions unfold. The type of bankruptcy filing – whether Chapter 11 or Chapter 7 – plays a key role in shaping deal structures, valuation methods, and overall strategies.

Impact on M&A Opportunities and Valuations

Chapter 11 cases often present buyers with the chance to acquire a functioning business. These businesses typically come with established revenue streams, customer relationships, and market presence, which can lead to higher valuations. Since court-supervised reorganization provides a clearer picture of a company’s operational capacity, buyers can make more informed decisions.

However, Chapter 11 transactions often require extended due diligence. Buyers must sift through detailed financial disclosures and court filings, which can slow down the process. While the automatic stay provision helps protect buyers from assuming pre-petition liabilities, the need for court approval can further extend closing timelines.

On the other hand, Chapter 7 liquidations focus on selling off assets like equipment, inventory, real estate, or intellectual property – often at deeply discounted prices. These transactions move more quickly but leave buyers with the challenge of rebuilding operations from scratch, as they’re not acquiring an intact business.

Valuation methods also differ between the two bankruptcy chapters. Chapter 11 deals are typically assessed using standard business valuation techniques, such as discounted cash flow or comparable company analysis, adjusted for the distressed nature of the business. In contrast, Chapter 7 transactions prioritize estimating the liquidation value of individual assets.

Negotiation dynamics vary as well. In Chapter 11 cases, management often remains involved, facilitating more traditional M&A-style negotiations. In contrast, Chapter 7 trustees focus on maximizing creditor recovery, often relying on auction processes that can affect pricing strategies.

Financing structures also differ. Chapter 11 deals may involve debtor-in-possession financing or the assumption of certain liabilities, whereas Chapter 7 transactions are usually straightforward cash purchases. While simpler, this cash-only approach can limit the pool of potential buyers. These differences demand a flexible approach that works across both reorganization and liquidation scenarios.

Using Urgent Exits for Bankruptcy-Related Deals

Platforms like Urgent Exits are transforming how bankruptcy-related transactions are managed. Designed specifically for distressed businesses and assets, Urgent Exits provides tools to navigate both Chapter 11 reorganizations and Chapter 7 liquidations. Its tracking features allow users to monitor buyer interest and adjust strategies in real time.

For Chapter 11 cases, sellers can use the platform to highlight operational strengths and financial performance, while clearly communicating restructuring plans to potential buyers. This helps attract interest from buyers looking for a restructured operating business.

In Chapter 7 scenarios, trustees and liquidators leverage Urgent Exits’ broad market reach to maximize asset recovery. The platform’s filtering and browsing tools make it easier for multiple buyers to evaluate available assets simultaneously, encouraging competitive bidding.

Buyers also benefit from Urgent Exits by using its advanced search tools to find opportunities that align with their goals – whether acquiring a reorganized business through Chapter 11 or specific assets from a Chapter 7 liquidation. Direct communication with sellers facilitates early engagement, which can strengthen negotiating positions.

Advisors find value in the platform’s lead generation features, allowing them to connect with distressed business owners even before formal bankruptcy filings. This proactive approach can lead to restructurings or other transactions that bypass the complexities of bankruptcy, with tools to identify prospects based on industry, location, or early signs of distress.

Additionally, Urgent Exits’ online format removes geographic limitations, enabling international buyers to explore U.S. bankruptcy opportunities without needing to travel. This expanded access fosters a more dynamic market for distressed businesses and assets, creating opportunities for both buyers and sellers.

Conclusion

Understanding the differences between Chapter 11 and Chapter 7 bankruptcy is crucial when navigating financial challenges. Chapter 11 focuses on restructuring debt and keeping the business operational, offering a chance for recovery and a new beginning. On the other hand, Chapter 7 involves liquidating assets and shutting down the business, marking a definitive end to its operations.

The choice between these two paths impacts everyone involved. For debtors, Chapter 11 offers a lifeline to rebuild, while Chapter 7 signifies closure. Creditors, too, weigh these options carefully. Many prefer Chapter 11 if there’s hope for a turnaround, as it often provides better recovery outcomes. However, senior secured creditors might lean toward Chapter 7, as it can ensure quicker repayment and reduce the uncertainties that come with lengthy reorganization processes. These considerations influence recovery strategies and future transactions, underscoring the need for well-informed decisions during financial distress.

For businesses, the decision largely hinges on their ability to remain viable and the level of support from stakeholders. Companies with a solid foundation and backing often find Chapter 11 to be the better route.

This choice also shapes opportunities in the market. Chapter 11 cases often present buyers with operational businesses and ongoing revenue streams, while Chapter 7 liquidations offer individual assets at discounted prices. Being aware of these dynamics helps buyers, sellers, and advisors navigate the complexities of distressed transactions with greater confidence.

Whether a business opts for reorganization or liquidation, having the right connections with buyers, creditors, and advisors can significantly influence outcomes. While challenging, the bankruptcy process provides a structured way to address financial difficulties. When approached strategically, it can lead to outcomes that benefit all parties involved, offering clarity and direction in distressed business scenarios.

FAQs

What should a business consider when deciding between Chapter 11 and Chapter 7 bankruptcy?

When weighing the options between Chapter 11 and Chapter 7 bankruptcy, businesses need to carefully evaluate their current financial health, future potential, and overall objectives for managing debt.

Chapter 7 is typically suited for companies that are unable to continue operations, have minimal assets, or need to liquidate quickly to address outstanding debts. Choosing this path often means the business will close its doors permanently.

In contrast, Chapter 11 works better for businesses with a solid foundation and a desire to stay operational while restructuring their debt. This route allows companies to reorganize their finances while maintaining control, providing an opportunity to stabilize and eventually thrive. Important considerations include the value of your assets, the likelihood of future profitability, and whether you can effectively handle the complexities of the restructuring process.

What is the difference in management’s role between Chapter 11 and Chapter 7 bankruptcy?

In Chapter 11 bankruptcy, the current management typically remains in charge of the business as the debtor in possession. This means they continue handling daily operations while crafting a plan to reorganize and address their debts. However, if there’s evidence of fraud, mismanagement, or other major problems, the court may assign a trustee to step in and take control. This setup allows the business to keep running as it works toward financial recovery.

In Chapter 7 bankruptcy, the situation is quite different. Management loses control, and a trustee appointed by the court takes over. The trustee’s role is to sell off the company’s assets and distribute the funds to creditors. This process usually marks the end of the business, as it typically results in a permanent shutdown.

How do Chapter 11 and Chapter 7 bankruptcies affect employees and creditors?

When a business files for Chapter 11 bankruptcy, it doesn’t shut down but continues its operations while working to reorganize its debts. This process allows the company to negotiate with creditors and create a plan that could help it regain profitability. During this time, employees often keep their jobs, although restructuring efforts might result in layoffs or adjustments to operations. Creditors usually receive partial payments over an extended period, depending on the terms of the reorganization plan.

On the other hand, Chapter 7 bankruptcy involves the complete closure of the business. Its assets are sold off, or liquidated, to settle outstanding debts. In most cases, employees lose their jobs, and creditors are paid from the proceeds of the liquidation. However, not all creditors are guaranteed to recover the full amount they’re owed, as payments are distributed based on a set priority system.