Valuing a distressed business is complex, and mistakes can lead to costly consequences for buyers, sellers, and lenders. Here are the seven most common pitfalls to avoid:

- Overestimating Future Cash Flows: Unrealistic revenue projections often ignore financial struggles and market realities.

- Ignoring Market Conditions and Economic Changes: Outdated data and failure to consider economic shifts can lead to misjudged valuations.

- Using Wrong[Valuation Methods: Traditional approaches like DCF or market multiples often fail for distressed companies.

- Missing Hidden Liabilities and Risks: Contingent obligations, off-balance sheet debts, and other risks can drastically alter valuations.

- Overlooking Business Model Problems: Flawed revenue streams, inefficiencies, or heavy reliance on key individuals can undermine long-term viability.

- Not Adjusting Asset Values for Distress: Fire-sale scenarios and urgency often reduce asset values far below book value.

- Not Accounting for Higher Risk: Elevated risks tied to insolvency, market volatility, and execution failures require higher discount rates.

Key Takeaways:

- Distressed businesses require tailored valuation methods and risk adjustments.

- Hidden liabilities, market conditions, and flawed assumptions can derail deals.

- Platforms like Urgent Exits and professional advisors can help ensure accurate valuations.

Addressing these pitfalls with data-driven insights and expert guidance is critical to making informed decisions in distressed business transactions.

1. Overestimating Future Cash Flows

When a business is already struggling, projecting overly rosy financial outcomes can lead to serious missteps. This trap often ensnares both experienced investors and distressed sellers, resulting in valuations that lean more on optimism than on actual data.

The problem often starts with applying assumptions suited for thriving businesses to ones in distress. For example, a company facing challenges might predict an unrealistic 25% revenue growth or anticipate a quick recovery in market share – without any solid plan to back it up.

Historical performance can act as a reality check. If a manufacturing company has seen its profit margins shrink for three years straight, expecting a turnaround without evidence is overly optimistic. Patterns from the past tend to persist when the root problems remain unresolved, providing a clearer picture of the broader market difficulties.

Market conditions further complicate the picture. Distressed businesses often stand out as anomalies within their industries, making it tough to find reliable comparisons. Strategies that work for stronger competitors may not apply here, and ignoring negative trends – like shrinking sales or growing competition – can lead to forecasts that are far removed from reality.

Certain red flags should immediately raise concerns: revenue projections that show rapid growth without any justification, or forecasts that overlook recent setbacks, such as losing major clients.

A more cautious, data-driven approach is the safest way to avoid this pitfall. Start by analyzing several years of financial data, adjust for one-time events, and assess whether past performance is likely to continue or worsen. Industry benchmarks and up-to-date market research can help anchor projections in current realities rather than wishful thinking. Scenario analysis is especially useful – skilled appraisers often use multiple scenarios to account for risks and uncertainties tied to recovery or restructuring efforts.

Platforms like Urgent Exits can be invaluable here, offering market data and access to expert advisors who can validate or challenge cash flow assumptions. The guidance of qualified professionals can mean the difference between a successful deal and a costly mistake.

Finally, open communication about risks and assumptions with all stakeholders is crucial. When everyone involved understands the challenges and uncertainties, platforms like Urgent Exits can help ensure valuations reflect the genuine prospects of a distressed business by connecting sellers with seasoned advisors who bring clarity to the process.

2. Ignoring Market Conditions and Economic Changes

Market conditions and economic shifts play a huge role in valuing distressed businesses, yet some appraisers treat these factors as secondary. Distressed businesses are particularly vulnerable to market swings because their shaky financial footing makes them highly sensitive to changes in investor sentiment, industry dynamics, and the overall economy. This sensitivity calls for constant re-evaluation of market conditions as they evolve. It’s not just cash flow assumptions that need to be data-driven – external factors shaping those cash flows demand equal attention.

History offers stark lessons on what happens when these factors are overlooked. During the 2008 financial crisis and the COVID-19 pandemic, many businesses were valued using outdated market multiples. These valuations ignored sudden drops in demand and tighter credit conditions, leading to failed sales and significant financial losses.

Economic uncertainty only magnifies these challenges. When markets are unstable, the pool of potential buyers shrinks, and those who remain often demand steep discounts to offset the increased risk. This creates a ripple effect where businesses are sold at "fire-sale" prices, reflecting the urgency of the sale rather than the true worth of the business.

For distressed businesses, the Market Approach often falls short during times of economic turbulence. These businesses are typically outliers, making it hard to find meaningful comparisons. Even when comparable data is available, using benchmarks from healthy companies can result in overly optimistic valuations. Conversely, relying on data from other distressed sales can lead to overly pessimistic conclusions, as those sales often stem from desperation rather than fair market conditions.

Several economic indicators are crucial for valuing distressed businesses. These include industry-specific trends, recent sales of other distressed businesses, unemployment rates, consumer confidence indices, interest rates, and regional economic forecasts. U.S. appraisers should frequently consult resources like the Bureau of Economic Analysis (BEA), Federal Reserve data, and industry trade reports to ensure their valuations align with current realities.

Addressing these challenges requires appraisers to incorporate real-time market data into their evaluations. This means regularly updating valuation models based on the latest economic data, applying higher discount rates to account for increased risk, and stress-testing cash flow projections against adverse scenarios. Scenario analysis becomes essential, helping appraisers understand how different economic outcomes might impact the business’s value.

Platforms like Urgent Exits offer valuable tools for this process. They provide real-time access to listings, recent sales data, and market trends specifically for distressed businesses in the U.S. These platforms also connect users with experienced advisors who can interpret market shifts and economic changes, ensuring valuations are based on current conditions rather than outdated assumptions.

The cost of ignoring market conditions is steep. During recessions or periods of high economic volatility, business sale prices can drop by 20-50% or more. Distressed businesses often face even deeper discounts due to limited buyer interest and the urgency to sell.

3. Using Wrong Valuation Methods

When market conditions shift, choosing the right valuation method becomes especially crucial for distressed businesses. Unfortunately, many appraisers default to techniques designed for stable, thriving companies, which often fail to account for the complexities of financial distress. Valuation methods like Discounted Cash Flow (DCF), Market Multiples, and Asset-Based Approaches each have significant limitations when applied to struggling businesses.

Discounted Cash Flow (DCF)

DCF relies heavily on projecting future cash flows, but this approach crumbles when a business faces restructuring or potential liquidation. Predicting stable earnings for a company in distress is nearly impossible, making DCF valuations unrealistic in these scenarios.

Market Multiples

The Market Multiples method also falters under distress. This approach depends on finding comparable companies, but distressed businesses often have unique challenges that make finding suitable benchmarks difficult. Using EBITDA multiples from healthy industry peers can lead to valuations that don’t reflect the distressed company’s reality. Even when distressed data is available, it often represents fire-sale prices, which are poor indicators for setting a fair valuation.

Asset-Based Approaches

Asset-based methods might seem more reliable for distressed valuations, but they are frequently misapplied. A common mistake is using book value instead of fair market value, which can distort valuations significantly. For example, failing to adjust for obsolete inventory or outdated equipment can lead to inflated asset values. In one case, a business owner relied on book values without accounting for outdated inventory, resulting in a failed sale when buyers uncovered the real condition of the assets. Additionally, overlooking non-operating assets or ignoring built-in gains tax for S corporations can materially affect valuations, especially within the five-year lookback period.

Mixing Methods Without Adjustments

Another frequent error is combining multiple valuation methods without proper normalization. For instance, blending DCF with market multiples can lead to skewed results since each method is based on different assumptions.

Choosing the Right Approach

The key to accurate valuations lies in tailoring the method to the specific circumstances of the distressed business:

- Asset-based approaches work best when liquidation is the likely outcome.

- DCF should only be used with highly conservative, risk-adjusted projections.

- Market multiples require truly comparable distressed transactions, which are often hard to find.

For U.S. distressed valuations, platforms like Urgent Exits provide access to real transaction data and connect users with experts who specialize in these complex scenarios. These advisors can guide businesses in selecting methods that align with their realities, ensuring valuations reflect actual market conditions rather than overly optimistic projections. Accurate valuations require methods that adapt to the unique challenges of distressed businesses.

4. Missing Hidden Liabilities and Risks

Hidden liabilities – like off-balance sheet and contingent obligations – can significantly skew the valuation of a distressed business. These financial pitfalls often stay under the radar, unlike visible debts that are clearly outlined in financial statements. Unfortunately, their eventual emergence can lead to costly mistakes for buyers and investors.

Common Types of Hidden Liabilities

Contingent liabilities hinge on future events that may or may not occur. Examples include pending lawsuits, warranty claims, and product liability issues. For instance, distressed manufacturing businesses often face class-action lawsuits, which can result in massive financial damages not reflected on their balance sheets.

Off-balance sheet obligations are another source of risk. These include operating leases, pension liabilities, and contractual guarantees that don’t show up in standard financial reviews. A retail business, for example, might have signed personal guarantees for long-term store leases. These obligations can persist even if the business shuts down.

Environmental liabilities are especially problematic for industries like manufacturing or fuel retail. Cleanup costs for a former gas station or factory site can far exceed the business’s apparent value. Worse yet, these liabilities often transfer to new owners, making environmental assessments a non-negotiable part of due diligence.

The Valuation Impact

Overlooking hidden liabilities can lead to severe overvaluation. If appraisers focus only on visible assets and debts, they risk missing major financial threats. For example, a company with $2 million in net assets might actually have $1.5 million in undisclosed liabilities, drastically altering its attractiveness as an investment.

Economic downturns only heighten these risks. In tough market conditions, contingent liabilities are more likely to materialize, and distressed businesses often lack the resources to manage them. A warranty claim that a stable company could handle with ease might push a struggling business into bankruptcy.

Uncovering Hidden Risks

Thorough due diligence is critical to uncovering these hidden liabilities. This involves combing through legal documents, contracts, and regulatory filings. Employment agreements, supplier contracts, and insurance policies often contain obligations that can impact a business’s financial standing.

Financial modeling and sensitivity analysis are also essential tools. Rather than ignoring uncertain liabilities, experts assign probability-weighted values to potential outcomes. For instance, a 30% chance of a $500,000 legal settlement would result in a $150,000 adjustment to the valuation.

Professional Expertise Matters

Given the complexity of hidden liabilities, professional expertise is indispensable. Experienced appraisers, attorneys, and consultants know where to look and how to assess uncertain obligations. Platforms like Urgent Exits connect sellers and buyers with specialists who can navigate these challenges effectively.

These experts rely on industry benchmarks and market data to quantify liabilities and adjust valuations. Their insights help prevent unexpected financial surprises that could derail transactions or restructuring efforts. By addressing these hidden risks, businesses can avoid further valuation pitfalls and ensure a more accurate financial assessment.

In distressed business valuations, what’s hidden can often matter more than what’s visible. Properly accounting for these liabilities ensures a complete and realistic financial picture, rather than just scratching the surface.

5. Overlooking Business Model Problems

A solid business model is just as important as financial metrics when it comes to accurate valuations. While financial statements can highlight signs of trouble, they don’t always tell the full story. Sometimes, the underlying issue is a flawed business model that jeopardizes the company’s ability to thrive in the long run. If appraisers focus solely on past performance, they might miss whether the company’s core offerings still align with evolving consumer needs and technological advancements.

Unsustainable Revenue Streams

Certain revenue patterns can expose deeper problems. For instance, when a business heavily relies on just one or a few clients, it creates a precarious situation. Losing even one major client could have a devastating impact. Similarly, revenue models that bank on unrealistic growth expectations or depend on outdated offerings can signal practices that aren’t built to last. These issues can chip away at the company’s real value.

Operational Inefficiencies and Owner Dependency

Operational challenges also play a major role in determining a business’s value. Inefficiencies in daily operations waste resources and eat into profits, which directly affects goodwill – a critical factor in valuation. Another red flag is when a business’s success depends too heavily on the owner or a few key individuals. This kind of dependency makes the business harder to sell, shrinking the pool of potential buyers and lowering its overall worth.

Market Relevance: The Ultimate Test

Staying relevant in the market is the ultimate measure of a business’s potential for recovery. If the company’s business model no longer meets current market demands, even the most optimistic forecasts won’t hold up. This challenge becomes even tougher during economic downturns or periods of market uncertainty, when distressed businesses struggle to attract buyers.

The Valuation Impact

Just as inflated cash flow projections or incorrect valuation methods can skew results, a flawed business model can lead to misguided assumptions about a company’s future. Ignoring these structural issues often results in appraisers applying inappropriate growth rates or valuation multiples. The key is distinguishing between temporary financial struggles and a business model that’s fundamentally broken. For companies with these deeper challenges, specialized platforms can connect sellers with buyers who understand these complexities.

Identifying and addressing these problems early in the valuation process ensures that the final assessment reflects the true value – or lack thereof – of the business.

6. Not Adjusting Asset Values for Distress

When a business faces distress, asset values tend to plummet. This happens because buyers demand steep discounts, driven by the urgency to sell, uncertainty about the future, and the seller’s limited ability to negotiate.

The Fire-Sale Reality

In cases of liquidation or forced sales, assets are often sold at "fire-sale" prices – far below their fair market value. Sellers in these situations have little leverage, and the pool of potential buyers is usually small. As a result, assets might only fetch a fraction of their recorded value. For instance, machinery might sell for just 30–50% of its appraised worth, while inventory could be heavily discounted or even written off completely.

Take this example: a distressed manufacturing company had to liquidate its inventory and equipment. Although the inventory was valued at $500,000 on the books, it sold for only $150,000 at auction. Similarly, real estate appraised at $2 million was sold for $1.2 million due to the urgency of the sale. The company’s intellectual property, valued at $300,000, wasn’t sold at all because it couldn’t maintain the necessary patents – resulting in a total loss.

Assets Hit Hardest by Distress

Some assets are more vulnerable than others in distress situations:

- Inventory: This often takes the biggest hit. Products can become outdated, seasonal items may lose their appeal, and perishable goods might spoil. These factors force businesses to apply deep discounts or, in some cases, write off the inventory entirely.

- Real Estate: Properties sold under tight timelines tend to attract lower offers than they would in a typical market.

- Intellectual Property: When a business can no longer protect its rights or maintain operational continuity, the value of patents, trademarks, or other intangible assets can plummet.

Common Valuation Mistakes

Misjudging asset values during distress can lead to costly errors. Appraisers often fall into predictable traps, such as:

- Over-relying on book value instead of fair market value.

- Failing to adjust valuations to reflect distress conditions.

- Neglecting the value of non-operating or intangible assets.

- Ignoring built-in gains tax implications, particularly for appreciated assets within S corporations during the five-year lookback period.

U.S. accounting and tax rules require assets to be valued at their fair market value, not their book value. Additionally, built-in gains tax must be factored in for assets that have appreciated. Following these guidelines helps avoid overstated valuations that don’t align with what buyers are willing to pay in a distressed sale.

Getting the Numbers Right

Accurate valuations require a thorough and detailed approach. Appraisers often:

- Conduct on-site inspections to assess the condition of assets.

- Review recent sales data for similar distressed assets.

- Use specialized valuation methods, like orderly liquidation value (OLV) or forced liquidation value (FLV), to estimate realistic recovery rates.

- Consult industry benchmarks, auction results, and distressed transaction data to refine their assessments.

Platforms like Urgent Exits provide appraisers with access to market data and connect them with professionals who specialize in distress-driven pricing. By using these tools and methods, appraisers can offer valuations that reflect the realities of quick-sale scenarios, avoiding inflated numbers that mislead stakeholders.

7. Not Accounting for Higher Risk

When evaluating distressed businesses, one of the biggest mistakes is overlooking their heightened risk profile. Unlike stable companies with predictable operations, distressed businesses face immediate financial challenges and even the threat of insolvency. This requires a completely different approach to assessing risk. Let’s break down the key aspects of this elevated risk and how they impact valuations.

The Reality of Elevated Risk

Distressed businesses operate under a level of uncertainty that healthy companies rarely encounter. Whether the company can successfully turn things around, undergo major restructuring at the expense of future profits, or end up in liquidation creates a highly unpredictable environment. This makes cash flow projections much more subjective and prone to significant errors.

Multiple Layers of Risk

Distressed businesses come with a variety of risks that must be carefully factored into their valuations. These include:

- Financial distress risk: The increased likelihood of bankruptcy or liquidation.

- Business model risk: Uncertainty about whether the company’s core products or services remain viable.

- Market volatility risk: Greater exposure to adverse economic conditions.

- Execution risk: Doubts about management’s ability to successfully implement a turnaround plan.

- Liquidity risk: A limited pool of potential buyers and the risk of forced sales.

Each of these risks can significantly lower a company’s value and must be accounted for in any thorough assessment.

The Cost of Ignoring Risk

Ignoring the elevated risk of distressed businesses can lead to valuations that are completely out of sync with market realities. Standard valuation methods, which often assume optimism and future growth, don’t work for companies facing immediate financial trouble. Using discount rates that are too low inflates cash flow estimates, creating unrealistic expectations for sellers. Worse, buyers may end up overpaying for assets that turn out to be worth far less.

Practical Risk Adjustments

For distressed businesses, discount rates need to be much higher than those used for healthier companies. While healthy businesses might use discount rates of 12–15%, distressed companies often require rates of 20–30% or more, depending on their circumstances [8, 5]. Scenario analysis is a critical tool here. Valuators should create multiple projections – such as a successful turnaround, moderate restructuring, or liquidation – and assign realistic probabilities to each (e.g., a 20% chance of turnaround, 30% chance of modest recovery, and 50% chance of liquidation).

Another factor to consider is reliance on key personnel. If a distressed company depends heavily on a few individuals, the potential loss of these people can severely damage customer relationships and derail recovery efforts.

To make these adjustments more precise, platforms like Urgent Exits connect professionals specializing in distressed business valuations with market data that reflects risk-adjusted pricing. This helps ensure valuations better align with the realities of distressed business transactions, offering a more accurate picture of what these companies are truly worth.

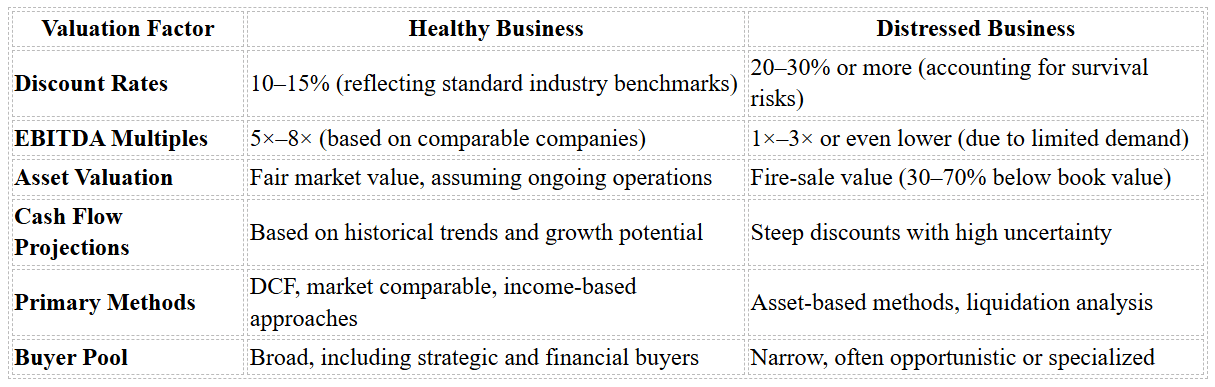

Healthy vs. Distressed Business Valuation Comparison

When it comes to determining the value of a business, the approach varies significantly depending on whether the business is thriving or struggling. Healthy businesses and distressed businesses require fundamentally different valuation methods, largely due to the stark contrast in their financial stability and future prospects.

Healthy businesses are typically valued based on their ongoing operations, while distressed businesses are assessed with their survival hanging in the balance. This difference ripples through every step of the valuation process, from discount rates to buyer interest.

Here’s a side-by-side look at how key valuation factors differ between healthy and distressed businesses:

These differences highlight why using valuation methods meant for healthy businesses on distressed ones can lead to major overestimations.

For example, consider a manufacturing company. A healthy version of this business might be valued at a 7× EBITDA multiple due to stable operations and growth potential. In contrast, if the same company is in financial distress, it could sell for just 2× EBITDA – or less – because of the uncertainty surrounding its ability to maintain earnings.

Cash flow analysis is another area where the contrast is stark. Healthy businesses can rely on historical data and reasonable growth assumptions, making discounted cash flow (DCF) models a reliable option. Distressed businesses, however, face so much uncertainty – whether a turnaround plan will work, or if management can retain key customers during restructuring – that asset-based approaches often take precedence. These businesses require a focus on tangible assets and their recoverable value, rather than speculative future earnings.

Due diligence also shifts gears. For healthy businesses, the emphasis is on growth opportunities and competitive positioning. For distressed businesses, it’s all about uncovering hidden liabilities and assessing the true value of assets.

Platforms like Urgent Exits offer invaluable insights into the actual market for distressed business transactions. These platforms provide real-world data that often reveals much lower valuations than traditional methods might suggest. This is a sobering reminder of the harsh realities in distressed sales, where urgency plays a critical role.

Timing is another key factor. Healthy businesses can afford to wait for the right buyer and the best price. Distressed businesses, on the other hand, are often under immense pressure – whether from creditors, cash flow shortages, or regulatory deadlines – to sell quickly. This urgency forces sellers to accept lower offers, further depressing valuations.

Ultimately, the market values distressed businesses through a completely different lens. Understanding these nuances is essential for accurate valuations and avoiding the pitfalls of overestimating a distressed company’s worth.

Conclusion

Valuing a distressed business requires a completely different playbook compared to assessing healthy companies. The seven pitfalls we’ve covered – like overestimating future cash flows or ignoring elevated risks – highlight just how easy it is to misstep. And in this space, mistakes don’t just hurt; they can lead to failed deals and major financial setbacks.

The stakes are high for a reason. Distressed businesses operate under immense pressure – creditors are knocking, cash is running out, and time is never on their side. This urgency leaves no room for error, making precise valuation absolutely essential.

This is where specialized expertise becomes indispensable. Professionals with credentials like Certified Valuation Analyst (CVA) or Accredited in Business Valuation (ABV) bring a wealth of knowledge and experience to these situations. They understand when traditional valuation methods fall short and know how to adjust for the unique risks that come with distressed environments.

Thorough due diligence is another non-negotiable. It’s often during this deep dive that hidden liabilities – like off-balance-sheet debts or pending lawsuits – come to light. These factors can dramatically alter a company’s value and, if overlooked, can derail an entire transaction.

As we’ve emphasized, reliable data and realistic assumptions are the backbone of accurate valuations. Transparent practices, historical data, and industry benchmarks help ground projections in reality. Stress-testing assumptions and running multiple scenarios, including worst-case outcomes, offer a clearer picture of the risks and potential rewards involved.

Specialized platforms can also play a game-changing role. For example, platforms like Urgent Exits connect sellers of distressed businesses with buyers who understand the unique challenges of these transactions. They also provide access to a network of specialists – appraisers, accountants, legal advisors, and restructuring experts – who can help ensure valuations are accurate and deals are structured for success.

Ultimately, the distressed business market operates on its own set of rules, filled with unique risks and opportunities. Navigating this space requires acknowledging those differences, leveraging the right expertise, and approaching every transaction with the care and precision these situations demand. With the right strategy, even the most complex deals can be managed confidently.

FAQs

What are the best ways to value a distressed business, and why don’t traditional methods always work?

Valuing a distressed business requires a tailored approach because traditional methods often miss the mark when dealing with the unique hurdles these businesses face. For instance, standard techniques like discounted cash flow (DCF) analysis can paint an overly rosy picture by assuming stable cash flow or overlooking how financial distress affects day-to-day operations.

More reliable methods for assessing the value of a distressed business usually hinge on asset-based approaches or liquidation value. These strategies focus on the tangible assets of the company, estimating what those assets might fetch if sold in the current market. Another useful angle is a market-based comparison, where the business is evaluated against similar distressed sales to gauge its potential worth.

It’s also crucial to dig into the specific details of the business – things like debt levels, market conditions, and operational struggles. This ensures the valuation is grounded in reality, avoiding overly optimistic forecasts that don’t align with the company’s actual situation.

What steps can buyers or investors take to identify hidden liabilities in a distressed business during due diligence?

When evaluating a distressed business, uncovering potential hidden liabilities is a critical step. To do this, you’ll need to dive deep into financial records, legal obligations, and operational risks. Start by carefully examining tax filings, unpaid debts, and any ongoing or pending lawsuits – these can often reveal warning signs.

It’s also wise to bring in experts like accountants, attorneys, or consultants with experience in the specific industry. They can help scrutinize contracts, spot compliance issues, and identify liabilities that might not be immediately obvious. Beyond the internal factors, take time to evaluate the business’s market environment and any external challenges that could affect its financial outlook. By being thorough, you can reduce risks and make better-informed decisions about your investment.

How do economic conditions and market trends influence the valuation of distressed businesses, and what steps can ensure these factors are properly considered?

Economic conditions and market trends are key drivers in shaping the value of distressed businesses. These factors influence cash flow, profitability, and the likelihood of recovery. Changes in consumer demand, industry dynamics, and overall economic stability can either support a business’s turnaround efforts or make recovery more challenging.

To navigate these challenges, it’s important to closely examine the current economic climate, keep an eye on industry-specific trends, and understand the competitive landscape. Doing so offers valuable insights into how external pressures affect the business’s value and can help inform strategies for recovery or potential sale opportunities.