When acquiring a distressed business, the stakes are high, and the timeline is tight. The biggest challenge? Aligning two organizations’ values, management styles, and work practices while navigating financial instability and employee uncertainty. Here’s what you need to know:

- Why it matters: Misaligned workplace practices cause 30% of acquisitions to fall short of financial goals. In distressed deals, this risk is amplified by rushed timelines and low morale.

- Key challenges: Limited time for workplace assessments, leadership conflicts, and employee resistance.

- Solutions: Rapid assessments, clear communication, leadership alignment, and structured action plans are critical to success.

For buyers, platforms like Urgent Exits can connect you with advisors who specialize in managing these complex transitions. Success depends on addressing these issues early and treating workplace integration as a priority, not an afterthought.

Why is Culture the Biggest Uncertainty in M&A Integration?

1. Distressed Business Acquisitions

When it comes to distressed acquisitions, the stakes are high, and the clock is ticking. These deals happen under intense pressure, with financial struggles and operational hurdles making cultural integration a tough nut to crack. The urgency to align cultures becomes even more critical – and complicated – under these circumstances.

Integration Timelines

In typical M&A deals, companies have months to align their cultures. But in distressed acquisitions, that luxury disappears, with integration often needing to happen in mere weeks – or even days. Take the oil and gas sector as an example: in 2022, a regional energy group acquired an Asian oil and gas company in a distressed situation. The new leadership quickly enforced a rigid culture, clashing with the collaborative style of the acquired company. The result? High turnover in management and plummeting morale among employees.

This kind of accelerated timeline forces acquiring companies to make lightning-fast decisions about leadership, operations, and organizational hierarchy. Meanwhile, employees are left grappling with uncertainty about their jobs and the company’s future. In such a compressed timeframe, clear and effective communication becomes absolutely essential.

Stakeholder Communication

Transparent communication is the backbone of any successful distressed acquisition. Employees are often on edge, worried about layoffs, benefit cuts, or even the company shutting down entirely. Providing consistent updates about the acquisition’s purpose and the cultural changes ahead can help ease these fears. In the oil and gas example, communication missteps early on only deepened the cultural divide. However, things began to stabilize once the new management implemented structured measures like regular all-hands meetings and feedback forums.

Another effective strategy is appointing integration champions – trusted individuals from both companies who can relay real-time feedback to leadership. These champions play a crucial role in addressing employee concerns and bridging cultural gaps.

Leadership and Workforce Involvement

Leadership dynamics in distressed acquisitions often come with their own set of challenges. The target company’s leadership might have been brought in during the crisis, meaning they may not have built strong trust with employees. To address this, joint workshops and vision-setting exercises can help unify management teams and set clear expectations.

For the workforce, involvement is key. Employees are more likely to embrace change when they feel included in the process. Cross-functional teams and cultural training programs can encourage collaboration and foster a sense of ownership. Sure, there might be skepticism at first, but these efforts can gradually build trust and improve morale. Keeping a close eye on cultural dynamics is essential, as the risks of misalignment are amplified in these high-pressure scenarios.

Risk Factors for Company Culture Misalignment

Distressed acquisitions magnify the usual risks of cultural misalignment. Differences in core values, conflicting management styles, poor communication, and resistance to change all become more pronounced under financial strain and tight deadlines. The rush to make decisions often leaves little room for thorough cultural assessments, increasing the likelihood of employee dissatisfaction, identity loss, and lowered productivity.

To address these risks, tracking key metrics – like employee engagement, retention rates, and turnover statistics – is critical. These indicators can highlight integration challenges early on, allowing leadership to make timely adjustments. For instance, monitoring these metrics has helped some companies improve efficiency and reduce attrition rates.

Adding to the complexity, employees may see cultural changes as thinly veiled cost-cutting measures, which can fuel resistance. This is where specialized resources come into play. Platforms like Urgent Exits connect buyers with advisors skilled in navigating the legal, restructuring, and cultural hurdles unique to distressed business transactions. Their expertise can be a game-changer in smoothing out the rough edges of these high-stakes deals.

2. Standard M&A Deals

Standard M&A deals are characterized by financial stability and strategic foresight, giving companies the luxury of time and resources to address cultural integration thoughtfully. Unlike the high-pressure environment of distressed acquisitions, these deals allow for a more deliberate approach to merging operations and values.

Integration Timelines

In standard M&A deals, integration typically unfolds over several months to a year, depending on the size and complexity of the companies involved. This extended timeline provides an opportunity to thoroughly assess cultural compatibility, align leadership teams, and engage employees at all levels – a pace rarely afforded in distressed acquisitions. By taking a phased approach, businesses can explore each other’s values, management styles, and operational practices. Gradual implementation of changes, coupled with feedback from employees, helps minimize disruption. However, prolonged timelines can sometimes lead to uncertainty, which may increase the risk of employee dissatisfaction or turnover.

Stakeholder Communication

Effective communication with stakeholders is a cornerstone of successful cultural integration in standard M&A deals. With more time and resources at their disposal, companies can craft detailed communication strategies to keep everyone – from employees to external partners – informed throughout the process. These strategies often include town hall meetings, departmental updates, and feedback sessions, all of which help establish trust and clarify the vision for the merger. Cross-functional teams and designated "integration champions" play a key role in fostering open, two-way communication between the merging organizations.

Leadership and Workforce Involvement

Leadership alignment is critical in setting the tone for cultural integration. Standard M&A deals provide sufficient time for joint leadership workshops and vision-setting sessions, which help reconcile differing management philosophies. Equally important is the involvement of the broader workforce. Employees from both organizations often participate in cross-cultural training programs, collaborative initiatives, and other activities designed to promote teamwork and a shared sense of purpose. Tools like employee surveys, focus groups, and cultural training sessions not only give employees a voice in shaping the new organization but also help identify potential areas of conflict early on.

Risk Factors for Company Culture Misalignment

Even with the advantages of time and resources, cultural alignment in standard M&A deals is not guaranteed. In fact, around 30% of these deals fail to meet their financial goals due to cultural misalignment. Common challenges include mismatched core values, conflicting management styles, ineffective communication, and differing levels of employee engagement . For instance, friction often arises when one company emphasizes open communication and collaboration while the other adheres to a rigid, hierarchical structure.

Another significant risk is cultural dilution, where the unique attributes of each organization may fade in the rush to create a unified identity. This can lead to dissatisfaction and even attrition, particularly among high-performing employees who were drawn to the original culture.

To mitigate these risks, companies that prioritize cultural due diligence – through methods like employee surveys, leadership interviews, and workplace observations – are more likely to achieve a successful integration. These efforts provide valuable insights and lay the groundwork for addressing the complexities of merging two distinct organizational cultures.

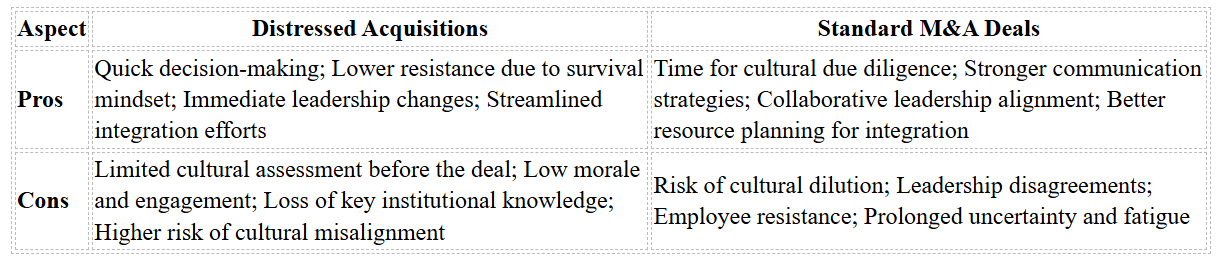

Pros and Cons

Cultural alignment strategies in distressed acquisitions and standard M&A deals come with their own sets of benefits and challenges. Weighing these trade-offs is essential for companies to decide how best to approach integration and allocate resources effectively.

In distressed acquisitions, the compressed timeline creates a unique sense of urgency. On one hand, this can speed up decision-making and reduce prolonged resistance from employees who recognize that change is essential for the business to survive. On the other hand, the rush leaves little room for thorough cultural assessments before the deal is finalized, which increases the likelihood of cultural misalignment and potential failure.

Employee reactions also differ in these scenarios. In distressed deals, employees often show a greater willingness to adapt to new cultural norms, driven by the fear of job loss or business closure. However, this acceptance can be superficial – while they may feel relief that the company survives, many may also grieve the loss of their original workplace culture. This can result in only surface-level cultural integration.

Leadership dynamics present another key difference. Distressed acquisitions often involve immediate leadership restructuring, which can quickly set a new direction. By contrast, standard M&A deals tend to favor a more collaborative approach, with joint workshops and alignment sessions helping build unified leadership teams. These sessions can create a shared vision but require more time and effort to implement effectively. Tailoring strategies to fit the specific context is crucial for success.

Resource constraints and communication add further complexity. Distressed deals often require companies to focus on high-impact, targeted efforts rather than broad-scale initiatives. While this can drive efficiency, underinvesting in cultural integration raises the risk of failure. Communication, too, carries its own hurdles. In distressed acquisitions, clear and urgent messaging can help employees understand the necessity of change. However, without a solid communication plan, panic and misinformation can spread. Standard M&A deals allow more time to craft detailed communication strategies that outline a shared vision, but these efforts can backfire if employees perceive the messaging as disingenuous.

For those navigating distressed acquisitions, resources like Urgent Exits provide tools to address these cultural challenges head-on. By understanding these trade-offs, companies can create integration strategies that set the foundation for long-term success.

Methods for Successful Company Culture Alignment in Distressed Acquisitions

Navigating the challenges of cultural integration during a distressed acquisition requires a focused and efficient approach. Companies that prioritize culture as a key element of the process – rather than treating it as an afterthought – stand a much better chance of achieving their goals and unlocking the full potential of their acquisition.

Accelerated Cultural Due Diligence

In distressed acquisitions, cultural due diligence needs to be both fast and thorough. The goal is to quickly pinpoint areas of potential conflict that could derail the integration process. Tools like surveys, leadership interviews, and workplace observations can help uncover these friction points early on.

A practical method is conducting rapid culture audits. These audits examine critical areas such as management styles, conflict resolution methods, and policies that reveal underlying cultural norms. For example, a company that claims to value innovation but operates with rigid approval processes may face significant challenges during integration. Additionally, it’s essential to assess how the financial crisis has impacted employee morale, trust in leadership, and the organization’s overall resilience.

Another key aspect is understanding decision-making practices. Are decisions driven by transparent, performance-based metrics, or are they based on subjective, unclear measures? Is information shared openly, or is it tightly controlled by senior leadership? These dynamics are particularly important when merging companies with vastly different approaches to communication and information sharing. An initial cultural audit lays the groundwork for clear communication and aligned leadership in the next steps.

Strategic Communication Planning

Communication is critical in distressed acquisitions. Without clear messaging, rumors can spread, leading to panic and uncertainty among employees. A strong communication plan should address the heightened anxiety that often accompanies both the acquisition itself and the financial challenges that preceded it. Keeping employees informed about progress, addressing concerns directly, and emphasizing shared goals and values can help ease tensions.

It’s also important to tailor communication strategies to bridge gaps between different styles. Misunderstandings are inevitable when two companies have distinct communication practices, so aligning goals, managing expectations, and building trust become essential. Regular updates can go a long way in minimizing anxiety and preventing misinformation.

Leadership Alignment and Integration Champions

Cultural alignment starts at the top. A unified leadership team establishes the tone for the entire organization. Joint leadership workshops early in the process can help resolve philosophical differences and create a shared framework for decision-making, communication, and performance expectations. This is especially critical in distressed acquisitions, where the acquired company’s leadership may have lost credibility or may be planning to leave.

A proven strategy is appointing integration champions within both organizations. These individuals act as cultural ambassadors, guiding employees through new processes and providing leadership with real-time feedback on how the integration is being received. This feedback allows leaders to make timely adjustments and address concerns as they arise.

For instance, in one case from the oil and gas sector, leadership alignment workshops helped executives craft a unified vision, define key business behaviors, and set clear expectations for cultural integration. The result? Improved operational efficiency and stronger leadership effectiveness.

Third-Party Advisory Support

Engaging professional advisors with expertise in mergers and acquisitions can provide a structured approach to cultural integration. Firms like Mercer offer data-driven frameworks and culture diagnostics to identify potential risks and develop strategies for addressing them.

In one example, Mercer worked with an Asian oil and gas company to conduct culture diagnostics and executive assessments. The firm developed an integration plan that embedded cultural priorities into the broader transformation strategy and introduced a pulse-check system to measure progress. The outcome included higher employee engagement and reduced attrition rates.

Third-party advisors can also act as neutral facilitators, helping to bridge differences in priorities, values, and norms between the two workforces. This objectivity is particularly valuable when internal stakeholders may carry biases that could hinder integration efforts.

Structured Integration Roadmaps

A well-defined roadmap is essential for cultural integration in distressed acquisitions, especially given the tight timelines involved. This plan should include steps such as cultural training, cross-cultural workshops, and quick wins to build momentum and foster employee buy-in.

Key milestones might include:

- Immediate actions to stabilize employee morale and reduce anxiety

- Early successes that demonstrate progress

- Regular pulse checks to track integration progress

- Long-term initiatives aimed at creating a cohesive, unified organization

Small but visible achievements – like adopting best practices from both companies or introducing new traditions – can help establish positive momentum. These roadmaps ensure that cultural integration aligns seamlessly with leadership strategies and broader organizational goals.

Leveraging Specialized Platforms

Platforms like Urgent Exits can play a pivotal role in cultural integration by connecting buyers with the expertise needed for distressed acquisitions. As an online marketplace focused on distressed businesses, Urgent Exits offers access to consultants, accountants, lawyers, and other specialists who can provide critical support during these complex transactions.

Conclusion

Acquiring a distressed business comes with its own set of challenges, and cultural alignment is one of the most critical hurdles to overcome. These deals often happen under tight deadlines, with companies already grappling with financial strain and low employee morale. This makes addressing cultural issues a matter of urgency.

Ignoring cultural misalignment can erode the value of an acquisition. According to Mercer’s research on over 1,400 M&A deals each year, businesses that prioritize cultural integration from the start see better results – whether it’s improved operational efficiency, stronger leadership, or reduced employee turnover.

In these scenarios, speed and accuracy are non-negotiable. Companies need to conduct rapid cultural assessments, streamline due diligence, and realign leadership without delay. The most successful organizations treat cultural integration with the same level of importance as financial restructuring. After all, employee morale and retention are directly tied to performance and, ultimately, the success of the acquisition.

For businesses navigating these high-pressure situations, tapping into specialized expertise can make a world of difference. Platforms like Urgent Exits connect companies with consultants, restructuring experts, and M&A advisors who understand the unique challenges of distressed deals. These professionals can quickly evaluate cultural dynamics, align leadership teams, and create actionable integration plans tailored for fast-paced environments. Their guidance helps ensure that every step forward is part of a cohesive strategy.

The bottom line? Cultural alignment should never be an afterthought. Companies that take the time to assess cultural compatibility, unite leadership early, and communicate openly are far more likely to achieve long-term success. On the flip side, neglecting these factors can derail the integration process and threaten the financial health of both organizations.

In the high-stakes arena of distressed acquisitions, cultural alignment isn’t just about fostering a positive workplace. It’s a core component of unlocking the combined organization’s potential and securing its path to survival and growth.

FAQs

How can businesses effectively align company cultures during a distressed acquisition?

Aligning company cultures during a distressed business acquisition might feel like navigating a minefield, but getting it right is critical for long-term success. The first step? Spot the cultural gaps. Take a close look at how the acquiring and target companies operate – what are their core values, how do they communicate, and what are their workplace dynamics? These differences can often make or break the integration process.

Once you’ve identified the gaps, open communication becomes your best tool. Employees are bound to have questions and concerns, so address them head-on. Share a clear vision for what the combined company will look like and explain how the acquisition benefits everyone. By involving employees early, you can build trust and create a sense of collaboration, making the transition smoother for all.

Sometimes, you might need an extra hand. External advisors or consultants with experience in distressed acquisitions can be game-changers. Platforms like Urgent Exits connect you with experts in areas like legal, restructuring, and more. Their guidance can help you navigate the tricky process of cultural integration, ensuring both organizations find common ground and work together effectively.

What are the best ways to evaluate cultural integration success in distressed business acquisitions?

When evaluating the success of cultural integration in distressed acquisitions, it’s important to look at both numbers and the human side of things. Metrics like employee retention rates, productivity levels, and customer satisfaction scores after the acquisition offer a clear picture of how well the teams are coming together. Tracking these over time can reveal whether the integration is on the right track.

But numbers alone don’t tell the full story. Gathering feedback through employee surveys and regular check-ins can shed light on morale, teamwork, and overall alignment. Open conversations and tackling cultural differences early on play a big role in creating a cohesive company environment. By blending hard data with honest dialogue, businesses can gain a clearer view of their progress and work toward stronger cultural alignment.

Why is aligning leadership so important in distressed business acquisitions, and how can it be done quickly?

Aligning leadership is crucial when acquiring a distressed business. It ensures that everyone involved is working toward the same objectives during what is often a fast-moving and high-stakes transition. Without this alignment, decision-making can become disjointed, which not only slows down recovery but also amplifies risks.

To get everyone on the same page quickly, prioritize clear communication, establish a shared understanding of key priorities, and take decisive steps to implement the turnaround strategy. In these high-pressure scenarios, cohesive leadership is essential for stabilizing operations and fostering trust among stakeholders.