Struggling with financial challenges? An interim CFO might be the solution you need. These temporary financial leaders specialize in handling crises, managing cash flow issues, and guiding businesses through restructuring. Unlike a permanent CFO, they focus on immediate problems, offering expertise in debt negotiations, compliance, and turnaround strategies.

Key takeaways:

- What they do: Interim CFOs address urgent financial issues like cash shortages, creditor negotiations, and leadership gaps.

- When to hire: If your business faces bankruptcy, cash flow problems, or is preparing for M&A or asset sales.

- Benefits: No long-term salary commitments, unbiased decision-making, and fast implementation of financial strategies.

- Challenges: Higher short-term costs and potential knowledge loss after their tenure ends.

Hiring an interim CFO can stabilize your business, improve cash flow, and rebuild stakeholder confidence. If you’re facing financial distress, acting quickly is critical to avoid worsening the situation.

Financial Problems That Distressed Businesses Face

Distressed businesses often grapple with a whirlwind of financial challenges that can jeopardize their survival. Recognizing these issues early is crucial, as it often signals the need for an interim CFO to help navigate the storm. Among the many hurdles, cash flow problems stand out as the most pressing.

Cash Flow Problems and Money Shortages

Cash flow shortages are an immediate and existential threat to struggling businesses. When cash inflows dwindle or expenses spiral out of control, companies can quickly find themselves unable to cover payroll, pay suppliers, or meet loan obligations. Picture this: a U.S. retailer with a monthly payroll of $500,000 but only $300,000 in available cash. If receivables are delayed, the company might have no choice but to furlough employees or shut down locations.

A lack of working capital can lead to missed payments, breached loan agreements, and strained supplier relationships. These issues can snowball into legal troubles, terminated contracts, or even bankruptcy. In fact, more than 80% of distressed businesses cite cash flow management as their biggest financial hurdle during restructuring.

Take, for instance, a mid-sized manufacturing company in Ohio. After a sudden 40% revenue drop and mounting unpaid bills, they brought in an interim CFO. Through strict cash flow controls and emergency financing, the company not only avoided bankruptcy but also returned to profitability within a year.

Missing Leadership and Business Disruptions

The unexpected loss of a key financial leader can throw a business into chaos. Without seasoned financial expertise, companies may struggle to make sound decisions, maintain stakeholder trust, or adapt to market shifts. Such leadership gaps can disrupt financial reporting, stall critical decisions, and signal instability to lenders, investors, and employees.

For distressed companies, these disruptions often translate into weakened financial controls, missed reporting deadlines, and a loss of institutional knowledge. Consider a tech startup that lost its CFO during a pivotal funding round. The absence of leadership nearly derailed the deal, but an interim CFO stepped in, provided clear financial reporting, and developed a strategic plan. This intervention restored investor confidence and ensured the funding round was successfully completed.

Difficult Financial Reporting and Compliance Requirements

On top of leadership gaps, distressed businesses face mounting pressure to meet complex financial reporting and compliance demands. Frequent, detailed reports are often required, especially when resources are already stretched thin. Complying with U.S. GAAP, SEC filings, and tax regulations can overwhelm understaffed teams, leading to costly errors, fines, or even legal risks.

Stakeholders, too, demand greater transparency. Banks might request regular cash flow updates, investors could ask for detailed recovery plans, and creditors often expect progress reports. Many distressed companies find themselves lacking the financial expertise needed to navigate these challenges.

Tasks like negotiating with creditors, adhering to loan covenants, preparing for audits, and keeping investors informed go far beyond basic accounting. The consequences of falling short are severe. A missed loan covenant might trigger default clauses, late SEC filings can result in hefty penalties or loss of public company status, and poor communication with stakeholders could lead to lawsuits or forced liquidation.

A real-world example? In 2022, a technology company that had struggled with years of losses hired NYC Advisors as an interim CFO. Within just 12 months, the executive helped the company increase gross margins by 50%, achieve its first profitable quarter, cut operating costs, accelerate financial reporting, and secure better loan terms. These actions not only restored profitability but also put the company on a stable path for the future.

For businesses facing these intricate financial struggles, platforms like Urgent Exits provide a lifeline. By connecting distressed companies with experienced interim CFOs and restructuring specialists, these platforms ensure that expert guidance is accessible when it’s needed most.

Signs Your Business Needs an Interim CFO

When financial challenges start piling up, knowing when to bring in an interim CFO can make all the difference. The right timing can determine whether your company successfully restructures or faces more serious consequences. While each business has its own unique hurdles, there are certain scenarios where the expertise of an interim CFO becomes absolutely critical.

Navigating Bankruptcy or Creditor Negotiations

If your company is dealing with bankruptcy proceedings or intense creditor negotiations, an interim CFO can be a game-changer. These situations demand specialized skills that your internal team might lack.

For example, when cash flow projections suggest that your company won’t have enough funds in the next six months – even after cutting costs – an interim CFO steps in with detailed cash forecasts. These forecasts not only justify the need for restructuring but also provide the foundation for negotiating debt reductions. Since interim CFOs operate from an external perspective, they can bypass internal politics and offer unbiased recommendations, which often carry more weight with stakeholders.

During these critical moments, an interim CFO acts as a bridge between your business and financial stakeholders. They tackle immediate financial concerns, negotiate directly with creditors, and craft crisis management plans tailored to your situation. They also create detailed financial projections to show lenders and bankers that your business has a viable future, making a strong case for debt restructuring. This helps reduce financial strain and redirects resources toward recovery. Without this level of guidance, businesses often struggle to meet creditor expectations or manage complex reporting requirements.

This kind of financial leadership is also essential when preparing for significant transitions, like mergers or asset sales.

Preparing for M&A or Selling Assets

Getting a distressed business ready for a merger, acquisition, or asset sale requires precision, and few professionals are as equipped for this as an interim CFO.

An interim CFO oversees the financial due diligence process, ensuring that your company’s financial health is presented clearly and accurately. They analyze financial statements, evaluate cash flow projections, and identify risks or opportunities that could impact the deal. Their role also extends to managing post-merger integration plans and maximizing the overall value of the transaction through strategic financial planning.

If you’re listing your business on platforms like Urgent Exits, an interim CFO ensures all financial records are complete and organized to attract serious buyers. They prepare key documents like audited financial statements, cash flow analyses, debt schedules, and operational metrics, giving potential buyers a clear view of the business’s potential.

Additionally, interim CFOs streamline communication with buyers and M&A advisors, ensuring that the exchange of financial information is smooth and efficient. By working closely with professionals like M&A lawyers and restructuring experts, they help navigate the sale process with transparency – an essential factor in distressed business markets.

But sometimes, before you can even think about M&A or selling assets, a more immediate turnaround is needed.

Turning Around Financial Problems

When a business is in trouble, an interim CFO brings the expertise to stabilize operations and introduce sustainable improvements. Most financial turnarounds and restructuring efforts last between 12 and 18 months, focusing on cutting costs, managing debt, and improving overall efficiency.

One of the first things an interim CFO does is streamline operations to improve cash flow. This might involve automating routine tasks using tools like robotic process automation or integrating systems to create smoother financial workflows. They also root out inefficiencies, implement automated reporting systems, and build analytics frameworks to give you better visibility into your company’s financial performance.

But their role isn’t just about quick fixes. Interim CFOs also mentor your existing finance team, helping them develop stronger forecasting and risk management skills. They introduce frameworks for assessing financial risks, strengthen internal controls, and ensure compliance with regulations. These steps not only address immediate issues but also help prevent future crises, leading to better productivity and fewer errors.

The temporary nature of an interim CFO’s role gives them a unique advantage: they can remain objective and focus entirely on delivering results. This allows them to cut through office politics and make bold decisions that are in the company’s best interest.

Results often appear quickly. In the first 30 to 60 days, you’ll likely see improved cash flow visibility. By 60 to 90 days, cost-cutting measures are typically in place, and by the end of the first quarter, financial reporting tends to stabilize. Over the full 12- to 18-month period, these efforts usually lead to restored financial health, increased profitability, and a stronger foundation for the future.

sbb-itb-84c8851

Pros and Cons of Hiring an Interim CFO

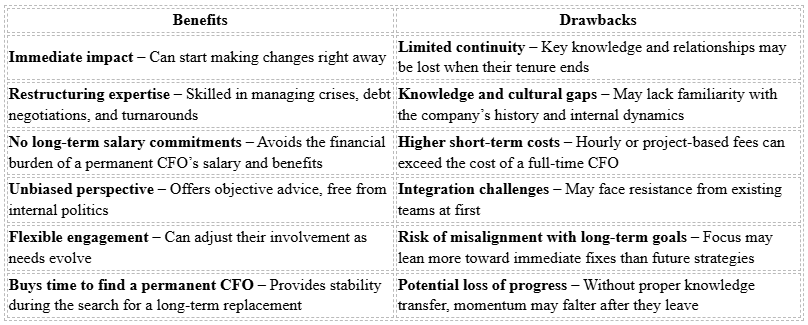

Hiring an interim CFO comes with its own set of advantages and disadvantages. Weighing these factors carefully can help you determine whether this option suits your business during periods of restructuring or financial uncertainty.

Benefits vs. Drawbacks Comparison

When immediate financial expertise is a priority, understanding these trade-offs is essential.

In some situations, the benefits of hiring an interim CFO clearly outweigh the downsides. For businesses in financial distress, the cost savings can be particularly compelling. Instead of committing to the ongoing expense of a full-time executive, resources can be redirected toward operational improvements or managing debt obligations.

When your business needs quick solutions – like improving cash flow or making tough operational decisions – an interim CFO brings valuable expertise. They operate independently of company politics, which allows them to make difficult calls on cost reductions, layoffs, or restructuring that internal leaders might hesitate to address. This impartial approach often resonates more strongly with creditors, lenders, and potential buyers.

Companies generating over $1 million in annual revenue often find interim CFO services especially beneficial, as strategic financial planning becomes increasingly critical at this level. That said, integration challenges shouldn’t be underestimated. Setting clear expectations and involving the interim CFO in leadership discussions can help build trust and ensure alignment with broader objectives.

Interim CFOs excel in areas like debt restructuring, bankruptcy processes, and mergers or acquisitions (M&A). They prepare detailed financial forecasts and projections that meet creditor expectations while ensuring compliance with financial regulations. This level of expertise can be a game-changer for businesses navigating high-stakes situations.

Ultimately, the decision hinges on your business’s timing and specific needs. If you’re facing urgent financial challenges – such as potential cash shortages within the next six months or complex creditor negotiations – bringing in high-level financial expertise without committing to a long-term hire can make all the difference.

How to Choose and Onboard an Interim CFO

Selecting the right interim CFO during a restructuring phase is a critical decision. A misstep can drain time and resources – two things most businesses can’t afford to lose in such situations. Here’s how to approach the process effectively.

Identifying Needed Skills and Setting Goals

Start with a focus on restructuring expertise. Look for candidates who have successfully handled debt restructuring, cash flow challenges, and turnaround scenarios. Their past achievements should include tangible results like cutting costs, negotiating with creditors, or improving operational efficiency.

Strong communication skills are equally important. The interim CFO will need to collaborate with creditors, lenders, investors, and internal teams, often under intense pressure. A proven ability to manage these relationships smoothly is essential.

Industry knowledge can be a game-changer. While financial expertise is non-negotiable, familiarity with your industry’s unique challenges, regulations, and market dynamics allows the interim CFO to deliver results faster.

Set clear, measurable goals. For example, aim for positive cash flow within 120 days, a 25% reduction in operating expenses, or securing creditor agreements for payment deferrals. These objectives should align with your broader restructuring strategy. Be upfront about these expectations during the hiring process to ensure candidates understand what success entails.

Once the skills and targets are defined, the next step is formalizing the engagement.

Setting Contract Terms and Planning Knowledge Handoff

Contracts for interim CFOs often last between 6 to 18 months, but flexibility is key. Include provisions for early termination or extensions as circumstances evolve. Compensation can be structured as a fixed fee, hourly rate, or project-based payment.

Clearly outline deliverables in the contract. These might include creating a 13-week cash flow forecast, conducting a full financial review, implementing new reporting systems, or achieving specific cost-cutting goals. Adding performance-based incentives tied to milestones can reinforce accountability.

Plan for knowledge transfer from day one. Require documentation for all processes, decisions, and financial models the interim CFO develops. This ensures continuity and supports long-term financial stability.

Here’s an example: In 2023, a tech startup gearing up for an IPO brought in an interim CFO to overhaul its financial systems. The CFO revamped the finance department, trained the team, and set up scalable systems. The company not only completed its IPO but also reported a 25% boost in operational efficiency. By documenting all processes, the interim CFO ensured a seamless transition to the permanent CFO.

To ensure a smooth handoff, schedule an overlap period with the incoming permanent CFO. This allows for shadowing, dedicated knowledge transfer sessions, and a gradual shift of responsibilities. A formal transition plan with timelines, assigned tasks, and access to essential information is vital.

Once these steps are covered, the focus shifts to communicating the change to stakeholders.

Telling Stakeholders About the New CFO

Start with internal communication, and do it quickly. Announce the interim CFO’s appointment in team meetings, internal memos, and one-on-one conversations with key department heads. Address any concerns about leadership changes and emphasize how this move supports the company’s stability.

Be transparent about the interim CFO’s role and timeline. Explain their specific mandate in the restructuring process and how their expertise will benefit the business. This clarity helps ease any uncertainty among employees and minimizes resistance.

External communication should follow a coordinated approach. Notify creditors, lenders, investors, and key vendors through formal updates or letters. Highlight the interim CFO’s experience in restructuring and how their involvement reflects your commitment to financial recovery and stabilization.

Timing is crucial. Share the news with internal teams before informing external parties to avoid rumors and preserve trust. If your company has public visibility, consider issuing a press release to demonstrate transparency and rebuild stakeholder confidence.

Involve the board in these communications. Having board members participate in stakeholder discussions or co-sign announcements reinforces the strategic importance of the decision and shows unified leadership support.

Interim CFOs often play a mentoring role for finance teams, helping to build skills and bridge knowledge gaps during their tenure. Emphasizing this aspect can help employees see the interim CFO as a valuable resource rather than a disruption.

For businesses facing immediate financial distress, platforms like Urgent Exits can connect you with experienced interim CFOs and restructuring advisors quickly. This can be a lifesaver when time is of the essence for your company’s survival.

Conclusion: Act Fast When Hiring an Interim CFO

When financial trouble strikes, time is your most valuable asset. The difference between steering your business toward recovery or watching it spiral out of control often hinges on how quickly you act. Waiting too long to bring in an interim CFO can turn challenges that are fixable into crises that are far harder to resolve.

Studies back this up. A 2021 report by Korn Ferry revealed that companies with interim CFOs were 30% more likely to achieve successful turnarounds compared to those without one. Similarly, research from the Association of Management Accountants in 2022 showed that 70% of businesses hiring interim CFOs saw improved financial performance within a year. These numbers highlight the critical role an interim CFO can play in navigating tough times.

Financial problems like cash flow shortages or mounting creditor demands won’t wait for you to make a decision. On top of that, fluctuating market conditions can quickly diminish your attractiveness to investors or buyers. This is where an interim CFO’s expertise in areas like crisis management, debt restructuring, and stakeholder negotiations can make all the difference.

What makes interim CFOs even more appealing is their flexibility. With no long-term commitments and hourly rates typically ranging between $200 and $500 [Business Talent Group, 2023], they offer a practical and cost-effective solution. Compared to the potential losses from delayed restructuring, this is a small price to pay for expert guidance.

For businesses in urgent need of financial stability or gearing up for a strategic exit, platforms like Urgent Exits can be game-changing. They connect distressed businesses with restructuring experts, interim CFOs, and potential buyers – all while keeping the clock in mind. Time is critical, as distressed assets lose value quickly. Acting fast ensures you maximize recovery and minimize losses.

If you’re seeing the warning signs – declining cash flow, mounting creditor pressure, leadership gaps, or compliance issues – don’t wait. Bringing in an interim CFO immediately can be the decisive step that keeps your business afloat and positions it for a stronger future.

FAQs

What are the key signs that a business should hire an interim CFO for restructuring?

Hiring an interim CFO can be a game-changer when your business is grappling with financial or operational hurdles. Signs that you might need one include cash flow struggles, rising debt, or challenges in covering payroll. Beyond these, if your company is gearing up for a sale, going through a restructuring phase, or managing a crisis, an interim CFO can step in to stabilize the situation and offer strategic guidance.

These professionals are especially useful for businesses in distress. They bring expertise in areas like financial planning, cutting costs, and communicating with stakeholders. Since their role is temporary, they can act quickly without requiring the long-term commitment of a permanent hire. If your business is facing these kinds of difficulties, an interim CFO might be the solution you need.

How can a business ensure a seamless handoff from an interim CFO to a permanent CFO?

To make the shift from an interim CFO to a permanent CFO as seamless as possible, it’s important to focus on clear communication and well-organized documentation. The interim CFO should take the time to compile detailed records of key financial strategies, systems, and active projects. This ensures the new CFO steps into the role with a solid grasp of the company’s financial operations.

A structured handover period can also make a big difference. During this time, the interim CFO can personally brief the permanent CFO, answer questions, and share valuable insights about the company’s financial hurdles and opportunities. Prioritizing teamwork during this phase helps ensure continuity and avoids unnecessary disruptions to the business.

How does the role of an interim CFO differ from a permanent CFO during a restructuring?

An interim CFO steps in to tackle pressing financial challenges during times of restructuring. Their focus is on immediate priorities like stabilizing cash flow, negotiating with creditors, and crafting a turnaround plan. This role is short-term and laser-focused, aimed at making swift, impactful decisions to help steer the company out of a crisis.

On the other hand, a permanent CFO takes on a broader scope of responsibilities, including strategic planning, financial reporting, and overall fiscal oversight. While they may also manage restructuring efforts, an interim CFO offers specialized expertise and a fresh approach, specifically geared toward addressing urgent financial issues.